Starwood 2012 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2012 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

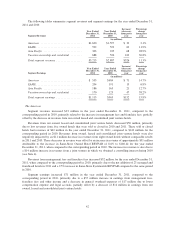

$8 million in unfavorable mark-to-market adjustments on US dollar denominated loans at primarily three joint

venture properties in Latin America.

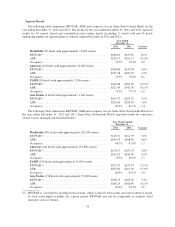

Year Ended

December 31,

2012

Year Ended

December 31,

2011

Increase /

(decrease)

from prior

year

Percentage

change

from prior

year

(in millions)

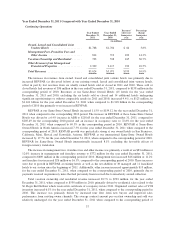

Net Interest Expense .................... $170 $200 $(30) (15.0)%

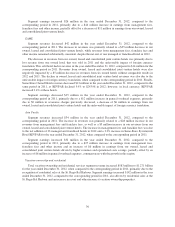

Net interest expense decreased $30 million for the year ended December 31, 2012, when compared to the

same period of 2011, primarily due to the significant reduction in our debt balances and lower average interest

rates, partially offset by a reduction in capitalized interest related to completed construction projects.

Our weighted average interest rate was approximately 5.86% at December 31, 2012, compared to 6.66% at

December 31, 2011.

Year Ended

December 31,

2012

Year Ended

December 31,

2011

Increase /

(decrease)

from prior

year

Percentage

change

from prior

year

(in millions)

Loss on Early Extinguishment of Debt,

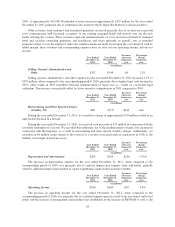

Net ................................ $128 $16 $112 n/m

In December 2012, we redeemed all $500 million of our 7.875% Senior Notes due 2014 and partially

redeemed $156 million of our 7.375% Senior Notes due 2015, $29 million of our 6.75% Senior Notes due 2018

and $40 million of our 7.15% Senior Notes due 2019 (the “December 2012 Redemptions”). We recognized a net

charge of approximately $113 million, in the year ended December 31, 2012, associated with the December 2012

Redemptions, which primarily represents $108 million in tender premiums and other redemption costs and an

$11 million charge to write-off unamortized deferred financing costs and unamortized issuance discounts,

partially offset by gains on swap settlements of $6 million.

In June 2012, we redeemed all $495 million of our 6.25% Senior Notes due 2013. We recognized a net

charge of approximately $15 million, in the year ended December 31, 2012, associated with this redemption,

which represents $18 million in tender premiums and other redemption costs, partially offset by gains on swap

settlements of $3 million.

In December 2011, we redeemed all $605 million of our 7.875% Senior Notes due 2012. We recognized a

net charge of approximately $16 million associated with this redemption, in the year ended December 31, 2011,

which represents the tender premiums, swap settlements and other related redemption costs.

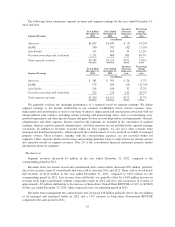

Year Ended

December 31,

2012

Year Ended

December 31,

2011

Increase /

(decrease)

from prior

year

Percentage

change

from prior

year

(in millions)

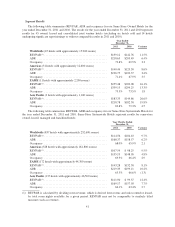

Gain (Loss) on Asset Dispositions and

Impairments, Net ..................... $(21) $— $(21) n/m

During the year ended December 31, 2012, we recorded a loss of $9 million related to the impairment of our

investment in an unconsolidated joint venture, a loss of $7 million related to the sale of one hotel, $2 million in

losses related to the impairments of two hotels whose carrying values exceeded their fair values and a charge of

$4 million to reflect the current market price less costs to sell two properties.

During the year ended December 31, 2011, we recorded an impairment charge of $31 million to write-off

our noncontrolling interest in a joint venture that owns a hotel in Tokyo, Japan, a $9 million loss due to

significant renovations and related asset retirements at two properties, $7 million in losses relating to the

impairment of six hotels whose carrying value exceeded their book value and a $2 million loss on an investment

in a management contract that was terminated during the period. These amounts were offset by a $50 million

32