PNC Bank 2001 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

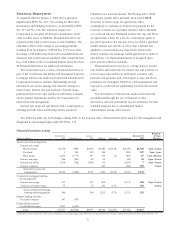

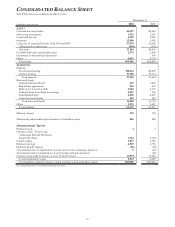

The following table sets forth the notional value and the fair value of financial derivatives used for risk management and

designated as accounting hedges under SFAS No. 133 at December 31, 2001. Weighted-average interest rates presented are

based on the implied forward yield curve at December 31, 2001.

Financial Derivatives - 2001

Notional Weighted-Average Interest Rates

December 31, 2001 - dollars in millions Value Fair Value Paid Received

Interest rate risk management

Asset rate conversion

Interest rate swaps (a)

Receive fixed designated to loans $4,335 $132 3.35% 5.23%

Pay fixed designated to loans 107 (5) 5.88 4.66

Basis swaps designated to loans 87 5.49 5.42

Interest rate caps designated to loans (b) 25 NM NM

Interest rate floors designated to loans (c) 7 NM NM

Future contracts designated to loans 398 NM NM

Total asset rate conversion 4,959 127

Liability rate conversion

Interest rate swaps (a)

Receive fixed designated to borrowed funds 2,413 135 5.20 5.94

Total liability rate conversion 2,413 135

Total interest rate risk management 7,372 262

Commercial mortgage banking risk management

Pay fixed interest rate swaps designated to loans held for sale (a) 105 1 5.52 5.82

Pay total rate of return swaps designated to loans held for sale (a) 150 5.89 1.39

Total commercial mortgage banking risk management 255 1

Total financial derivatives designated for risk management $7,627 $263

(a) The floating rate portion of interest rate contracts is based on money-market indices. As a percent of notional value, 65% were based on 1-month LIBOR, 34% on 3-month

LIBOR and the remainder on other short-term indices.

(b) Interest rate caps with notional values of $15 million require the counterparty to pay the Corporation the excess, if any, of 3-month LIBOR over a weighted-average strike of

6.40%. In addition, interest rate caps with notional values of $6 million require the counterparty to pay the excess, if any, of 1-month LIBOR over a weighted-average strike of

6.00%. The remainder is based on other short-term indices. At December 31, 2001, 3-month LIBOR was 1.88% and 1-month LIBOR was 1.87%.

(c) Interest rate floors with notional values of $5 million require the counterparty to pay the excess, if any, of the weighted-average strike of 4.50% over 3-month LIBOR. The

remainder is based on other short-term indices. At December 31, 2001, 3-month LIBOR was 1.88%.

NM- Not meaningful