Starwood 2012 Annual Report Download - page 177

Download and view the complete annual report

Please find page 177 of the 2012 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS

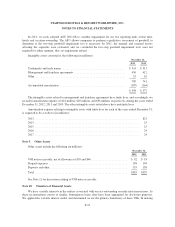

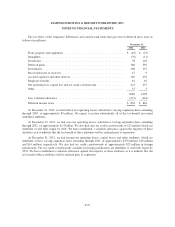

The above balances include unamortized capitalized computer software costs of $108 million and $155

million at December 31, 2012 and 2011 respectively. Amortization of capitalized computer software costs was

$33 million, $32 million and $36 million for the years ended December 31, 2012, 2011 and 2010, respectively.

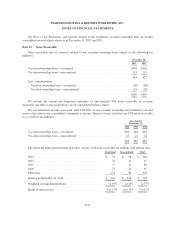

Note 8. Goodwill and Intangible Assets

The changes in the carrying amount of goodwill for the years ended December 31, 2012 and 2011 is as

follows (in millions):

Americas

Segment

EAME

Segment

Asia

Pacific

Segment

Vacation

Ownership

and

Residential

Segment Total

Balance at January 1, 2011 ............... $819 $242 $283 $151 $1,495

Acquisitions .......................... — 26 — — 26

Currency translation adjustment ........... — (11) — — (11)

Asset dispositions ...................... (33) — — — (33)

Other ................................ — (1) — — (1)

Balance at December 31, 2011 ............ $786 $256 $283 $151 $1,476

Balance at January 1, 2012 ............... $786 $256 $283 $151 $1,476

Acquisitions .......................... — 6 — — 6

Currency translation adjustment ........... — 3 — — 3

Asset dispositions ...................... (58) — — — (58)

Other ................................ — — — — —

Balance at December 31, 2012 ............ $728 $265 $283 $151 $1,427

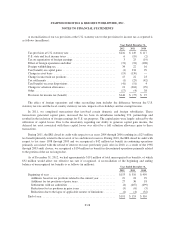

In 2012, we changed our reportable segments and have reclassified the above table to be consistent with our

new reportable segments (see Note 26).

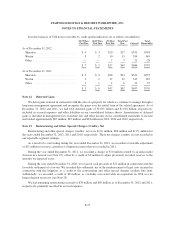

As previously discussed in Note 6, Assets Held for Sale, we included approximately $4 million of goodwill

in assets held for sale, which represented the goodwill we allocated to the sale of wholly-owned hotels that took

place in January 2013. The goodwill balances as of December 31, 2011 have been reclassified to be consistent

with the current year presentation.

At October 31, 2012, the date of our annual impairment valuation, the vacation ownership and residential

segment’s fair value significantly exceeded its book value. The fair value was determined primarily from a

discounted cash flow model, in which the underlying cash flows were derived from our current financial

projections. The two key assumptions used in the fair value calculation are the discount rate and the

capitalization rate in the terminal period, which were 10% and 2%, respectively. Based on the results of the

discounted cash flow model and the comparison of the segment’s fair value to its book value, we determined

goodwill was not impaired.

At October 31, 2012, the date of our annual impairment valuation, we evaluated the goodwill for the hotel

segments and determined that, for each of the hotel segments, the fair value significantly exceeded the book

value. We used a market approach to determine the fair value of the reporting units. We utilized earnings

multiples from various independent, third party investment firms and applied those earnings multiples to the

respective earnings streams (owned hotels, management and franchise fees and other) generated by each of our

hotel segments to determine the fair value for each of the hotel segments.

F-20