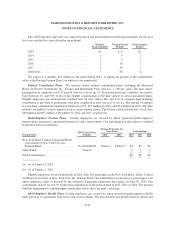

Starwood 2012 Annual Report Download - page 187

Download and view the complete annual report

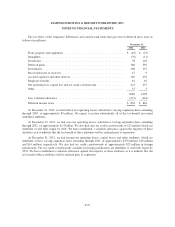

Please find page 187 of the 2012 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS

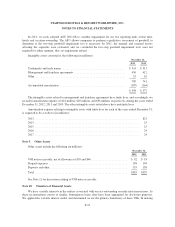

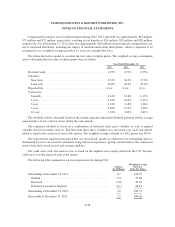

mature in November 2013. The New Facility is a multi-currency revolving loan commitment and is expected to

be used for general corporate purposes. We had approximately $1.75 billion of available borrowing capacity

under our domestic and foreign lines of credit as of December 31, 2012. The short-term borrowings under these

lines of credit at December 31, 2012 and 2011 were de minimis.

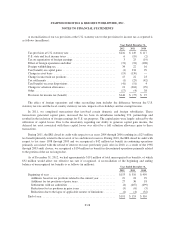

On December 5, 2012, we issued $350 million of 3.125% senior notes. Interest on the notes is payable semi-

annually on February 15 and August 15 of each year, beginning on August 15, 2013, and the notes will mature on

February 15, 2023. The notes rank pari passu with all of our other unsecured and unsubordinated obligations. We

may redeem all or a portion of the notes at our option at any time prior to November 15, 2022 at the make-whole

redemption price equal to the greater of (1) 100% of the aggregate principal amount of the notes being redeemed,

plus accrued and unpaid interest to, but excluding, the redemption date, and (2) the sum, as determined by an

independent investment banker, of the present values of the remaining scheduled payments of principal and

interest in respect of the notes being redeemed (exclusive of any interest accrued to the date of redemption)

discounted to the redemption date on a semi-annual basis at the treasury rate plus 25 basis points, plus accrued

and unpaid interest to, but excluding, the redemption date. At any time on or after November 15, 2022, we may

redeem all or a portion of the notes at a redemption price equal to 100% of the principal amount plus accrued and

unpaid interest to, but excluding, the redemption date. We used the net proceeds from the offering, together with

cash on hand, to finance the 2012 redemptions discussed below.

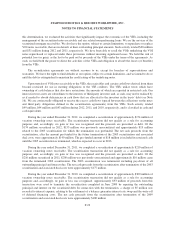

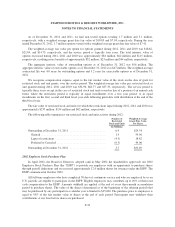

During the year ended December 31, 2012, we completed a tender offer to purchase four different series of

senior notes. The offer to purchase resulted in principal tenders of $321 million of our 7.875% Senior Notes due

2014, $156 million of our 7.375% Senior Notes due 2015, $29 million of our 6.75% Senior Notes due 2018 and $40

million of our 7.15% Senior Notes due 2019. Subsequent to the tender offer, we exercised our option to redeem the

remaining $179 million 7.875% Senior Notes due 2014. We paid $833 million in connection with these

redemptions. We recorded a charge of approximately $113 million in the loss on early extinguishment of debt, net,

line item in our statements of income, which primarily relates to $85 million of tender premiums, $23 million of

make-whole premiums related to our redemption exercise, $11 million to write-off unamortized deferred financing

costs, and unamortized issuance discounts, partially offset by favorable swap settlements of $6 million.

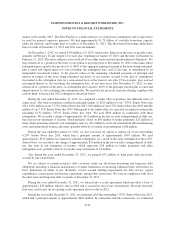

During the year ended December 31, 2012, we also exercised our option to redeem all of our outstanding

6.25% Senior Notes due 2013, which had a principal amount of approximately $495 million. We paid

approximately $513 million in connection with this redemption. As a result of the early redemption of the 6.25%

Senior Notes, we recorded a net charge of approximately $15 million in the loss on early extinguishment of debt,

net, line item in our statements of income, which represents $18 million in tender premiums and other

redemption costs, partially offset by favorable swap settlements of $3 million.

Also during the year ended December 31, 2012, we prepaid $52 million of third party debt previously

secured by one owned hotel.

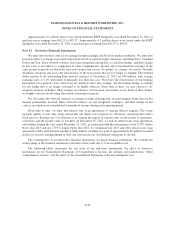

We are subject to certain restrictive debt covenants under our short-term borrowing and long-term debt

obligations including a financial maintenance covenant, limitations on incurring additional debt, restrictions on

liens, limitations on ability to pay dividends, escrow account funding requirements for debt service, capital

expenditures, tax payments and insurance premiums, among other restrictions. We were in compliance with all of

the short-term and long-term debt covenants at December 31, 2012.

During the year ended December 31, 2011, we entered into a credit agreement which provided a loan of

approximately $38 million, which is due in 2016 and is secured by one of our owned hotels. Proceeds from this

loan were used to pay off an existing credit agreement that was due in 2012.

During the year ended December 31, 2011, we redeemed all of the outstanding 7.875% Senior Notes due 2012,

which had a principal amount of approximately $605 million. In connection with this transaction, we terminated

F-30