Starwood 2012 Annual Report Download - page 186

Download and view the complete annual report

Please find page 186 of the 2012 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS

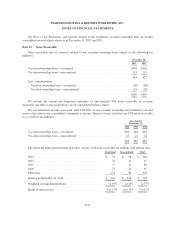

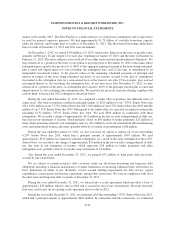

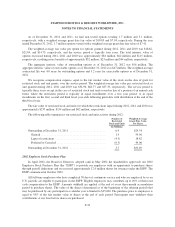

It is reasonably possible that approximately $51 million of our unrecognized tax benefits as of

December 31, 2012 will reverse within the next twelve months, the majority of which will not impact the

effective tax rate.

We recognize interest and penalties related to unrecognized tax benefits through income tax expense. We

had $80 million and $74 million accrued for the payment of interest as of December 31, 2012 and December 31,

2011, respectively. We did not have any reserves for penalties as of December 31, 2012 and 2011.

We are subject to taxation in the U.S. federal jurisdiction, as well as various state and foreign jurisdictions.

As of December 31, 2012, we are no longer subject to examination by U.S. federal taxing authorities for years

prior to 2007 and to examination by any U.S. state taxing authority prior to 1998. All subsequent periods remain

eligible for examination. In the significant foreign jurisdictions in which we operate, we are no longer subject to

examination by the relevant taxing authorities for any years prior to 2001.

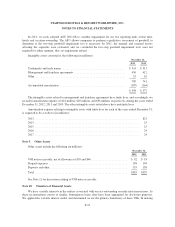

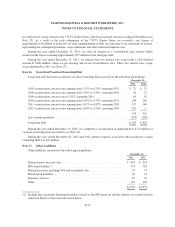

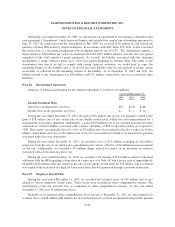

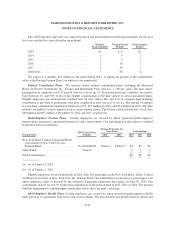

Note 15. Debt

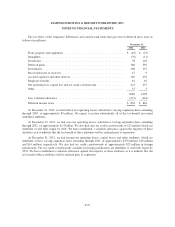

Long-term debt and short-term borrowings consisted of the following (in millions):

December 31,

2012 2011

Senior Credit Facility:

Revolving Credit Facility, maturing 2018 ........................................ $ — $ —

Senior Notes, interest at 6.25%, redeemed in 2012 ................................... — 500

Senior Notes, interest at 7.875%, redeemed in 2012 .................................. — 497

Senior Notes, interest at 7.375%, maturing 2015 ..................................... 294 450

Senior Notes, interest at 6.75%, maturing 2018 ...................................... 371 400

Senior Notes, interest at 7.15%, maturing 2019 ...................................... 206 245

Senior Notes, interest at 3.125%, maturing 2023 ..................................... 349 —

Mortgages and other, interest rates ranging from 1.00% to 9.00%, various maturities ........ 55 105

1,275 2,197

Less current maturities ......................................................... (2) (3)

Long-term debt ............................................................... $1,273 $2,194

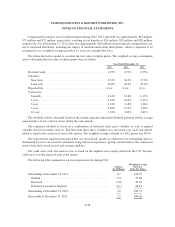

Aggregate debt maturities for each of the years ending December 31 are as follows (in millions):

2013 ............................................................................... $ 2

2014 ............................................................................... 2

2015 ............................................................................... 296

2016 ............................................................................... 35

2017 ............................................................................... 3

Thereafter ........................................................................... 937

$1,275

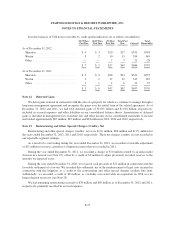

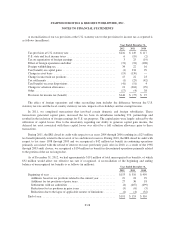

We maintain lines of credit under which bank loans and other short-term debt can be drawn on. In addition,

smaller credit lines are maintained by our foreign subsidiaries. In November 2012, we closed on a new $1.75

billion senior credit facility (the “New Facility”) to replace the existing $1.5 billion credit agreement (the

“Existing Facility”). The New Facility matures in February 2018, whereas the Existing Facility was scheduled to

F-29