PNC Bank 2001 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

CONSOLIDATED STATEMENT OF

INCOME REVIEW

NET INTEREST INCOME

Changes in net interest income and margin result from the

interaction between the volume and composition of

earning assets, related yields and associated funding costs.

Accordingly, portfolio size, composition and yields earned

and funding costs can have a significant impact on net

interest income and margin.

Taxable-equivalent net interest income of $2.278 billion

for 2001 increased 4% compared with 2000. The increase

was primarily due to the impact of transaction deposit

growth and a lower rate environment that was partially

offset by the impact of continued downsizing of the loan

portfolio. The net interest margin widened 20 basis points

to 3.84% for 2001 compared with 3.64% for 2000. The

increase was primarily due to the impact of the lower rate

environment, the benefit of growth in transaction deposits

and downsizing of higher-cost, less valuable retail

certificates and wholesale deposits. See Interest Rate Risk in

the Risk Management section of this Financial Review for

additional information regarding interest rate risk.

Loans represented 76% of average interest-earning

assets for 2001 compared with 84% for 2000. The decrease

was primarily due to the continued downsizing of certain

institutional lending portfolios and the securitization of

residential mortgage loans during 2001.

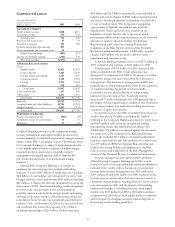

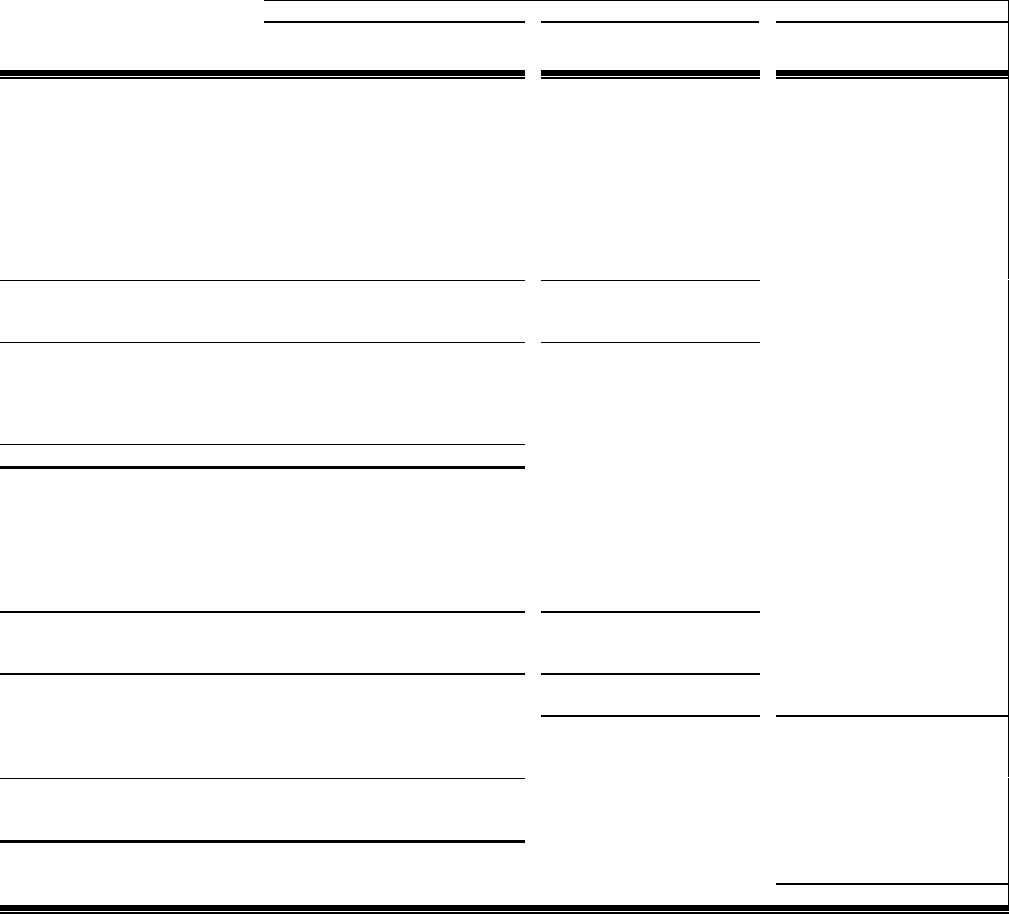

Net Interest Income Analysis

Average Balances Interest Income/Expense Average Yields/Rates

Taxable-equivalent basis

Year ended December 31

Dollars in millions 2001 2000 Change 2001 2000 Change 2001 2000 Change

Interest-earning assets

Loans held for sale $2,021 $2,507 $(486) $119 $204 $(85) 5.89% 8.14% (225)b

p

Securities 10,867 6,061 4,806 627 389 238 5.77 6.42 (65)

Loans, net of unearned income

Commercia

l

19,658 21,685 (2,027) 1,418 1,839 (421) 7.21 8.48 (127)

Commercial real estate 2,580 2,685 (105) 184 240 (56) 7.13 8.94 (181)

Consumer 9,099 9,177

(

78

)

732 791

(

59

)

8.04 8.62

(

58

)

Residential mort

g

a

g

e8,801 12,599 (3,798) 635 900 (265) 7.22 7.14 8

Lease financing 4,223 3,222 1,001 293 235 58 6.94 7.29 (35)

Other 460 650

(

190

)

30 55

(

25

)

6.52 8.46

(

194

)

Total loans, net of unearned

income 44,821 50,018 (5,197) 3,292 4,060 (768) 7.34 8.12 (78)

Other 1,632 1,289 343 115 97 18 7.05 7.53 (48)

Total interest-earning assets/

interest income 59,341 59,875 (534) 4,153 4,750 (597) 7.00 7.93 (93)

Noninterest-earning assets 11,014 8,616 2,398

Investment in discontinued

operations 51 487 (436)

Total assets $70,406 $68,978 $1,428

Interest-bearing liabilities

Deposits

Demand and mone

y

marke

t

$21,322 $18,735 $2,587 506 658

(

152

)

2.37 3.51

(

114

)

Savin

g

s1,928 2,050 (122) 18 36 (18) .93 1.76 (83)

Retail certificates of deposit 12,313 14,642 (2,329) 634 826 (192) 5.15 5.64 (49)

Other time 522 621

(

99

)

34 40

(

6

)

6.51 6.44 7

De

p

osits in forei

g

n offices 829 1,473 (644) 37 93 (56) 4.46 6.31 (185)

Total interest-bearing

deposits 36,914 37,521 (607) 1,229 1,653 (424) 3.33 4.41 (108)

Borrowed funds 13,482 13,746 (264) 646 915 (269) 4.79 6.66 (187)

Total interest-bearing liabilities/

interest expense 50,396 51,267 (871) 1,875 2,568 (693) 3.72 5.01 (129)

Noninterest-bearing liabilities,

minority interest, capital securities

and shareholders’ equity 20,010 17,711 2,299

Total liabilities, minority interest,

capital securities and

shareholders’ equity $70,406 $68,978 $1,428

Interest rate spread 3.28 2.92 36

Impact of noninterest-bearing sources .56 .72 (16)

Net interest income/margin $2,278 $2,182 $96 3.84% 3.64% 20bp