PNC Bank 2001 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

80

Cash distributions on the Capital Securities are made to

the extent interest on the debentures is received by the

Trusts. In the event of certain changes or amendments to

regulatory requirements or federal tax rules, the Capital

Securities are redeemable in whole.

Trust A is a wholly owned finance subsidiary of PNC

Bank, N.A., PNC’s principal bank subsidiary, and Trusts B

and C are wholly owned finance subsidiaries of the

Corporation.

The respective parents of the Trusts have, through the

agreements governing the Capital Securities, taken together,

fully, irrevocably and unconditionally guaranteed all of the

obligations of the Trusts under the Capital Securities. For a

discussion of certain dividend restrictions, see Note 19

Regulatory Matters.

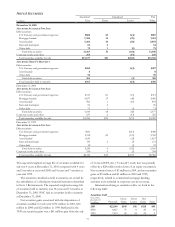

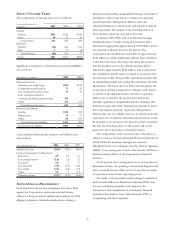

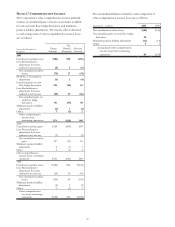

NOTE 18 SHAREHOLDERS’ EQUITY

Information related to preferred stock is as follows:

Liquidation Preferred Shares

December 31

Shares in thousands

Value per

Share 2001 2000

Authorized

$1 par value 17,172 17,224

Issued and outstanding

Series A $40 10 11

Series B 40 33

Series C 20 204 229

Series D 20 293 318

Series F 50 6

,

000

Total 510 6,561

Series A through D are cumulative and, except for Series B,

are redeemable at the option of the Corporation. Annual

dividends on Series A, B and D preferred stock total $1.80

per share and on Series C preferred stock total $1.60 per

share. Holders of Series A through D preferred stock are

entitled to a number of votes equal to the number of full

shares of common stock into which such preferred stock is

convertible. Series A through D preferred stock have the

following conversion privileges: (i) one share of Series A or

Series B is convertible into eight shares of common stock;

and (ii) 2.4 shares of Series C or Series D are convertible into

four shares of common stock.

The Series F preferred stock was nonconvertible and

nonvoting, except in limited circumstances. On March 6,

2001, the Corporation commenced a cash tender offer for its

nonconvertible Series F preferred stock. Approximately 1.9

million shares were purchased by the Corporation at a price

of $50.35 per share plus accrued and unpaid dividends on

April 5, 2001. The remainder of the outstanding shares of

Series F preferred stock was redeemed on October 4, 2001

for approximately $205 million.

During 2000, the Board of Directors adopted a

shareholder rights plan providing for issuance of share

purchase rights. Except as provided in the plan, if a person

or group becomes beneficial owner of 10% or more of

PNC’s outstanding common stock, all holders of the rights,

other than such person or group, may purchase PNC

common stock or equivalent preferred stock at half of

market value.

The Corporation has a dividend reinvestment and stock

purchase plan. Holders of preferred stock and common

stock may participate in the plan, which provides that

additional shares of common stock may be purchased at

market value with reinvested dividends and voluntary cash

payments. Common shares purchased pursuant to this plan

were: 472,015 shares in 2001, 649,334 shares in 2000 and

567,266 shares in 1999.

At December 31, 2001, the Corporation had reserved

approximately 33.8 million common shares to be issued in

connection with certain stock plans and the conversion of

certain debt and equity securities.

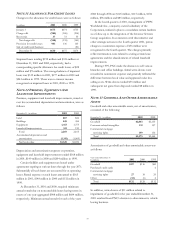

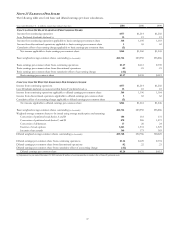

NOTE 19 REGULATORY MATTERS

The Corporation is subject to the regulations of certain

federal and state agencies and undergoes periodic

examinations by such regulatory authorities. Neither the

Corporation nor any of its subsidiaries is subject to written

agreements entered into with any of the agencies.

Under capital adequacy guidelines and the regulatory

framework for prompt corrective action, the Corporation

must meet specific capital guidelines that involve quantitative

measures of assets, liabilities and certain off-balance-sheet

items as calculated under regulatory accounting practices.

Failure to meet minimum capital requirements can result in

certain mandatory and possibly additional discretionary

actions by regulators that, if undertaken, could have a

material effect on PNC’s financial condition and results of

operations. The Corporation’s capital amounts and

classification are also subject to qualitative judgments by

regulatory agencies about components, risk weightings and

other factors.