Starwood 2012 Annual Report Download - page 130

Download and view the complete annual report

Please find page 130 of the 2012 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

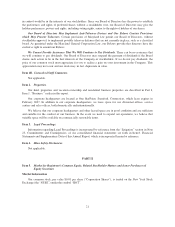

approximately $9 million in severance costs. Other changes took place in early 2013, and we expect to record

additional severance costs in the first quarter of 2013.

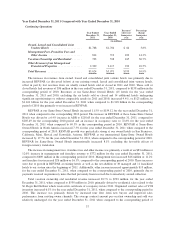

Year Ended

December 31,

2012

Year Ended

December 31,

2011

Increase /

(decrease)

from prior

year

Percentage

change

from prior

year

(in millions)

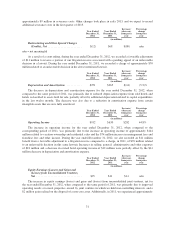

Restructuring and Other Special Charges

(Credits), Net ........................ $(12) $68 $(80) n/m

n/m = not meaningful

As a result of a court ruling, during the year ended December 31, 2012, we recorded a favorable adjustment

of $11 million to reverse a portion of our litigation reserve associated with a pending appeal of an unfavorable

decision in a lawsuit. During the year ended December 31, 2011, we recorded a charge of approximately $70

million related to an unfavorable decision in the above mentioned lawsuit.

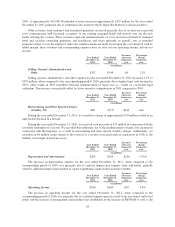

Year Ended

December 31,

2012

Year Ended

December 31,

2011

Increase /

(decrease)

from prior

year

Percentage

change

from prior

year

(in millions)

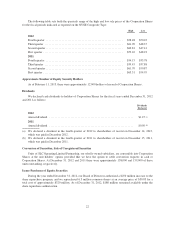

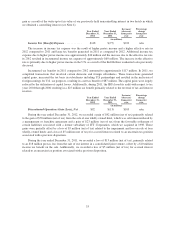

Depreciation and Amortization ........... $251 $265 $(14) (5.3)%

The decrease in depreciation and amortization expense for the year ended December 31, 2012, when

compared to the same period of 2011, was primarily due to reduced depreciation expense from sold hotels and

hotels reclassified to assets held for sale, partially offset by additional depreciation related to capital expenditures

in the last twelve months. The decrease was also due to a reduction in amortization expense from certain

intangible assets that are now fully amortized.

Year Ended

December 31,

2012

Year Ended

December 31,

2011

Increase /

(decrease)

from prior

year

Percentage

change

from prior

year

(in millions)

Operating Income ...................... $912 $630 $282 44.8%

The increase in operating income for the year ended December 31, 2012, when compared to the

corresponding period of 2011, was primarily due to the increase in operating income of approximately $144

million related to vacation ownership and residential sales and the $74 million increase in management fees and

franchise fees and other income. During the year ended December 31, 2012, we also recorded an $11 million

benefit from a favorable adjustment to a litigation reserve compared to a charge, in 2011, of $70 million related

to an unfavorable decision in this same lawsuit. Increases in selling, general, administrative and other expenses

of $18 million and a decrease in owned hotel operating income of $12 million were partially offset by the $14

million decrease in depreciation and amortization expense.

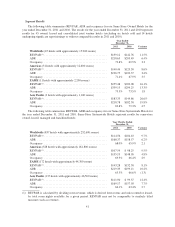

Year Ended

December 31,

2012

Year Ended

December 31,

2011

Increase /

(decrease)

from prior

year

Percentage

change

from prior

year

(in millions)

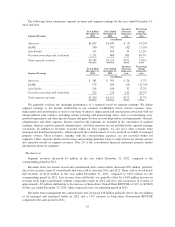

Equity Earnings (Losses) and Gains and

(Losses) from Unconsolidated Ventures,

Net ................................ $25 $11 $14 n/m

The increase in equity earnings (losses) and gains and (losses) from unconsolidated joint ventures, net for

the year ended December 31, 2012, when compared to the same period of 2011, was primarily due to improved

operating results at several properties owned by joint ventures in which we hold non-controlling interests, and a

$2 million gain realized on the disposal of a non-core asset. Additionally, in 2011, we experienced approximately

31