Starwood 2012 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2012 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We may continue to reposition our owned, leased and consolidated joint venture hotels as we pursue our brand

and quality strategies. In addition, several owned hotels are located in regions which are seasonal and, therefore,

these hotels do not operate at full capacity throughout the year.

We and our hotel owners have continued to invest capital in our hotels and provide innovative ways to

utilize public space, such as our Link@SheratonSM experienced with Microsoft, and also by maximizing guest

room conveniences. Finally, we believe our SPG loyalty guest program is an industry leader. With our recently

announced changes to the program, we expect to drive further loyalty to our properties and brands from our SPG

members as well as attract the next wave of global elite members. As the program is constantly refined and new

promotions are offered, it provides rewards to our patrons while its growth in membership favorably impacts our

results. As we move forward to 2013, we will continue to focus on providing superior guest experiences for our

business, leisure, and group customers while maintaining a commitment to controlling our costs.

On July 1, 2012, we completed an internal management reorganization related to how we manage and

operate our former hotel operating segment. Whereas our hotel business had previously been included in a single

reportable segment, as a result of this reorganization, these results are now segregated into three separate hotel

segments: (i) the Americas, (ii) EAME, and (iii) Asia Pacific. Our vacation ownership and residential business

remains a separate segment. Prior period data has been restated to be consistent with the current year

presentation.

In addition to revenues recorded within our four segments, we also have other revenues from managed and

franchised properties, which represent the reimbursement of costs incurred on behalf of managed property

owners. These revenues, together with the corresponding expenses, are not recorded within our segments. Other

corporate unallocated revenues and earnings primarily relate to other license fee income and are also reported

outside of segment revenues.

This Management’s Discussion and Analysis of Financial Condition and Results of Operations includes

discussion of our consolidated operating results, which were unaffected by our internal management

reorganization, as well as discussion about each of our four segments. Additionally, Note 26 to the consolidated

financial statements presents further information about our segments.

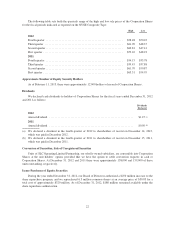

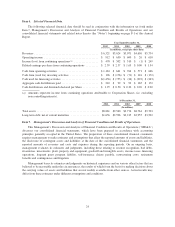

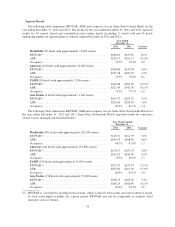

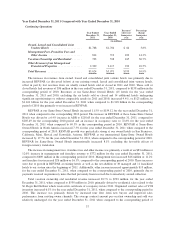

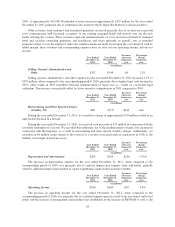

Year Ended December 31, 2012 Compared with Year Ended December 31, 2011

Consolidated Results

Year Ended

December 31,

2012

Year Ended

December 31,

2011

Increase /

(decrease)

from prior

year

Percentage

change

from prior

year

(in millions)

Owned, Leased and Consolidated Joint Venture Hotels .... $1,698 $1,768 $ (70) (4.0)%

Management Fees, Franchise Fees and Other Income .... 888 814 74 9.1%

Vacation Ownership and Residential ................... 1,287 703 584 83.1%

Other Revenues from Managed and Franchised

Properties ....................................... 2,448 2,339 109 4.7%

Total Revenues .................................... $6,321 $5,624 $697 12.4%

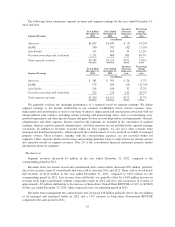

The decrease in revenues from owned, leased and consolidated joint venture hotels was primarily due to lost

revenues from 11 owned hotels that were sold or closed in 2011 and 2012. These sold or closed hotels had

revenues of $420 million in the year ended December 31, 2012, compared to $484 million for the corresponding

period in 2011. Revenues at our Same-Store Owned Hotels (39 hotels for the year ended December 31, 2012 and

2011, excluding the 11 hotels sold and 14 additional hotels undergoing significant repositionings or without

comparable results in 2012 and 2011) decreased 0.2%, or $3 million, to $1.252 billion for the year ended

December 31, 2012, when compared to $1.255 billion in the corresponding period of 2011.

29