Starwood 2012 Annual Report Download - page 171

Download and view the complete annual report

Please find page 171 of the 2012 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS

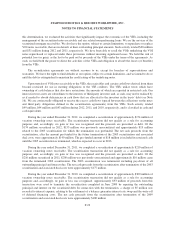

Foreign Currency Translation. Balance sheet accounts are translated at the exchange rates in effect at

each period end and income and expense accounts are translated at the average rates of exchange prevailing

during the year. The national currencies of foreign operations are generally the functional currencies. Gains and

losses from foreign exchange and the effect of exchange rate changes on intercompany transactions long-term in

nature are generally included in other comprehensive income. Gains and losses from foreign exchange rate

changes related to intercompany receivables and payables that are not of a long-term investment nature are

reported currently in costs and expenses and amounted to a net gain of $5 million in 2012, a net loss of $12

million in 2011 and a net gain of $39 million in 2010.

Income Taxes. We provide for income taxes in accordance with principles contained in ASC Topic 740,

Income Taxes. Under these principles, we recognize the amount of income tax payable or refundable for the

current year and deferred tax assets and liabilities for the future tax consequences of events that have been

recognized in our financial statements or tax returns.

Deferred tax assets and liabilities are measured using enacted tax rates in effect for the year in which those

temporary differences are expected to be recovered or settled. The effect on deferred tax assets and liabilities of a

change in tax rates is recognized in earnings in the period when the new rate is enacted. Deferred tax assets are

evaluated for future realization and reduced by a valuation allowance if we believe a portion will not be realized.

We consider many factors when assessing the likelihood of future realization of our deferred tax assets, including

our recent cumulative earnings experience and expectations of future available taxable income by taxing

jurisdiction, the carry-back and carry-forward periods available to us for tax reporting purposes and tax

attributes.

We measure and recognize the amount of tax benefit that should be recorded for financial statement

purposes for uncertain tax positions taken or expected to be taken in a tax return. With respect to uncertain tax

positions, we evaluate the recognized tax benefits for derecognition, classification, interest and penalties, interim

period accounting and disclosure requirements. Judgment is required in assessing the future tax consequences of

events that have been recognized in our financial statements or tax returns.

Stock-Based Compensation. We calculate the fair value of share-based awards on the date of grant.

Restricted stock awards are valued based on the share price. We have determined that a lattice valuation model

provides a better estimate of the fair value of options granted under our long-term incentive plans than a Black-

Scholes model. The lattice valuation option pricing model requires that we estimate key assumptions such as

expected life, volatility, risk-free interest rates and dividend yield to determine the fair value of share-based

awards, based on both historical information and management decision regarding market factors and trends. We

amortize the share-based compensation expense over the period that the awards are expected to vest, net of

estimated forfeitures. If the actual forfeitures differ from management estimates, additional adjustments to

compensation expense are recorded. Please refer to Note 22, Stock-Based Compensation.

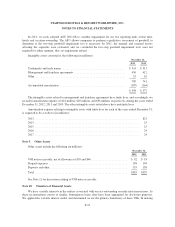

Revenue Recognition. Our revenues are primarily derived from the following sources: (1) hotel and resort

revenues at our owned, leased and consolidated joint venture properties; (2) management fees and franchise fees;

(3) vacation ownership and residential sales; (4) other revenues from managed and franchised properties.

Generally, revenues are recognized when services are rendered. Taxes collected from customers and submitted to

taxing authorities are not recorded in revenue. The following is a description of the composition of our revenues:

• Owned, Leased and Consolidated Joint Ventures — Represents revenue primarily derived from hotel

operations, including the rental of rooms and food and beverage sales, from owned, leased or

consolidated joint venture hotels and resorts. Revenue is recognized when rooms are occupied and

services have been rendered. These revenues are impacted by global economic conditions affecting the

travel and hospitality industry as well as relative market share of the local competitive set of hotels.

Revenue per available room (“REVPAR”), is a leading indicator of revenue trends at owned, leased and

F-14