PNC Bank 2001 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

PNC ADVISORS

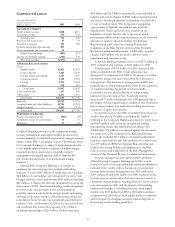

Year ended December 31

Taxable-equivalent basis

Dollars in millions 2001 2000

INCOME STATEMENT

Net interest income $128 $136

Noninterest income

Investment management and trust 393 421

Brokerage 130 171

Other 84 64

Total noninterest income 607 656

Total revenue 735 792

Provision for credit losses 25

Noninterest expense 504 511

Pretax earnings 229 276

Income taxes 86 103

Earnings $143 $173

AVERAGE BALANCE

S

HEET

Loans

Consumer $1,103 $965

Residential mortgage 848 962

Commercial 528 602

Other 384 532

Total loans 2,863 3,061

Other assets 467 439

Total assets $3,330 $3,500

Deposits $2,058 $2,034

Assigned funds and other liabilities 730 917

Assigned capital 542 549

Total funds $3,330 $3,500

P

ERFORMANCE

R

ATIO

S

Return on assigned capital 26% 32%

Noninterest income to total revenue 83 83

Efficiency 68 64

PNC Advisors provides a full range of tailored investment

products and services to affluent individuals and families,

including full-service brokerage through J.J.B. Hilliard, W.L.

Lyons, Inc. (“Hilliard Lyons”) and investment advisory

services to the ultra-affluent through Hawthorn. PNC

Advisors also serves as investment manager and trustee for

employee benefit plans and charitable and endowment assets.

PNC Advisors is focused on selectively expanding Hilliard

Lyons and Hawthorn, increasing market share in PNC’s

primary geographic region and leveraging its expansive

distribution platform.

PNC Advisors earned $143 million in 2001 compared

with $173 million in 2000. Earnings for 2001 decreased 17%

compared with the prior year primarily due to a $57 million

decrease in total revenue resulting from the impact of weak

equity market conditions on brokerage activity and asset

management fees. Investment management and trust

revenue benefited from accrual adjustments of $15 million in

2001 and $11 million in 2000. Management expects that

revenue and earnings in this business will continue to be

challenged at least until equity market conditions improve.

Noninterest expense decreased $7 million in the year-to-

year comparison primarily due to lower production-based

compensation and expense management initiatives.

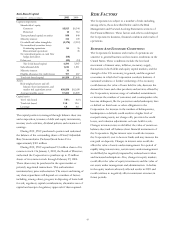

Assets Under Management (a)

December 31 – in billions 2001 2000

Personal investment management and trust $47 $50

Institutional trust 13 15

T

ota

l

$60 $65

(a) Excludes brokerage assets administered.

Assets under management decreased $5 billion as net new

asset inflows of $1 billion from new and existing customers

during 2001 were more than offset by a decline in the value

of the equity component of customers’ portfolios. See

Business and Economic Conditions and Asset Management

Performance in the Risk Factors section of this Financial

Review for additional information regarding matters that

could impact PNC Advisors’ revenue.

Brokerage assets administered by PNC Advisors were

$28 billion at December 31, 2001 and 2000 and were also

impacted by weak equity market conditions.

PNC Advisors expects to continue to focus on acquiring

new customers and growing and expanding existing

customer relationships while aggressively managing its

revenue/expense relationship.