PNC Bank 2001 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

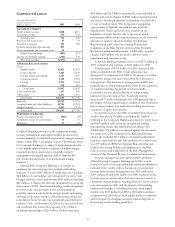

CORPORATE BANKING

Year ended December 31

Taxable-equivalent basis

Dollars in millions 2001 2000

INCOME STATEMENT

Credit-related revenue $408 $411

Noncredit revenue 356 433

T

otal revenue 764 844

Provision for credit losses 57 79

Noninterest expense 381 394

Institutional lending repositioning 891

Asset impairment and severance costs 16

Pretax (loss) earnin

g

s(581) 371

Income tax (benefit) expense (206) 130

(Net loss) earnings $(375) $241

AVERAGE BALANCE

S

HEET

Loans

Middle market $5,811 $6,553

Large corporate 3,103 3,193

Energy, metals and mining 1,233 1,507

Communications 1,110 1,501

Leasing 2,322 1,844

Other 328 357

Total loans 13,907 14,955

Loans held for sale 367 800

Other assets 2,411 1,991

Total assets $16,685 $17,746

De

p

osits $4,729 $4,701

Assigned funds and other liabilities 10,705 11,714

Assigned capital 1,251 1,331

Total funds $16,685 $17,746

P

ERFORMANCE

R

ATIO

S

Return on assigned capital (30)% 18%

Noncredit revenue to total revenue 64 51

Efficiency 71 46

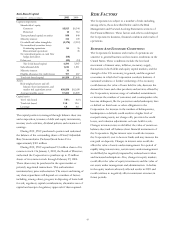

Corporate Banking provides credit, equipment leasing,

treasury management and capital markets products and

services primarily to mid-sized corporations and government

entities within PNC’s geographic region. The strategic focus

for Corporate Banking is to adapt its institutional expertise

to the middle market with an emphasis on higher-margin

noncredit products and services, especially treasury

management and capital markets, and to improve the

risk/return characteristics of its institutional lending

business.

During 2001, Corporate Banking took actions to

accelerate the repositioning of its institutional lending

business. A total of $9.7 billion of credit exposure including

$4.0 billion of outstandings were designated for exit or sale.

Charges related to these actions were $891 million, including

$41 million of charge-offs on loans designated for exit in the

first quarter of 2001. Institutional lending credits designated

for exit or sale were primarily in the communications

portfolio, certain portions of the energy, metals and mining

and large corporate portfolios, and relationships where the

potential for future returns was considered unacceptable in

relation to risk. At December 31, 2001, the exit and held for

sale portfolios had total credit exposure of $7.2 billion

including outstandings of $2.5 billion. Of these amounts,

$4.6 billion and $2.3 billion, respectively, were classified as

held for sale, net of charges of $850 million that represented

the excess of principal balances outstanding over the lower

of cost or market values. The Corporation is pursuing

opportunities to liquidate the held for sale portfolio

expeditiously. Gains and losses may result from the

liquidation of loans held for sale to the extent actual

performance differs from estimates inherent in the recorded

amounts or market valuations change. See Strategic

Repositioning and Critical Accounting Policies and

Judgments in the Risk Factors section of this Financial

Review for additional information. Additionally, a pretax

charge of $16 million was incurred in 2001 for asset

impairment and severance costs.

Corporate Banking incurred a net loss of $375 million in

2001 compared with earnings of $241 million in 2000.

Total revenue of $764 million for 2001 decreased $80

million compared with 2000. Credit-related revenue

decreased 1% compared with 2000 as the impact of a wider

net interest margin was more than offset by a decrease in

average loans. The decrease in average loans in 2001 was

primarily due to downsizing partially offset by the expansion

of equipment leasing. Noncredit revenue includes

noninterest income and the benefit of compensating

balances received in lieu of fees. Noncredit revenue

decreased $77 million compared with 2000 primarily due to

the impact of weak capital market conditions that resulted in

lower capital markets fees and losses resulting from lower

valuations of equity investments.

Total credit costs in the 2001 consolidated provision for

credit losses were $733 million, including $57 million

reflected in the Corporate Banking provision for credit losses

and $676 million reflected in the institutional lending

repositioning charge that represented net charge-offs.

Additionally, $76 million was charged against the allowance

for credit losses. The institutional lending repositioning

charge also included $215 million of valuation adjustments

related to loans held for sale. The provision for credit losses

was $79 million in 2000. See Strategic Repositioning and

Critical Accounting Policies and Judgments in the Risk

Factors section and Credit Risk in the Risk Management

section of this Financial Review for additional information.

Treasury management and capital markets products

offered through Corporate Banking are sold by several

businesses across the Corporation and related profitability is

included in the results of those businesses. Consolidated

revenue from treasury management was $331 million for

2001 compared with $341 million for 2000. Increases in fee

revenue were more than offset by lower income earned on

customers’ deposit balances resulting from the lower interest

rate environment in 2001 and the impact of downsizing

institutional lending. Consolidated revenue from capital

markets was $123 million for 2001, a $10 million decrease

compared with 2000 due to weak capital market conditions

and the impact of changing customer relationships due to

downsizing certain lending portfolios.