PNC Bank 2001 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

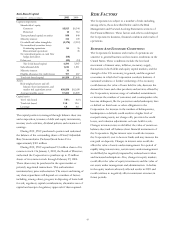

Nonperforming Assets By Type

December 31 - dollars in millions 2001 2000

Nonaccrual loans

Commercial $188 $312

Commercial real estate 43

Consumer 32

Residential mortgage 54

Lease financing 11 2

Total nonaccrual loans 211 323

Nonperforming loans held for sale (a) 169 33

Foreclosed assets

Commercial real estate 13

Residential mortgage 38

Other 75

Total foreclosed assets 11 16

Total nonperforming assets $391 $372

Nonaccrual loans to total loans .56% .64%

Nonperforming assets to total loans, loans

held for sale and foreclosed assets .93 .71

Nonperforming assets to total assets .56 .53

(a) Includes $6 million of a troubled debt restructured loan held for sale in 2001.

Of the total nonaccrual loans at December 31, 2001,

approximately 47% are related to PNC Business Credit.

These loans are to borrowers many of which have weaker

credit risk ratings. As a result, a greater proportion of such

loans may be classified as nonperforming. Such loans are

secured by accounts receivable, inventory, machinery and

equipment, and other collateral. This secured position helps

to mitigate risk of loss on these loans by reducing the

reliance on cash flows for repayment. The above table

excludes $18 million of equity management assets carried at

estimated fair value at December 31, 2001 and 2000. The

amount of nonaccrual loans that were current as to principal

and interest was $93 million at December 31, 2001 and $67

million at December 31, 2000. The amount of

nonperforming loans held for sale that were current as to

principal and interest was $8 million at December 31, 2001.

There were no nonperforming loans held for sale that were

current as to principal and interest at December 31, 2000.

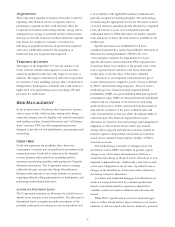

Nonperforming Assets By Business

December 31 – in millions 2001 2000

Regional Community Banking $52 $47

Corporate Banking 220 252

PNC Real Estate Finance 635

PNC Business Credit 109 36

PNC Advisors 42

Total nonperforming assets $391 $372

At December 31, 2001, Corporate Banking, PNC Business

Credit and PNC Real Estate Finance had nonperforming

loans held for sale of $161 million, $7 million and $1 million,

respectively.

Credit quality was adversely impacted in 2001 and a

sustained weakness or further weakening of the economy, or

other factors that affect asset quality, could result in an

increase in the number of delinquencies, bankruptcies or

defaults, and a higher level of nonperforming assets, net

charge-offs and provision for credit losses in future periods.

With the current weak economy and growth in PNC

Business Credit, nonperforming assets will likely increase

from year end amounts. See the Forward-Looking

Statements section of this Financial Review for additional

factors that could cause actual results to differ materially

from forward-looking statements or historical performance.

Change In Nonperforming Assets

In millions 2001 2000

January 1 $372 $325

T

ransferred from accrua

l

852 471

Returned to

p

erformin

g

(28) (13)

Princi

p

al reductions (278) (184)

Asset sales (27) (79)

Char

g

e-offs and other (500) (148)

December 31 $391 $372

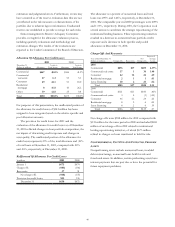

Accruing Loans And Loans Held For Sale Past Due 90

Days Or More

Amount

Percent of Total

Outstandings

December 31

Dollars in millions 2001 2000 2001 2000

Commercial $54 $46 .36% .22%

Commercial real estate 11 6.46 .23

Consumer 36 24 .39 .26

Residential mortgage 56 36 .88 .27

Lease financing 21.05 .03

Total loans 159 113 .42 .22

Loans held for sale 33 16 .79 .97

Total loans and

loans held for sale $192 $129 .46 .25

Loans and loans held for sale not included in nonperforming

or past due categories, but where information about possible

credit problems causes management to be uncertain about

the borrower’s ability to comply with existing repayment

terms over the next six months, totaled $87 million and $213

million, respectively, at December 31, 2001, compared with

$182 million and $11 million, respectively, at December 31,

2000.