Starwood 2012 Annual Report Download - page 201

Download and view the complete annual report

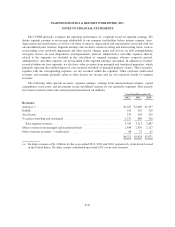

Please find page 201 of the 2012 Starwood annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.STARWOOD HOTELS & RESORTS WORLDWIDE, INC.

NOTES TO FINANCIAL STATEMENTS

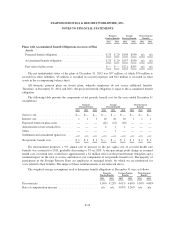

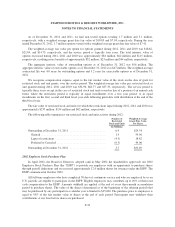

Variable Interest Entities. We have determined that we have a variable interest in 23 hotels, generally in

the form of investments, loans, guarantees, or equity. We determine if we are the primary beneficiary of these

hotels by primarily considering certain qualitative factors. Qualitative factors include evaluating if we have the

power to control the VIE and have the obligation to absorb the losses and rights to receive the benefits of the

VIE, that could potentially be significant to the VIE. We have determined that we are not the primary beneficiary

of these VIEs and therefore, these entities are not consolidated in our financial statements. See Note 10 for the

VIEs in which we are deemed the primary beneficiary and have consolidated the entities.

The 23 VIEs associated with our variable interests represent entities that own hotels for which we have

entered into management or franchise agreements with the hotel owners. We are paid a fee primarily based on

financial metrics of the hotel. The hotels are financed by the owners, generally in the form of working capital,

equity, and debt.

At December 31, 2012, we have approximately $109 million of investments associated with 21 of the

23 VIEs. The maximum loss under these agreements equals the carrying value because we are not obligated to

fund future cash contributions. In addition, we have not contributed amounts to the VIEs in excess of our

contractual obligations.

We also have approximately $5 million of investments and certain performance guarantees associated with

the remaining two VIEs. During the year ended December 31, 2011 and 2010, respectively, we recorded a

$1 million and $3 million charge to selling, general and administrative expenses, related to one of these VIEs, for

a performance guarantee related to a hotel managed by us. After these charges, we have no remaining funding

exposure for this guarantee related to this VIE. Our remaining performance guarantee has a possible cash outlay

of up to $62 million of which, if required, would be funded over several years and would be largely offset by

management fees received under this contract.

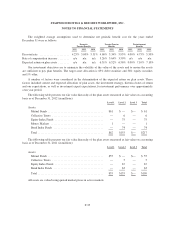

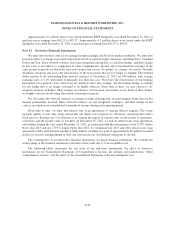

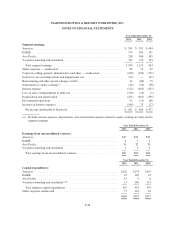

Guaranteed Loans and Commitments. In limited cases, we have made loans to owners of or partners in

hotel or resort ventures for which we have a management or franchise agreement. Loans outstanding under this

program totaled $3 million at December 31, 2012. We evaluate these loans for impairment, and at December 31,

2012, believes these loans are collectible. Unfunded loan commitments aggregating $18 million were outstanding

at December 31, 2012, none of which is expected to be funded in the future. These loans typically are secured by

pledges of project ownership interests and/or mortgages on the projects. We also have $86 million of equity and

other potential contributions associated with managed or joint venture properties, $41 million of which is

expected to be funded in 2013.

Surety bonds issued on our behalf at December 31, 2012 totaled $80 million, primarily related to an appeal

of certain litigation, requirements by state or local governments relating to our vacation ownership operations and

by our insurers to secure large deductible insurance programs.

To secure management contracts, we may provide performance guarantees to third-party owners. Most of

these performance guarantees allow us to terminate the contract rather than fund shortfalls if certain performance

levels are not met. In limited cases, we are obligated to fund shortfalls in performance levels through the issuance

of loans. Many of the performance tests are multi-year tests, are tied to the results of a competitive set of hotels,

and have exclusions for force majeure and acts of war and terrorism. We do not anticipate any significant

funding under performance guarantees, nor do we anticipate losing a significant number of management or

franchise contracts in 2013.

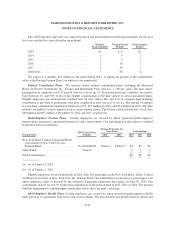

In connection with the acquisition of the Le Méridien brand in November 2005, we assumed the obligation

to guarantee certain performance levels at one Le Méridien managed hotel for the periods 2007 through 2014.

During the year ended December 31, 2010, we reached an agreement with the owner of this property to fully

release our performance guarantee obligation in return for a payment of approximately $1 million to the owner.

F-44