Starwood 2012 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2012 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.-2013Proxy Statement 47

EXECUTIVE COMPENSATION

In light of these accomplishments and impact on the Company, the

Compensation Committee awarded Mr. van Paasschen a payout

at 100% of target for the strategic/operational /leadership portion

of the annual bonus. Mr. Avril announced his retirement in April

2012 with transition of his direct report responsibilities effective

July 1, 2012; throughout the remainder of 2012, Mr. Avril also

worked with the Company and its key ownership relationships to

ensure an effective transition. Mr. Avril’s fi nal incentive award was

determined as described above, but reduced in light of his changed

responsibilities, with the strategic/operational/leadership portion of

the award determined based on the achievements described above

and this transition work. The Compensation Committee awarded

each of our other named executive offi cers participating in the

Executive Plan an “accomplished objectives” PMP performance

rating and a payout at 100% of target for their strategic/operational /

leadership portion of their annual bonus. While Mr. Rivera’s 2012

incentive was not technically paid under the Executive Plan, the

same evaluation structure was used for his award, and as a result he

was also awarded an “accomplished objectives” PMP performance

rating and a payout at 100% of target for the strategic/operational /

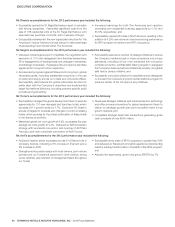

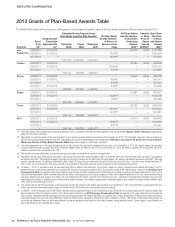

leadership portion of his annual bonus. The following table sets forth

for each named executive offi cer his salary, target award as both a

percentage of salary and a dollar amount, actual award and actual

award as a percentage of target award:

Name Salary

($)

Award Target

Relative to Salary

(%) Award Target

($) Actual Award

($) Actual Award

(% of Target)

van Paasschen 1,250,000 200% 2,500,000 2,300,000 92%

Prabhu 766,785 100% 766,785 705,443 92%

Rivera 722,000 100% 722,000 664,240 92%

Siegel 638,490 100% 638,490 587,411 92%

Turner 766,785 100% 766,785 705,443 92%

Avril(1) 766,785 100% 766,785 352,722 46%

(1) Mr. Avril’s job responsibilities changed during 2012, as further described in our Current Report on Form 8-K filed with the SEC on April16, 2012.

Annual awards made to our named executive offi cers with respect to

2011 performance are refl ected in the 2012 Summary Compensation

Table on page 55 of this proxy statement.

As noted above, effective with the 2012 performance period,

deferrals from cash incentive awards were no longer allowed under

the Executive Plan.

2012 Long-Term Incentive Compensation.Like the annual

incentives described above, long-term incentives are a key part of

the Company’s named executive offi cer compensation program.

Long-term incentive compensation for our named executive

offi cers for 2012 consisted entirely of equity compensation awards

granted in February2012 following the announcement of our 2011

earnings under our LTIP. On average, approximately 60% of total

compensation at target award levels for 2012 was equity-based

long-term incentive compensation.

The Compensation Committee granted awards under the LTIP to

Mr. van Paasschen consisting of a combination of stock options

and restricted stock awards. The Compensation Committee granted

awards under the LTIP for 2012 to all other named executive offi cers

also consisting of a combination of stock options and restricted stock

awards. For the other named executive offi cers, this compensation

was also geared towards performance and long-term incentives,

but to a lesser degree than Mr. van Paasschen. The Compensation

Committee believed an emphasis on long-term equity compensation

was particularly appropriate for the leader of a management team

committed to the creation of stockholder value.

In 2012, for all named executive offi cers, the Compensation

Committee used a grant approach in which the long-term award

was articulated as a dollar value. Under this approach, an overall

award value, in dollars, was determined for each named executive

offi cer based upon our compensation strategy and competitive

market positioning taking into account company and individual

performance factors for the named executive offi cers described

in the section entitled 2012 Annual Incentive Compensation

beginning on page 43 of this proxy statement.

The Compensation Committee determined the appropriate mix of

restricted stock and stock options to be given to our named executive

offi cers. For 2012, the Compensation Committee determined that

a split of 75% of restricted stock awards and 25% of stock options

was the appropriate balance to maximize cost effectiveness and

encourage equity ownership among our management. The number

of shares of restricted stock was calculated by dividing 75% of

the award value by the fair market value of our stock for the grant

date. The number of stock options was determined by dividing

the remaining 25% of the award value by the fair market value of

our stock for the grant date and multiplying the result by two and

one-half, which we believe historically approximates the number of

options determined through formal lattice model option valuation

methods. The named executive offi cers were able to elect a greater

portion of options (up to 100%). During 2012, only Mr. Turner elected

a greater portion of options (50%). Based on the factors set forth

above, including our performance and individual performance of

each named executive offi cer in 2011, the Compensation Committee

believes that the equity award grants in 2012 were appropriate.

The exercise price for each stock option was equal to fair market

value of our common stock on the option grant date. See the

section entitled Equity Grant Practices beginning on page 53

of this proxy statement for a description of the manner in which

we determined fair market value for this purpose. Currently, most

stock options vest in 25% increments annually starting with the

fi rst anniversary of the date of grant. For stock options granted in

2012, awards granted to associates who were retirement-eligible,

as defi ned in the LTIP, vest in 16 equal quarterly periods. The only

named executive offi cer who currently meets the retirement criteria

is Mr. Siegel, our Chief Administrative Offi cer, General Counsel and

Secretary. Unexercised stock options expire eightyears from the

date of grant, or earlier in the event of termination of employment.