Starwood 2012 Annual Report Download - page 199

Download and view the complete annual report

Please find page 199 of the 2012 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS

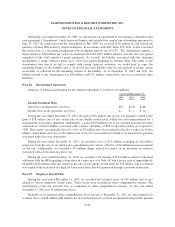

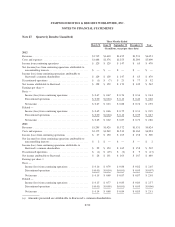

Balance at December 31, 2011 .................................................... $(3)

Mark-to-market loss (gain) on forward exchange contracts ............................ —

Reclassification of gain (loss) from OCI to management fees, franchise fees, and other

income ................................................................... 4

Balance at December 31, 2012 .................................................... $ 1

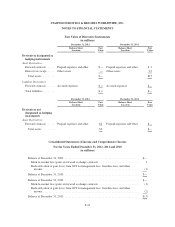

Derivatives Not Designated as Hedging

Instruments

Location of Gain or (Loss) Recognized

in Income on Derivative

Amount of Gain or

(Loss) Recognized in

Income on Derivative

Year Ended

December 31,

2012 2011 2010

Foreign forward exchange contracts ....... Interest expense, net $(1) $5 $(45)

Total (loss) gain included in income ....... $(1) $5 $(45)

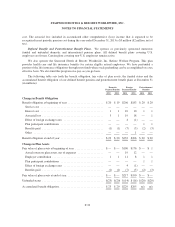

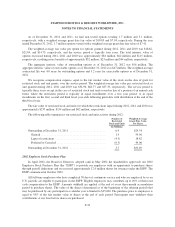

Note 24. Fair Value of Financial Instruments

The following table presents our fair value hierarchy for our financial assets and liabilities measured at fair

value on a recurring basis as of December 31, 2012 (in millions):

Level 1 Level 2 Level 3 Total

Assets:

Forward contracts .................................... $— $2 $— $2

Liabilities:

Forward contracts .................................... $— $1 $— $1

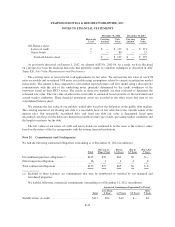

The forward contracts are over the counter contracts that do not trade on a public exchange. The fair values

of the contracts are classified as Level 2 since they are based on inputs such as foreign currency spot rates and

forward points that are readily available on public markets. We consider both our credit risk, as well as our

counterparties’ credit risk in determining fair value and we did not make an adjustment as it was deemed

insignificant based on the short duration of the contracts and our rate of short-term debt.

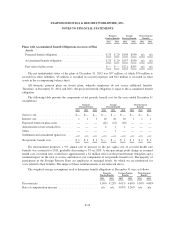

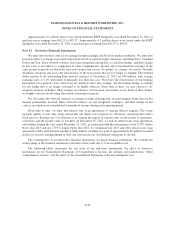

We believe the carrying values of our financial instruments related to current assets and liabilities

approximate fair value. The following table presents the carrying amounts and estimated fair values of our long-

term financial instruments (in millions):

December 31, 2012 December 31, 2011

Hierarchy

Level

Carrying

Amount

Fair

Value

Carrying

Amount

Fair

Value

Assets:

Restricted cash ....................... 1 $ 6 $ 6 $ 2 $ 2

VOI notes receivable .................. 3 92 113 93 109

Securitized vacation ownership notes

receivable ......................... 3 438 558 446 551

Other notes receivable ................. 3 11 11 26 26

Total financial assets ................ $ 547 $ 688 $ 567 $ 688

Liabilities:

Long-term debt ....................... 1 $1,273 $1,447 $2,194 $2,442

Long-term securitized debt ............. 3 383 402 402 412

Total financial liabilities ............. $1,656 $1,849 $2,596 $2,854

F-42