PNC Bank 2001 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

96

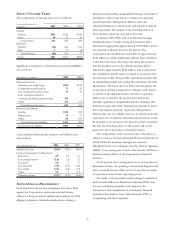

AVERAGE CONSOLIDATED BALANCE SHEET AND NET INTEREST ANALYSIS

2001 2000

Dollars in millions

Taxable-equivalent basis

Average

Balances Interest

Average

Yields/Rates

Average

Balances Interest

Average

Yields/Rates

ASSETS

Interest-earnin

g

assets

Loans held for sale $2,021 $119 5.89% $2,507 $204 8.14%

Securities

Securities available for sale

U.S. Treasury and government agencies and

corporations 3,833 216 5.64 1,760 104 5.91

Other debt 6,841 397 5.80 3,723 245 6.58

Other 101 8 7.92 578 40 6.92

Total securities available for sale 10,775 621 5.76 6,061 389 6.42

Securities held to maturity 92 6 6.52

Total securities 10,867 627 5.77 6,061 389 6.42

Loans, net of unearned income

Commercial 19,658 1,418 7.21 21,685 1,839 8.48

Commercial real estate 2,580 184 7.13 2,685 240 8.94

Consumer 9,099 732 8.04 9,177 791 8.62

Residential mortgage 8,801 635 7.22 12,599 900 7.14

Lease financing 4,223 293 6.94 3,222 235 7.29

Credit card

Other 460 30 6.52 650 55 8.46

Total loans, net of unearned income 44,821 3,292 7.34 50,018 4,060 8.12

Other 1,632 115 7.05 1,289 97 7.53

Total interest-earning assets/interest income 59,341 4,153 7.00 59,875 4,750 7.93

Noninterest-earning assets

Investment in discontinued operations 51 487

Allowance for credit losses

(

693

)

(

683

)

Cash and due from banks 2,939 2,718

Other assets 8,768 6,581

Total assets $70,406 $68,978

LIABILITIES, MINORITY INTEREST, CAPITAL

SECURITIES AND SHAREHOLDERS’ EQUITY

Interest-bearing liabilities

Interest-bearing deposits

Demand and money market $21,322 506 2.37 $18,735 658 3.51

Savings 1,928 18 .93 2,050 36 1.76

Retail certificates of deposit 12,313 634 5.15 14,642 826 5.64

Other time 522 34 6.51 621 40 6.44

Deposits in foreign offices 829 37 4.46 1,473 93 6.31

Total interest-bearing deposits 36,914 1,229 3.33 37,521 1,653 4.41

Borrowed funds

Federal funds purchased 2,057 91 4.42 2,139 135 6.31

Repurchase agreements 980 33 3.37 754 45 5.97

Bank notes and senior debt 5,521 265 4.80 6,532 431 6.60

Federal Home Loan Bank borrowings 2,178 83 3.81 1,113 68 6.11

Subordinated debt 2,362 138 5.84 2,406 179 7.44

Other borrowed funds 384 36 9.38 802 57 7.11

Total borrowed funds 13,482 646 4.79 13,746 915 6.66

Total interest-bearing liabilities/interest expense 50,396 1,875 3.72 51,267 2,568 5.01

Noninterest-bearing liabilities, minority interest, capital

securities and shareholders’ equity

Demand and other noninterest-bearing deposits 8,297 8,151

Accrued expenses and other liabilities 4,096 2,479

Minority interest 136 96

Mandatorily redeemable capital securities of

subsidiary trusts 848 848

Shareholders’ equity 6,633 6,137

Total liabilities, minority interest, capital securities

and shareholders’ equity $70,406 $68,978

Interest rate spread 3.28 2.92

Impact of noninterest-bearing sources .56 .72

Net interest income/margin $2,278 3.84% $2,182 3.64%

Nonaccrual loans are included in loans, net of unearned income. The impact of financial derivatives used in interest rate risk management is included in the interest and average

yields/rates of the related assets and liabilities. Average balances of securities available for sale are based on amortized historical cost (excluding SFAS No. 115 adjustments to fair value).

Loan fees for each of the years ended December 31, 2001, 2000, 1999, 1998 and 1997 were $119 million, $115 million, $120 million, $107 million and $89 million, respectively.