Starwood 2012 Annual Report Download - page 174

Download and view the complete annual report

Please find page 174 of the 2012 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS

In September 2011, the FASB issued ASU No. 2011-09, “Compensation-Retirement Benefits-

Multiemployer Plans (Subtopic 715-80): Disclosures about an Employer’s Participation in a Multiemployer

Plan”. This subtopic addresses concerns from users of financial statements on the lack of transparency about an

employer’s participation in a multiemployer pension plan. The disclosures also will indicate the financial health

of all of the significant plans in which the employer participates and assist a financial statement user to access

additional information that is available outside of the financial statements. The subtopic is effective for annual

reporting periods ending after December 15, 2011. We adopted this topic as of December 31, 2011 (see Note 19).

In May 2011, the FASB issued ASU No. 2011-04, “Fair Value Measurements (Topic 820): Amendments to

Achieve Common Fair Value Measurement and Disclosure Requirements in U.S. GAAP and IFRSs.” This topic

clarifies the application of existing fair value measurements and disclosure requirements and certain changes to

principles and requirements for measuring fair value. This update is to be applied prospectively and is effective

during interim and annual periods beginning after December 15, 2011. We adopted this ASU on January 1, 2012

(see Note 24).

On January 1, 2010, we adopted ASU No. 2009-17, “Consolidations (Topic 810): Improvements to

Financial Reporting by Enterprises Involved with Variable Interest Entities,” and we concluded we are the

primary beneficiary of the qualifying special purpose entities (“QSPEs”) used in our securitization transactions.

Accordingly, we began consolidating the QSPEs on January 1, 2010 and recorded the assets and liabilities of the

QSPEs, a $26 million (net of tax) decrease in beginning retained earnings and a $1 million decrease to

stockholders’ equity.

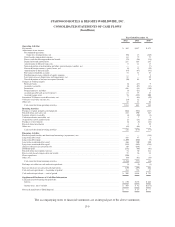

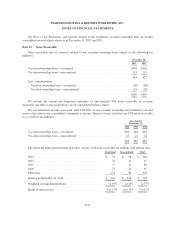

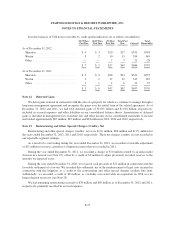

Note 3. Earnings (Losses) per Share

The following is a reconciliation of basic earnings per share to diluted earnings per share for income from

continuing operations attributable to Starwood’s common shareholders (in millions, except per share data):

Year Ended December 31,

2012 2011 2010

Earnings Shares

Per

Share Earnings Shares

Per

Share Earnings Shares

Per

Share

Basic earnings from continuing operations

attributable to Starwood’s common

shareholders ........................ $470 193 $2.44 $502 189 $2.65 $310 183 $1.70

Effect of dilutive securities:

Employee options and restricted stock

awards .......................... — 4 — 6 — 7

Diluted earnings from continuing operations

attributable to Starwood’s common

shareholders ........................ $470 197 $2.39 $502 195 $2.57 $310 190 $1.63

Approximately 1.3 million shares, 1.2 million shares and 4.8 million shares were excluded from the

computation of diluted shares in 2012, 2011 and 2010, respectively, as their impact would have been anti-

dilutive.

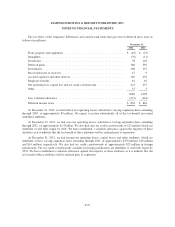

Note 4. Significant Acquisitions

During the year ended December 31, 2011, we executed a transaction with our former partner in a joint

venture that owned three luxury hotels in Austria. In connection with the transaction, we acquired substantially

the entire interest in two of the hotels in exchange for our interest in the third hotel and a cash payment of

approximately $27 million by us. We previously held a 47.4% ownership interest in the hotels. In accordance

F-17