Starwood 2012 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2012 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.-2013Proxy Statement60

EXECUTIVE COMPENSATION

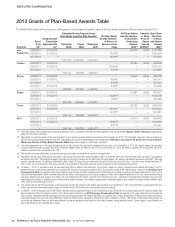

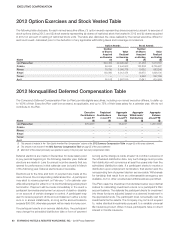

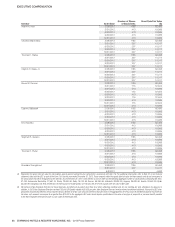

2012 Option Exercises and Stock Vested Table

The following table discloses, for each named executive offi cer, (1)option awards representing shares acquired pursuant to exercise of

stock options during 2012; and (2)stock awards representing (a)shares of restricted stock that vested in 2012 and (b)shares acquired

in 2012 on account of vesting of restricted stock units. The table also discloses the value realized by the named executive offi cer for

each such event, calculated prior to the deduction of any applicable withholding taxes and brokerage commissions.

Name

Option Awards Stock Awards

Number

of Shares

Acquired

onExercise

(#)

Value

Realized

onExercise

($)

Number

of Shares

Acquired

onVesting

(#)

Value

Realized

onVesting

($)

van Paasschen 623,452 29,295,997 21,468 1,213,157

Prabhu 50,000 2,444,903 122,808 6,735,487

Rivera 70,780 3,006,778 10,662 583,245

Siegel 130,380 6,012,474 33,675 1,826,100

Turner — — 4,562 257,799

Avril 90,518 3,697,816 10,847 604,909

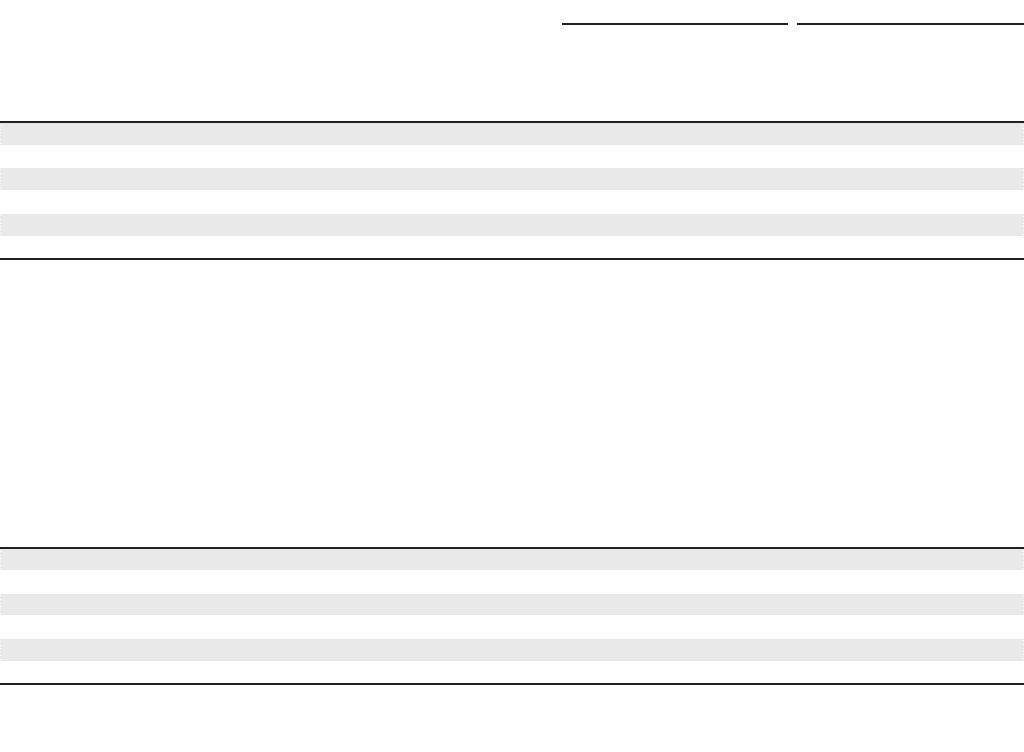

2012 Nonqualifi ed Deferred Compensation Table

The Company’s Deferred Compensation Plan (or Plan) permits eligible executives, including our named executive offi cers, to defer up

to 100% of their Executive Plan cash bonus award, as applicable, and up to 75% of their base salary for a calendar year. We do not

contribute to the Plan.

Name

Executive

Contributions

in Last FY

($)

Registrant

Contributions

in Last FY

($)

Aggregate

Earnings

inLast FY

($)

Aggregate

Withdrawals/

Distributions

($)

Aggregate

Balance

atLast FYE

($)

van Paasschen 575,000(1) — 73,274(2) — 1,281,003(3)

Prabhu ———— —

Rivera ———— —

Siegel ———— —

Turner ———— —

Avril ———— —

(1) This amount is included in the ‘“Non-Equity Incentive Plan Compensation” column of the

2012 Summary Compensation Table

on page 55 of this proxy statement .

(2) This amount is not included in the

2012 Summary Compensation Table

on page 55 of this proxy statement .

(3) $500,000 of this amount previously was reported as salary in the prior years’ Summary Compensation Tables.

Deferral elections are made in December for base salary paid

in pay periods beginning in the following calendar year. Deferral

elections are made in June for annual incentive awards that are

earned for performance in that calendar year but paid in March

of the following year. Deferral elections are irrevocable.

Elections as to the time and form of payment are made at the

same time as the corresponding deferral election. A participant

may elect to receive payment on February1 of a calendar year

while still employed or either 6 or 12months following employment

termination. Payment will be made immediately in the event a

participant terminates employment on account of death or disability

or on account of certain changes in control. A participant may

elect to receive payment of his account balance in either a lump

sum or in annual installments, so long as the account balance

exceeds $50,000; otherwise payment will be made in a lump sum.

If a participant elects an in-service distribution, the participant

may change the scheduled distribution date or form of payment

so long as the change is made at least 12months in advance of

the scheduled distribution date. Any such change must provide

that distribution will commence at least fi ve years later than the

scheduled distribution date. If a participant elects to receive a

distribution upon employment termination, that election and the

corresponding form of payment election are irrevocable. Withdrawals

for hardship that result from an unforeseeable emergency are

available, but no other unscheduled withdrawals are permitted.

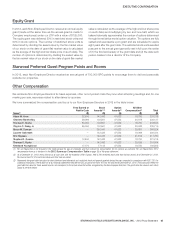

The Plan uses the investment funds listed below as potential

indices for calculating investment returns on a participant’s Plan

account balance. The deferrals the participant directs for investment

into these funds are adjusted based on a deemed investment in

the applicable funds. The participant does not actually own the

investments that he selects. TheCompany may, but is not required

to, make identical investments pursuant to a variable universal

life insurance product. When it does, participants have no direct

interest in this life insurance.