Starwood 2012 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2012 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.STARWOOD HOTELS & RESORTS WORLDWIDE, INC.-2013Proxy Statement48

EXECUTIVE COMPENSATION

Stock options provide compensation only when vested and only if

our stock price appreciates and exceeds the exercise price of the

option. Therefore, during business downturns, option awards may

not represent any economic value to an executive.

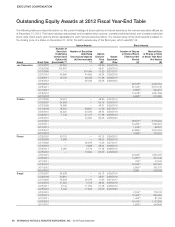

Prior to the 2012 annual incentive awards, our named executive

officers mandatorily deferred 25% of their annual incentive

compensation awards under the Executive Plan in the form of

deferred restricted stock units. The Compensation Committee had

the discretion to reduce the percentage of an annual long-term

incentive compensation award that was required to be deferred.

For 2011, the deferred amount (as increased by the percentage

described below) was converted into a number of deferred restricted

stock units by dividing the amount of the deferred award by the

average of the high and low fair market value of a share on the

date of grant. The deferred restricted stock units are then subject

to time-based vesting. Upon vesting, shares of our common stock

equal to the number of vested units will be delivered to the named

executive offi cers. As such, the awards combine performance-based

compensation with a further link to stockholder interests. First,

amounts must be earned based on annual Company fi nancial and

strategic/operational/leadership performance under the Executive

Plan. Second, these already earned amounts are put at risk through

a vesting schedule. Vesting occurs in installments over a three-year

period. Third, these earned amounts become subject to share

price performance. Primarily in consideration of this vesting risk

being applied to already earned compensation (but also taking

into account the enhanced stockholder alignment that results from

being subject to share performance), the amount of the deferred

long-term incentive compensation amount was increased by 33%.

Vesting for these deferred restricted stock units will accelerate in

the event of death, disability or retirement. While this program was

discontinued commencing with 2012 annual incentive awards

paid in 2013, deferred restricted stock units that were awarded

with respect to 2011 annual incentive compensation earnings are

refl ected in certain of the compensation tables below.

Restricted stock and restricted stock unit awards provide some

measure of mitigation of business cyclicality while maintaining a

direct tie to share price. We seek to enhance the link to stockholder

performance by building a strong retention incentive into the equity

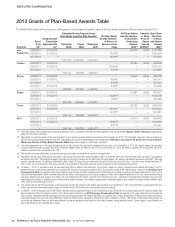

program. Consequently, for 2012 grants, 100% of restricted stock

unit awards vest on the fi scal year-end of the year immediately prior

to the third anniversary of the date of grant, and 100% of restricted

stock awards vest on the third anniversary of the date of grant.

This vesting places an executive’s long-term compensation at risk

to share price performance for a signifi cant portion of the business

cycle, while encouraging long-term retention of executives.

Promotion Equity Award. On August 1, 2012, we granted Mr. Rivera

a special award of 5,550 shares of restricted stock in connection

with his promotion to his current position as Co-President, The

Americas, to reward him for the new responsibilities and duties that

he assumed in connection with this position. The Compensation

Committee determined the value for this award based on competitive

benchmarking based on his new role. One hundred percent of this

restricted stock award vests on the third anniversary of the date of

grant. The fair value for this award is refl ected in the 2012 Summary

Compensation Table on page 55 of this proxy statement .

Special Long-Term Cash Incentive Award. In 2009, we granted

Mr. Rivera a special long-term performance-based cash award

opportunity related to the development of our St. Regis Bal Harbour

property. The design of the award was to align Mr. Rivera’s long-term

cash-based incentive compensation with overall construction

completion, contract sales and actual unit closing rates versus our

projections for the property. The target opportunity for the award

was established at $1.0 million, and performance metrics were

established for the award for 2010 and 2011 (to be evaluated in 2012)

consisting of: (1) achieving construction of the project below budget

and on time (during 2012); (2) funding all costs of the property from

Starwood Vacation Ownership cash fl ow; (3) achieving budgeted

closing rates for sales of property units; (4) exceeding mid-2012

revenue goals for the property; and (5) keeping cumulative sales

and marketing costs for the property below target. We do not

disclose any of the specifi c quantitative goals established for these

performance metrics for competitive harm reasons, but the goals

established for each of these performance metrics refl ected very

aggressive timetables and fi nancial expectations and tight budgetary

limits that were expected to require exceptional effort on the part of

Mr. Rivera to achieve. The St. Regis Bal Harbour property opened in

January 2012, after which Mr. Rivera’s performance with respect to

this award was evaluated by the Compensation Committee. Based

on its evaluation that Mr. Rivera exceeded all quantitative goals

for the applicable performance metrics and achieved signifi cant

outperformance against all of the other award terms, and based

on overwhelming external positive reviews of the property since

it opened, the Compensation Committee authorized a payout of

$1.1 million to Mr. Rivera for this award in 2012, representing 110%

achievement of the performance metrics. The payout for this award

is refl ected in the 2012 Summary Compensation Table on page

55 of this proxy statement .

Changes to Long-Term Incentive

Compensation Design in 2013

As outlined above, despite what we consider to be overwhelming and

continuing majority stockholder support for our say-on-pay proposals

(evidenced through the results for our recent say-on-pay votes), in 2012

we noted the concerns expressed by a small minority of stockholders

about a perceived lack of alignment between our named executive

offi cers and our stockholders due to the lack of performance-based

equity vehicles in our long-term equity incentive program. As part of a

routine review of our compensation program design conducted during

2012, the Compensation Committee approved the introduction of

performance-based equity awards for our named executive offi cers

starting in 2013. The Compensation Committee believes the introduction

of performance share equity vehicles into our program will enhance our

already strong “pay for performance” philosophy and serve to ensure that

key executives’ interests are closely aligned with long-term stockholder

objectives and expectations. The changes for 2013, which will be further

described and analyzed in next year’s proxy statement, are designed to:

•Remain aligned with best practices;

•

Link executive reward opportunities to our performance, especially

in relation to peer companies;

•Support global strategic business objectives, long-term growth

and key metrics of performance;