PNC Bank 2001 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

84

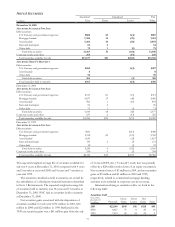

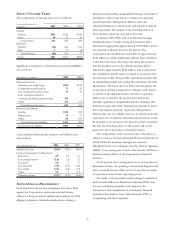

Components Of ESOP Shares

As of or for the year ended December 31

In thousands 2001 2000

Unallocated 364

Allocated 4,134 4,316

Released for allocation 364 348

Retired (490) (530)

Total 4,008 4,498

Compensation expense related to the portion of

contributions matched with ESOP shares is determined

based on the number of ESOP shares allocated.

Compensation expense related to these plans was $28

million, $30 million and $17 million for 2001, 2000 and

1999, respectively.

NOTE 22 STOCK-BASED COMPENSATION PLANS

The Corporation has a long-term incentive award plan

(“Incentive Plan”) that provides for the granting of

incentive stock options, nonqualified stock options, stock

appreciation rights, performance units, restricted stock and

other incentive shares to executives and directors. In any

given year, the number of shares of common stock

available for grant under the Incentive Plan may range

from 1.5% to 3% of total issued shares of common stock

determined at the end of the preceding calendar year. Of

this amount, no more than 20% is available for restricted

stock and other incentive share awards.

As of December 31, 2001 no incentive stock options,

stock appreciation rights or performance unit awards were

outstanding.

NONQUALIFIED STOCK OPTIONS

Options are granted at exercise prices not less than the

market value of common stock on the date of grant.

Generally, options granted in 2001, 2000 and 1999 become

exercisable in installments after the grant date. Options

granted prior to 1999 are mainly exercisable twelve months

after the grant date. Payment of the option price may be in

cash or previously owned shares of common stock at

market value on the exercise date.

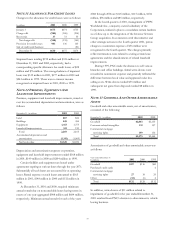

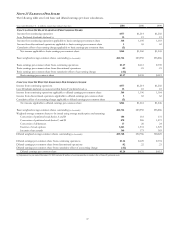

A summary of stock option activity follows:

Per O

p

tion

Shares in thousands Exercise Price

Weighted-

Average

Exercise

Price Shares

January 1, 1999 $11.38 - $66.00 $40.30 9,566

Granted 50.47 - 76.00 51.68 3,612

Exercised 11.38 - 54.72 33.89 (1,856)

Terminated 21.75 - 59.31 51.68 (247)

December 31, 1999 11.38 - 76.00 44.83 11,075

Granted 42.19 - 66.22 44.20 4,171

Exercised 11.38 - 59.31 37.77 (2,952)

Terminated 31.13 - 61.75 48.10 (496)

December 31, 2000 21.63 - 76.00 46.25 11,798

Granted 53.74 - 74.70 73.14 3,996

Exercised 21.63 - 59.31 43.46 (2,737)

Terminated 42.19 - 74.59 53.22 (580)

December 31, 2001 21.75 - 76.00 55.15 12,477

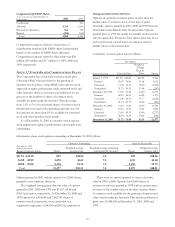

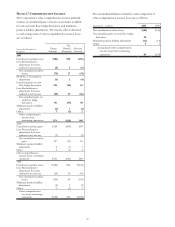

Information about stock options outstanding at December 31, 2001 follows:

Options Outstanding Options Exercisable

December 31, 2001

Shares in thousands

Range of exercise prices Shares

Weighted-average

exercise price

Weighted-average remaining

contractual life (in years) Shares

Weighted-average

exercise price

$21.75 - $32.99 829 $28.96 3.2 829 $28.96

33.00 - 49.99 3,478 42.69 7.5 1,211 43.04

50.00 - 76.00 8,170 63.12 7.8 3,239 54.73

Total 12,477 $55.15 7.4 5,279 $48.01

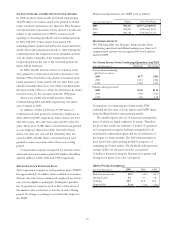

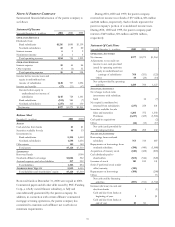

Options granted in 2001 include options for 52,000 shares

granted to non-employee directors.

The weighted-average grant-date fair value of options

granted in 2001, 2000 and 1999 was $15.87, $9.86 and

$10.15 per option, respectively. At December 31, 2000 and

1999 options for 5,834,898 and 7,682,745 shares of

common stock, respectively, were exercisable at a

weighted-average price of $45.96 and $42.05, respectively.

There were no options granted in excess of market

value in 2001or 2000. Options for 82,000 shares of

common stock were granted in 1999 with an exercise price

in excess of the market value on the date of grant. Shares

of common stock available for the granting of options and

other awards under the Incentive Plan and the predecessor

plans were 10,584,683 at December 31, 2001, 2000 and

1999.