Starwood 2012 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2012 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

with approximately 1,800 rooms exited our system. In addition, during 2012 we signed franchise agreements for

52 hotels with approximately 8,900 rooms, a portion of which opened in 2012 and a portion of which will open

in the future.

Owned, Leased and Consolidated Joint Venture Hotels. Historically, we have derived the majority of our

revenues and operating income from our owned, leased and consolidated joint venture hotels and a significant

portion of these results are driven by the hotels in North America. However, beginning in 2006, we embarked

upon a strategy of selling a significant number of hotels. The majority of these hotels were sold subject to long-

term management or franchise contracts. Total revenues generated from our owned, leased and consolidated joint

venture hotels worldwide for the years ending December 31, 2012, 2011 and 2010 were $1.698 billion,

$1.768 billion and $1.704 billion, respectively (total revenues from our owned, leased and consolidated joint

venture hotels in North America were $956 million, $1.001 billion and $1.067 billion for 2012, 2011 and 2010,

respectively).

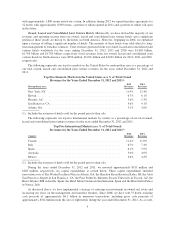

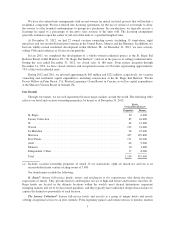

The following represents our top five markets in the United States by metropolitan area as a percentage of

our total owned, leased and consolidated joint venture revenues for the years ended December 31, 2012 and

2011:

Top Five Domestic Markets in the United States as a % of Total Owned

Revenues for the Years Ended December 31, 2012 and 2011(1)

2012 2011

Metropolitan Area Revenues Revenues

New York, NY ................................................... 11.9% 12.4%

Hawaii .......................................................... 6.7% 6.1%

Phoenix, AZ ...................................................... 5.6% 5.3%

San Francisco, CA ................................................. 4.6% 4.1%

Atlanta, GA ...................................................... 3.1% 3.6%

(1) Includes the revenues of hotels sold for the period prior to their sale.

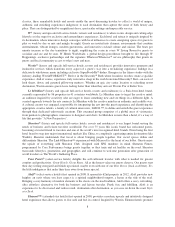

The following represents our top five international markets by country as a percentage of our total owned,

leased and consolidated joint venture revenues for the years ended December 31, 2012 and 2011:

Top Five International Markets as a % of Total Owned

Revenues for the Years Ended December 31, 2012 and 2011(1)

2012 2011

Country Revenues Revenues

Canada .......................................................... 11.4% 11.0%

Italy ............................................................ 6.7% 7.4%

Spain ........................................................... 6.1% 5.9%

Australia ........................................................ 5.0% 4.9%

Mexico .......................................................... 4.6% 4.2%

(1) Includes the revenues of hotels sold for the period prior to their sale.

During the years ended December 31, 2012 and 2011, we invested approximately $315 million and

$283 million, respectively, for capital expenditures at owned hotels. These capital expenditures included

renovation costs at The Westin Peachtree Plaza in Atlanta, GA, the Sheraton Kauai Resort in Koloa, HI, the Aloft

San Francisco Airport in San Francisco, CA, the Four Points by Sheraton Tucson University in Tucson, AZ, the

Hotel Alfonso XIII in Seville, Spain, the Hotel Maria Cristina in San Sebastian, Spain and the Hotel Gritti Palace

in Venice, Italy.

As discussed above, we have implemented a strategy of reducing our investment in owned real estate and

increasing our focus on the management and franchise business. Since 2006, we have sold 73 hotels realizing

cash proceeds of approximately $6.1 billion in numerous transactions, including gross cash proceeds of

approximately $542 million from the sale of eight hotels during the year ended December 31, 2012. As a result,

4