PNC Bank 2001 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

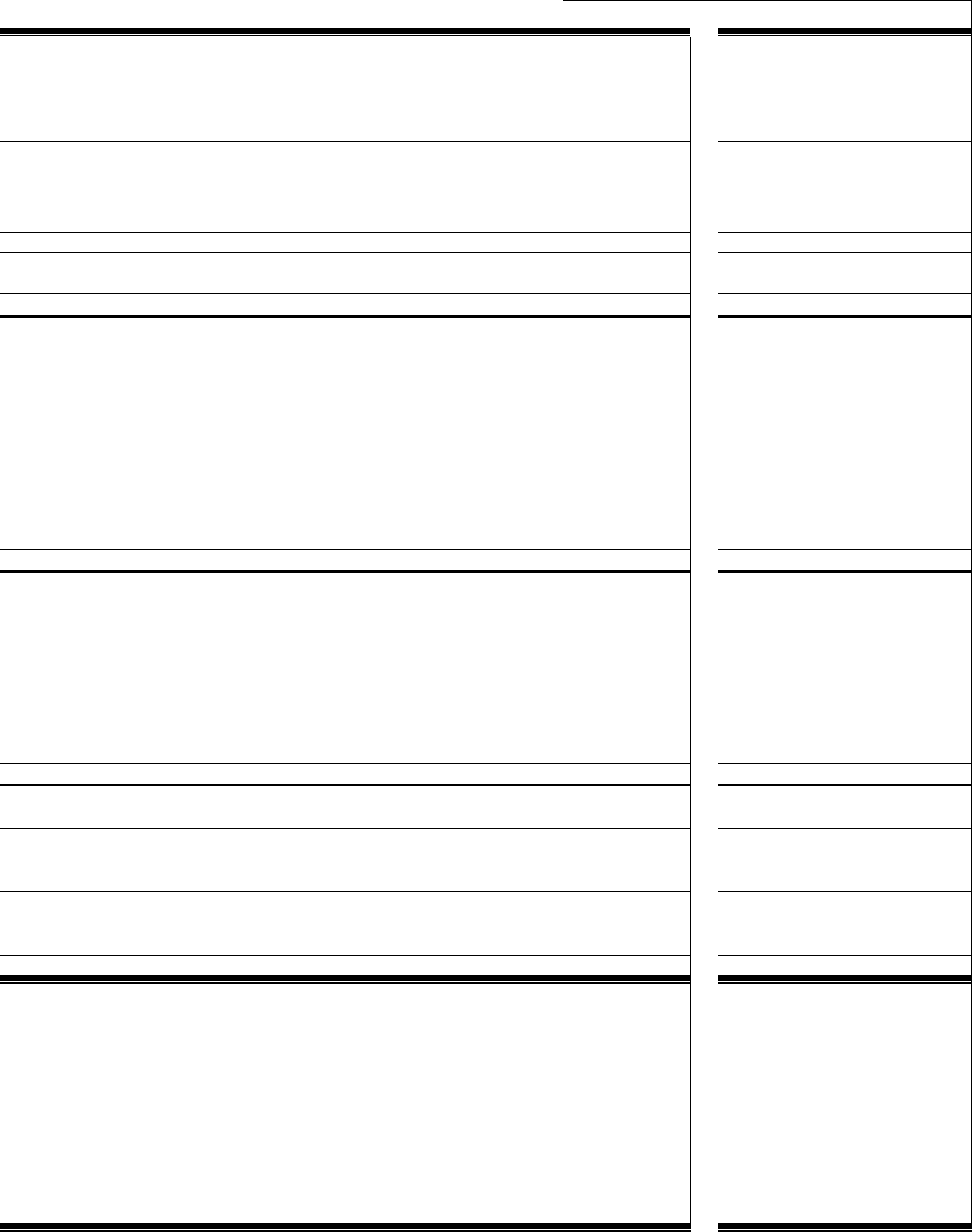

CONSOLIDATED STATEMENT OF INCOME

THE PNC FINANCIAL SERVICES GROUP, INC.

62

Year ended December 31

In millions, except per share data 2001 2000 1999

INTEREST INCOME

Loans and fees on loans $3,279 $4,045 $4,064

Securities 625 386 362

Loans held for sale 119 204 104

Othe

r

114 97 53

T

otal interest income 4,137 4,732 4,583

INTEREST EXPENSE

De

p

osits 1,229 1,653 1,369

Borrowed funds 646 915 870

T

otal interest ex

p

ense 1,875 2,568 2,239

Net interest income 2,262 2,164 2,344

Provision for credit losses 903 136 163

Net interest income less provision for credit losses 1,359 2,028 2,181

NONINTEREST INCOME

Asset mana

g

emen

t

848 809 681

Fund servicin

g

724 654 251

Service char

g

es on de

p

osits 218 206 207

Brokera

g

e206 249 219

Consumer services 229 209 218

Cor

p

orate services 60 342 133

E

q

uity mana

g

emen

t

(179) 133 100

Net securities

g

ains 131 20 22

Sale of subsidiary stock 64

Othe

r

306 269 555

T

otal noninterest income 2,543 2,891 2,450

NONINTEREST EXPENSE

Staff ex

p

ense 1,667 1,616 1,380

Net occu

p

anc

y

220 203 224

E

q

ui

p

men

t

255 224 232

Amortization 105 110 92

Marketin

g

57 70 70

Distributions on ca

p

ital securities 63 67 65

Minority interest in income of consolidated entities 33 27 15

Othe

r

938 754 765

T

otal noninterest ex

p

ense 3,338 3,071 2,843

Income from continuing operations before income taxes 564 1,848 1,788

Income taxes 187 634 586

Income from continuing operations 377 1,214 1,202

Income from discontinued o

p

erations

(less applicable income taxes of $0, $44 and $41) 565 62

Net income before cumulative effect of accounting change 382 1,279 1,264

Cumulative effect of accountin

g

chan

g

e (less a

pp

licable income

tax benefit of $2) (5)

Net income $377 $1,279 $1,264

E

ARNINGS

P

ER

C

OMMON

S

HAR

E

From continuing operations

Basic $1.27 $4.12 $3.98

Diluted 1.26 4.09 3.94

From net income

Basic 1.27 4.35 4.19

Diluted 1.26 4.31 4.15

C

ASH

D

IVIDENDS

D

ECLARED

P

ER

C

OMMON

S

HARE 1.92 1.83 1.68

AVERAGE

C

OMMON

S

HARES OUTSTANDING

Basic 287 290 297

Diluted 290 293 300

See accompanying Notes to Consolidated Financial Statements.