Starwood 2012 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2012 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

During the year ended December 31, 2010, we recorded a net loss on dispositions of approximately

$39 million, primarily related to a $53 million loss on the sale of one wholly-owned hotel (see Note 5) as well as

a $4 million impairment of fixed assets that are being retired in connection with a significant renovation of a

wholly-owned hotel, and a $2 million impairment on one hotel whose carrying value exceeded its fair value.

These charges were partially offset by a gain of $14 million from insurance proceeds received for a claim at a

wholly-owned hotel that suffered damage from a storm in 2008, a $5 million gain as a result of an acquisition of

a controlling interest in a joint venture in which we previously held a non-controlling interest (see Note 4) and a

$4 million gain from the sale of non-hotel assets.

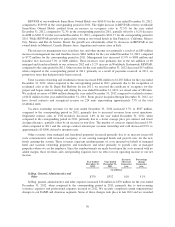

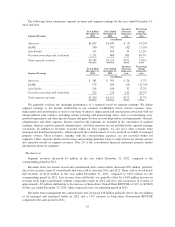

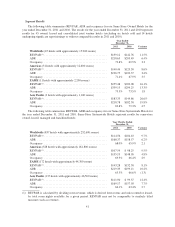

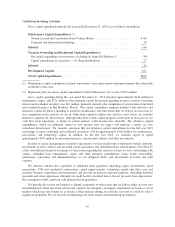

Year Ended

December 31,

2011

Year Ended

December 31,

2010

Increase /

(decrease)

from prior

year

Percentage

change

from prior

year

(in millions)

Income Tax (Benefit) Expense ............ $(75) $27 $(102) n/m

In 2011, the Company completed transactions that involved certain domestic and foreign subsidiaries. These

transactions generated capital gains increased the tax basis in subsidiaries including U.S. partnerships and

resulted in the inclusion of foreign earnings for U.S. tax purposes. The capital gains were largely reduced by the

utilization of capital losses. Due to the uncertainty regarding the Company’s ability to generate capital gain

income, the deferred tax asset associated with these capital losses was offset by a full valuation allowance prior

to these transactions. These transactions resulted in a net tax benefit of $87 million. Additionally, during 2011, an

income tax benefit of approximately $60 million was generated as the result of the sale of two wholly-owned

hotels. Also, in 2011, the IRS closed its audit in respect to tax years 2004 through 2006 resulting in the

recognition of a tax benefit of approximately $25 million, primarily for the reversal of tax and interest reserves.

These benefits were partially offset by tax on increased pretax income and valuation allowance increases in 2011

compared to 2010.

During 2010, the IRS closed its audit with respect to tax years 1998 through 2003 and the Company

recognized a $42 million tax benefit in continuing operations, primarily associated with the refund of interest on

taxes already paid. This benefit was partially offset by interest and taxes recorded on uncertain tax positions,

which resulted in a charge of $23 million.

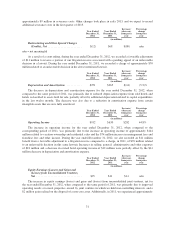

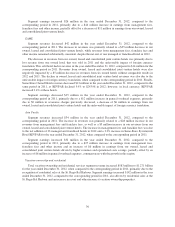

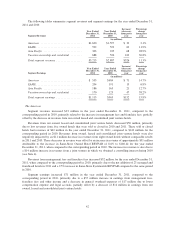

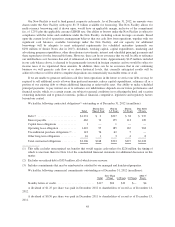

Year Ended

December 31,

2011

Year Ended

December 31,

2010

Increase /

(decrease)

from prior

year

Percentage

change

from prior

year

(in millions)

Discontinued Operations Gain (Loss), Net . . $(13) $168 $(181) n/m

During the year ended December 31, 2011, we recorded a loss of $13 million primarily related to an

$18 million pretax loss from the sale of our interest in a consolidated joint venture, offset by a $10 million

income tax benefit on the sale. Additionally, we recorded $5 million of interest charges related to an uncertain

tax position.

During the year ended December 31, 2010, we recorded a gain of $134 million related to the final settlement

with the IRS regarding a disposition in a prior year and a pretax gain of approximately $3 million ($36 million

after tax) related to the sale of one wholly-owned hotel. The tax benefit was related to the realization of a high

tax basis in this hotel that was generated through a previous transaction.

40