Starwood 2012 Annual Report Download - page 145

Download and view the complete annual report

Please find page 145 of the 2012 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Since 2006, we have sold 73 hotels realizing cash proceeds of approximately $6.1 billion in numerous

transactions, including gross cash proceeds of approximately $542 million from the sale of eight hotels during

the year ended December 31, 2012 (see Note 5 of the consolidated financial statements). There can be no

assurance, however, that we will be able to complete future dispositions on commercially reasonable terms or at

all.

In late 2011, we received certificates of occupancy for the St. Regis Bal Harbour and, as a result, we began

closings of units that had previously been sold. During the year ended December 31, 2012, we closed on 188

additional units. From project inception through December 31, 2012, we have closed contracts on 224 units

representing approximately 73% of the total residential units available at the St. Regis Bal Harbour and realized

residential revenue of $810 million.

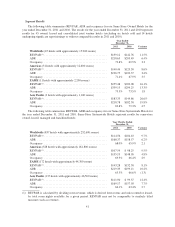

Cash Used for Financing Activities

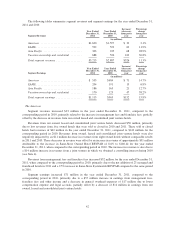

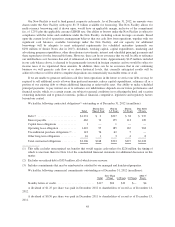

The following is a summary of our indebtedness (including capital leases) as of December 31, 2012:

Amount

Outstanding at

December 31,

2012 (a)

Weighted

Average

Interest Rate at

December 31,

2012

Weighted

Average

Maturity

(Dollars in millions) (In years)

Floating Rate Debt

Revolving Credit Facility ......................... $ — — 5.2

Mortgages and Other ............................ 43 4.65% 4.0

Total/Average .................................. $ 43 4.65% 4.0

Fixed Rate Debt

Senior Notes ................................... $1,220 5.93% 6.4

Mortgages and Other ............................ 12 3.07% 14.6

Total/Average .................................. $1,232 5.90% 6.5

Total Debt

Total Debt and Average Terms .................... $1,275 5.86% 6.4

(a) Excludes approximately $389 million of our share of unconsolidated joint venture debt and securitized

vacation ownership debt of $533 million, all of which is non-recourse.

For specifics related to our financing transactions, issuances, and terms entered into for the years ended

December 31, 2012 and 2011, see Note 15 of the consolidated financial statements.

In 2012, we repaid approximately $1.2 billion of our fixed rate senior notes with varying maturities. In June

2012, we redeemed all $495 million of our 6.25% Senior Notes, which were scheduled to mature in February

2013. We paid $513 million in connection with the early redemption and recorded a net charge of approximately

$15 million, which represents $18 million in tender premiums and other redemption costs, partially offset by

swap settlements of $3 million. In December 2012, we redeemed all $500 million of our 7.875% Senior Notes

due 2014 and partially redeemed $156 million of our 7.375% Senior Notes due 2015, $29 million of our 6.75%

Senior Notes due 2018 and $40 million of our 7.15% Senior Notes due 2019. We paid $833 million in connection

with these early redemptions and recorded a net charge of approximately $113 million, which primarily

represents $108 million in tender premiums and other redemption costs and an $11 million charge to write-off

unamortized deferred financing costs and unamortized issuance discounts, partially offset by gains on swap

settlements of $6 million.

Also during 2012, we prepaid $52 million of third party debt previously secured by one owned hotel.

46