Starwood 2012 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2012 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

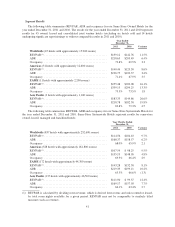

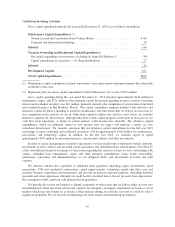

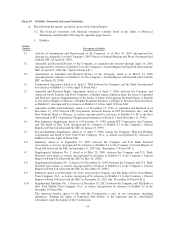

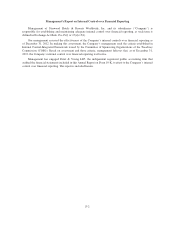

The following table sets forth the scheduled maturities and the total fair value of our indebtedness and

financial instruments as of December 31, 2012 (in millions, excluding average exchange rates):

Expected Maturity or Transaction Date

At December 31, Total at

December 31,

2012

Total Fair

Value at

December 31,

20122013 2014 2015 2016 2017 Thereafter

Indebtedness

Fixed rate ...................... $ 1 $— $294 $— $— $937 $1,232 $1,406

Average interest rate .............. 5.90%

Floating rate .................... $ 1 $ 2 $ 2 $35 $ 3 $ — $ 43 $ 43

Average interest rate .............. 4.65%

Forward Foreign Exchange Hedge

Contracts:

Fixed (EUR) to Fixed (USD) ....... $ 40 $— $ — $— $— $ — $ (1) $ (1)

Average Exchange rate ............ 1.29

Forward Foreign Exchange

Contracts:

Fixed (EUR) to Fixed (USD) ....... $ 55 $— $ — $— $— $ — $ — $ —

Average Exchange rate ............ 1.31

Fixed (USD) to Fixed (EUR) ....... $ 41 $— $ — $— $— $ — $ — $ —

Average Exchange rate ............ 0.76

Fixed (CLP) to Fixed (USD) ....... $ 59 $— $ — $— $— $ — $ — $ —

Average Exchange rate ............ 0.00

Fixed (THB) to Fixed (USD) ....... $ 13 $— $ — $— $— $ — $ — $ —

Average Exchange rate ............ 0.03

Fixed (JPY) to Fixed (USD) ........ $ 84 $— $ — $— $— $ — $ 2 $ 2

Average Exchange rate ............ 0.01

Fixed (MXP) to Fixed (USD) ....... $ 10 $— $ — $— $— $ — $ — $ —

Average Exchange rate ............ 0.08

Fixed (AUD) to Fixed (USD) ....... $ 15 $— $ — $— $— $ — $ — $ —

Average Exchange rate ............ 0.96

Fixed (CAD) to Fixed (USD) ....... $259 $— $ — $— $— $ — $ — $ —

Average Exchange rate ............ 1.01

Fixed (GBP) to Fixed (EUR) ....... $ 90 $— $ — $— $— $ — $ — $ —

Fixed (JPY) to Fixed (THB) ........ $ 19 $— $ — $— $— $ — $ — $ —

Item 8. Financial Statements and Supplementary Data.

The financial statements and supplementary data required by this item appear beginning on page F-1 of this

Annual Report and are incorporated herein by reference.

Item 9. Changes in and Disagreements with Accountants on Accounting and Financial Disclosure.

Not applicable.

Item 9A. Controls and Procedures.

As of the end of the period covered by this report, we carried out an evaluation, under the supervision and

with the participation of our management, including our principal executive and principal financial officers, of

the effectiveness of the design and operation of our disclosure controls and procedures (as such term is defined in

50