Starwood 2012 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2012 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STARWOOD HOTELS & RESORTS WORLDWIDE, INC.-2013Proxy Statement 43

EXECUTIVE COMPENSATION

instead received a lump sum cash payment equal to 2% of his

base salary. By providing this payment in the form of a discretionary

cash payment instead of a base salary increase (in which form it

would continue to be provided to him year after year), we were

able to maintain Mr. Siegel’s base salary at approximately 65%

of market median, and not raise his salary above that level. The

Compensation Committee viewed this as a favorable result as

it effectively rewarded Mr. Siegel for his accomplishments, but

maintains his base salary (or fi xed component of compensation)

below the 75th percentile.

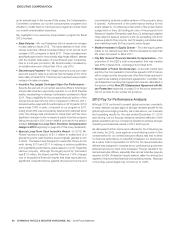

0

250

500

750

1,000

1,250

1,500

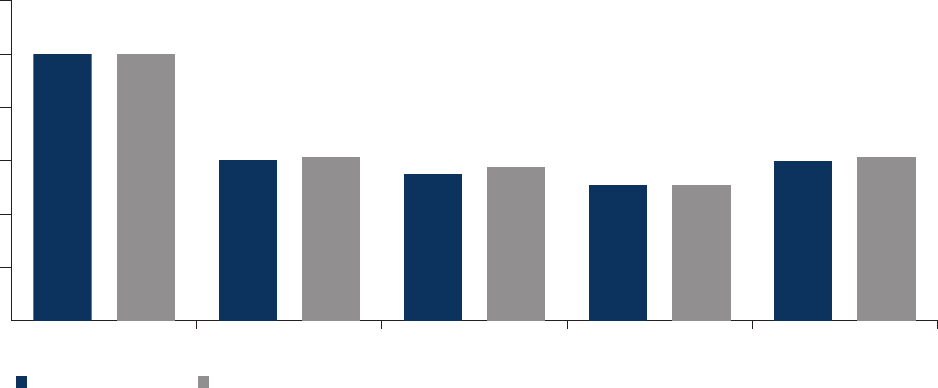

$000 2011-2012 CEO AND CURRENT NEO BASE SALARY CHANGES

$1,250,000 $1,250,000

$766,785 $722,000 $638,490

$766,785

$751,750 $674,500 $638,490

$750,020

2011 Base Salary 2012 Base Salary

van Paasschen Prabhu Rivera Siegel Turner

2012 Incentive Compensation

Incentive compensation includes annual cash incentive awards

under our Executive Plan, special non-equity incentive awards paid

in cash and long-term incentive compensation in the form of equity

awards under our LTIP. For 2012, incentive compensation accounted

for an average of approximately 80% of total compensation at

target (86% for Mr.vanPaasschen in 2012), with annual cash

incentive compensation and long-term incentive compensation

accounting for 19% and 61%, respectively (27% and 59% for Mr.

van Paasschen, respectively, in 2012). We believe that this structure

allowed us to provide each participating named executive offi cer

with substantial incentive compensation opportunities for 2012 if

our performance objectives were met.

We believe that the allocation between base salary and incentive

compensation is appropriate and benefi cial because:

•it promotes our competitive position by allowing us to provide

named executive offi cers with total compensation that refl ects

performance;

•

it targets and attracts highly motivated and talented executives

within and outside the hospitality industry;

•

it aligns senior management’s interests with those of stockholders;

•

it promotes achievement of business and individual performance

objectives;and

•

it provides long-term incentives for named executive offi cers to

remain in our employment.

2012 Annual Incentive Compensation.Annual cash incentive

awards are a key part of our executive compensation program.

For 2012, each named executive offi cer had an opportunity to

receive an incentive award under the stockholder-approved

Executive Plan, except for Mr. Rivera, who is a newly-designated

executive offi cer and therefore was not subject to the Executive

Plan in 2012. While Mr. Rivera’s annual incentive compensation

for 2012 was not te chnically paid under the Executive Plan, the

structure of Mr. Rivera’s annual incentive compensation was

substantially the same as the structure used for the other named

executive offi cers under the Executive Plan, as described below.

Viewed on a combined basis, once minimum performance is

attained, the annual incentive payments attributable to both

company fi nancial and strategic/operational/leadership performance

can range from 0% to 200% of target for the named executive

offi cers. See additional detail regarding targets in the section entitled

Narrative Disclosure to Summary Compensation Table and

Grants of Plan-Based Awards Table beginning on page 57 of

this proxy statement.

Minimum Threshold

For the named executive offi cers (except Mr. Rivera), the 2012 annual

incentive award was paid under the Executive Plan. Mr. Rivera’s

annual incentive award was paid outside the Executive Plan, but the

following discussion applies equally as to the operation and outcome

for Mr. Rivera’s annual incentive award. Under the Executive Plan,

for 2012, the Compensation Committee established in advance a

threshold level of adjusted EBITDA that we had to achieve in order

for any incentive to be paid under the Executive Plan (which we

refer to as the EP Threshold). The Executive Plan also specifi ed a

maximum incentive amount, in dollars, that could be paid to any