Starwood 2012 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2012 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

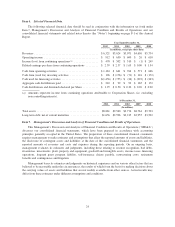

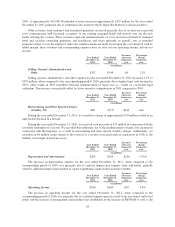

gain as a result of the write-up to fair value of our previously held noncontrolling interest in two hotels in which

we obtained a controlling interest (see Note 4).

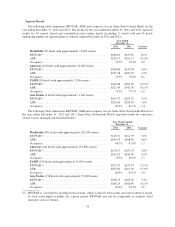

Year Ended

December 31,

2012

Year Ended

December 31,

2011

Increase /

(decrease)

from prior

year

Percentage

change

from prior

year

(in millions)

Income Tax (Benefit) Expense ............ $148 $(75) $223 n/m

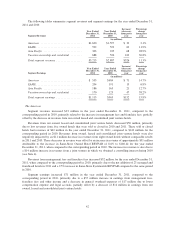

The increase in income tax expense was the result of higher pretax income and a higher effective rate in

2012 compared to 2011 and large tax benefits generated in 2011 as compared to 2012. Additional income tax

expense due to higher pretax income was approximately $46 million and the increase due to the effective tax rate

in 2012 resulted in incremental income tax expense of approximately $60 million. The increase in the effective

rate is primarily due to higher pretax income in the U.S. as a result of the Bal Harbour residential sales previously

discussed.

Incremental tax benefits in 2011 compared to 2012 amounted to approximately $117 million. In 2011, we

completed transactions that involved certain domestic and foreign subsidiaries. These transactions generated

capital gains, increased the tax basis in subsidiaries including U.S partnerships and resulted in the inclusion of

foreign earnings for U.S. tax purposes, resulting in a net tax benefit of $87 million. The capital gains were largely

reduced by the utilization of capital losses. Additionally, during 2011, the IRS closed its audit with respect to tax

years 2004 through 2006 resulting in a $25 million tax benefit primarily related to the reversal of tax and interest

reserves.

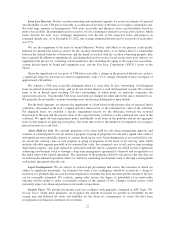

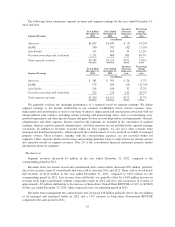

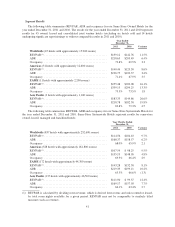

Year Ended

December 31,

2012

Year Ended

December 31,

2011

Increase /

(decrease)

from prior

year

Percentage

change

from prior

year

(in millions)

Discontinued Operations Gain (Loss), Net . . $92 $(13) $105 n/m

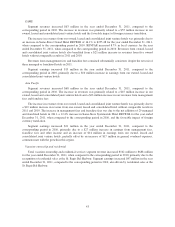

During the year ended December 31, 2012, we recorded a gain of $92 million (net of tax) primarily related

to the gain of $78 million (net of tax) from the sale of one wholly owned hotel, which was sold unencumbered by

a management or franchise agreement and a gain of $23 million (net of tax) from the favorable settlement of

certain liabilities associated with a former subsidiary of ITT Corporation, which we acquired in 1998. These

gains were partially offset by a loss of $5 million (net of tax) related to the impairment and loss on sale of four

wholly-owned hotels and a loss of $5 million (net of tax) for accrued interest related to an uncertain tax position

associated with a previous disposition.

During the year ended December 31, 2011, we recorded a loss of $13 million (net of tax), primarily related

to an $18 million pre-tax loss from the sale of our interest in a consolidated joint venture, offset by a $10 million

income tax benefit on the sale. Additionally, we recorded a loss of $5 million (net of tax) for accrued interest

related to an uncertain tax position associated with a previous disposition.

33