PNC Bank 2001 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.59

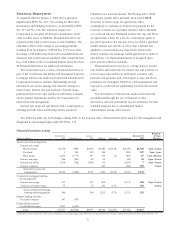

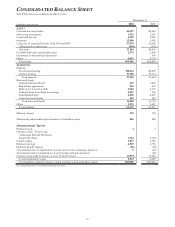

CONSOLIDATED BALANCE SHEET REVIEW

Loans

Loans were $50.6 billion at December 31, 2000, a $928

million increase from year-end 1999 as increases in

residential mortgage loans and lease financing more than

offset lower consumer, commercial and commercial real

estate loans.

Loans Held For Sale

Loans held for sale were $1.7 billion at December 31, 2000

compared with $3.5 billion at December 31, 1999. The

decrease was primarily due to dispositions of loans

designated for exit.

Securities Available For Sale

The fair value of securities available for sale at December 31,

2000 was $5.9 billion compared with $6.0 billion as of

December 31, 1999. Securities represented 8% of total assets

at December 31, 2000 and 9% at December 31, 1999. The

expected weighted-average life of securities available for sale

was 4 years and 5 months at December 31, 2000 and 4 years

and 7 months at year-end 1999.

Funding Sources

Total funding sources were $59.4 billion at December 31,

2000 and $60.0 billion at December 31, 1999. Increases in

demand and money market deposits allowed PNC to reduce

higher-costing funding sources including deposits in foreign

offices, Federal Home Loan Bank borrowings and bank

notes and senior debt.

Total deposits were $47.7 billion at December 31, 2000

compared to $45.8 billion at December 31, 1999. Increases in

demand and money market deposits, as a result of strategic

marketing initiatives to grow more valuable transaction

accounts, were partially offset by a decrease in deposits in

foreign offices.

Asset Quality

The ratio of nonperforming assets to total loans, loans held

for sale and foreclosed assets was .71% at December 31,

2000 and .61% at December 31, 1999. Nonperforming assets

were $372 million at December 31, 2000 compared with

$325 million at December 31, 1999. The allowance for credit

losses was $675 million and represented 209% of nonaccrual

loans and 1.33% of total loans at December 31, 2000. The

comparable amounts were $674 million, 232% and 1.36%,

respectively, at December 31, 1999.

Capital

Shareholders’ equity totaled $6.7 billion and $5.9 billion at

December 31, 2000 and 1999, respectively, and the leverage

ratio was 8.0% and 6.6%, respectively, in the comparison.

Tier I and total risk-based capital ratios were 8.6% and

12.6%, respectively, at December 31, 2000, compared with

7.1% and 11.1%, respectively, at December 31, 1999,

computed on a basis including discontinued operations.