Starwood 2012 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2012 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

net addition of 49 managed and franchised hotels to our system since the beginning of 2011. Additionally,

residential sales at the St. Regis Bal Harbour favorably impacted 2011 operating income by $27 million.

Operating income for the year ended December 31, 2011, as compared to 2010, was negatively impacted by a

$70 million charge associated with an unfavorable legal decision in 2011, while 2010 benefited from a favorable

settlement of a lawsuit of $75 million. Results were also negatively impacted by political unrest in the Middle

East and North Africa, as well as the earthquake and tsunami in Japan.

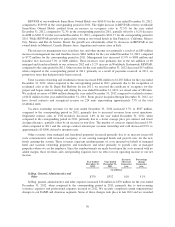

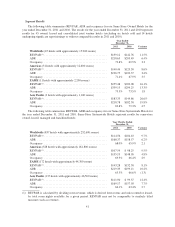

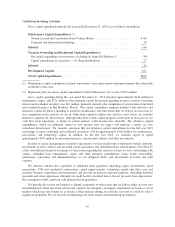

Year Ended

December 31,

2011

Year Ended

December 31,

2010

Increase /

(decrease)

from prior

year

Percentage

change

from prior

year

(in millions)

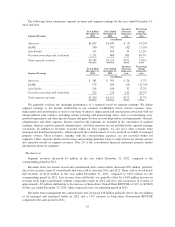

Equity Earnings (Losses) and Gains and

Losses from Unconsolidated Ventures,

Net ................................ $11 $10 $1 10.0%

The increase in equity earnings and gains and losses from unconsolidated joint ventures for the year ended

December 31, 2011, when compared to the corresponding period of 2010, was primarily due to improved

operating results at several properties owned by joint ventures in which we hold non-controlling interests,

partially offset by unfavorable mark-to-market adjustments on US dollar denominated loans at several properties

in Latin America.

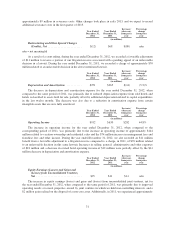

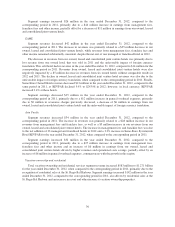

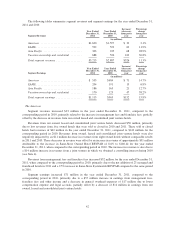

Year Ended

December 31,

2011

Year Ended

December 31,

2010

Increase /

(decrease)

from prior

year

Percentage

change

from prior

year

(in millions)

Net Interest Expense .................... $200 $235 $(35) (14.9)%

The decrease in net interest expense for the year ended December 31, 2011, when compared to the

corresponding period of 2010, was primarily due to a lower average debt balance and an increase in capitalized

interest related to construction projects, primarily relating to the St. Regis Bal Harbour. Our weighted average

interest rate was 6.66% at December 31, 2011 as compared to 6.86% at December 31, 2010.

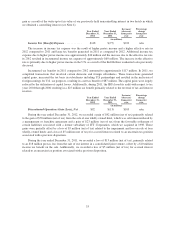

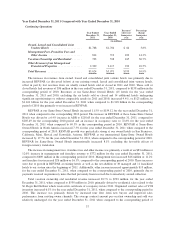

Year Ended

December 31,

2011

Year Ended

December 31,

2010

Increase /

(decrease)

from prior

year

Percentage

change

from prior

year

(in millions)

Loss on Early Extinguishment of Debt,

net ................................. $16 $1 $15 n/m

The increase in loss on early extinguishment of debt, net is from the $16 million charge for redemption

premiums and other costs associated with the December 2011 redemption of all $605 million of our 7.875%

Senior Notes due 2012.

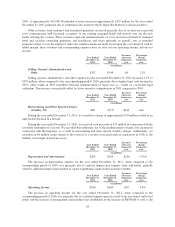

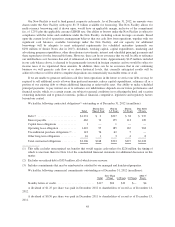

Year Ended

December 31,

2011

Year Ended

December 31,

2010

Increase /

(decrease)

from prior

year

Percentage

change

from prior

year

(in millions)

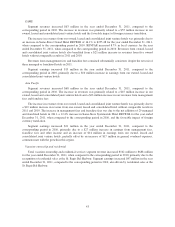

Loss on Asset Dispositions and Impairments,

Net ................................ $— $(39) $(39) 100.0%

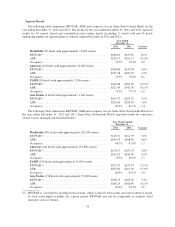

During the year ended December 31, 2011, we recorded an impairment charge of $31 million to write-off

our noncontrolling interest in a joint venture that owns a hotel in Tokyo, Japan, a $9 million loss due to

significant renovations and related asset retirements at two properties, $7 million in losses relating to the

impairment of six hotels whose carrying value exceeded their book value and a $2 million loss on an investment

in a management contract that was terminated during the period. These amounts were offset by a $50 million

gain as a result of the write-up to fair value of our previously held noncontrolling interest in two hotels in which

we obtained a controlling interest (see Note 4).

39