Starwood 2012 Annual Report Download - page 196

Download and view the complete annual report

Please find page 196 of the 2012 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS

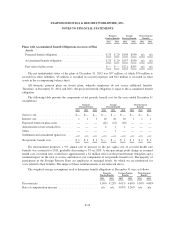

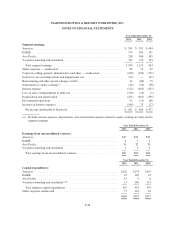

As of December 31, 2012 and 2011, we had non-vested options totaling 1.7 million and 3.1 million,

respectively, with a weighted average grant date fair value of $10.85 and $7.94, respectively. During the year

ended December 31, 2012, 1.7 million options vested with a weighted average grant date fair value of $7.41.

The weighted-average fair value per option for options granted during 2012, 2011 and 2010 was $18.62,

$21.84, and $14.73, respectively, and the service period is typically four years. The total intrinsic value of

options exercised during 2012, 2011 and 2010 was approximately $84 million, $62 million and $115 million,

respectively, resulting in tax benefits of approximately $32 million, $23 million and $44 million, respectively.

The aggregate intrinsic value of outstanding options as of December 31, 2012 was $96 million. The

aggregate intrinsic value of exercisable options as of December 31, 2012 was $47 million. The weighted-average

contractual life was 4.0 years for outstanding options and 3.2 years for exercisable options as of December 31,

2012.

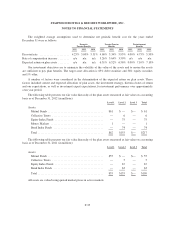

We recognize compensation expense, equal to the fair market value of the stock on the date of grant for

restricted stock and unit grants, over the service period. The weighted-average fair value per restricted stock or

unit granted during 2012, 2011 and 2010 was $54.96, $60.77 and $37.33, respectively. The service period is

typically three years except in the case of restricted stock and units issued in lieu of a portion of an annual cash

bonus where the restriction period is typically in equal installments over a two year period, or in equal

installments on the first, second and third fiscal year ends following grant date with distribution at the end of the

third fiscal year.

The fair value of restricted stock and units for which the restrictions lapsed during 2012, 2011 and 2010 was

approximately $237 million, $154 million and $62 million, respectively.

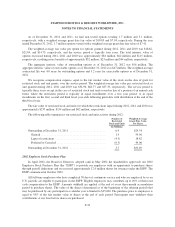

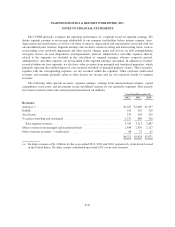

The following table summarizes our restricted stock and units activity during 2012:

Number of

Restricted

Stock and Units

Weighted Average

Grant Date Value

Per Share

(In Millions)

Outstanding at December 31, 2011 ......................... 6.9 $29.54

Granted ............................................. 1.4 54.96

Lapse of restrictions ................................... (4.3) 18.82

Forfeited or Canceled .................................. (0.3) 49.06

Outstanding at December 31, 2012 ......................... 3.7 $50.49

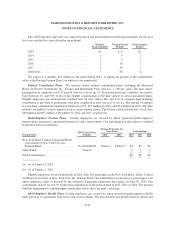

2002 Employee Stock Purchase Plan

In April 2002, the Board of Directors adopted (and in May 2002 the shareholders approved) our 2002

Employee Stock Purchase Plan (the “ESPP”) to provide our employees with an opportunity to purchase shares

through payroll deductions and we reserved approximately 12.0 million shares for issuance under the ESPP. The

ESPP commenced in October 2002.

All full-time employees who have completed 30 days of continuous service and who are employed by us on

U.S. payrolls are eligible to participate in the ESPP. Eligible employees may contribute up to 20% of their total

cash compensation to the ESPP. Amounts withheld are applied at the end of every three-month accumulation

period to purchase shares. The value of the shares (determined as of the beginning of the offering period) that

may be purchased by any participant in a calendar year is limited to $25,000. The purchase price to employees is

equal to 95% of the fair market value of shares at the end of each period. Participants may withdraw their

contributions at any time before shares are purchased.

F-39