PNC Bank 2001 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

79

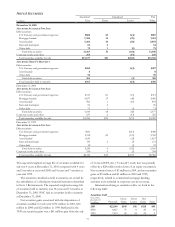

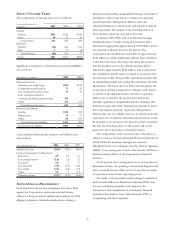

At December 31, 2001, key economic assumptions and

the sensitivity of the current fair value of residual cash flows

to an immediate 10% or 20% adverse change in those

assumptions are as follows:

Fair Value Assumptions

December 31, 2001

Dollars in millions

Residential

Mortgage

Student

Loans Other

Fair value of retained interest

(carrying value) $29 $52 $2

Weighted-average life (in years) .8 2.0 1.8

Residual cash flows discount rate 7.50% 4.40% 4.14%

Impact on fair value of 10%

adverse change $(.2) $(2.2)

Impact on fair value of 20%

adverse change (.3) (3.3)

Prepayment speed assumption

(CPR) 50.0% 13.7% (a)

Impact on fair value of 10%

adverse change $(1.9) $(.8) (a)

Impact on fair value of 20%

adverse change (3.5) (1.3) (a)

(a) Historically, there have been no prepayments on these loans, which are guaranteed

by an agency of the U. S. Government.

These sensitivities are hypothetical and should be used with

caution. As the figures indicate, changes in fair value based

on a 10% variation in assumptions generally cannot be

extrapolated because the relationship of the change in

assumption to the change in fair value may not be linear.

Also, the effect of a variation in a particular assumption on

fair value is calculated independently of variations in other

assumptions, whereas a change in one factor may realistically

have an impact on another, which might magnify or

counteract the sensitivities.

During 2000, the Corporation sold commercial mortgage

loans of $865 million in secondary market securitization

transactions and recognized a pretax gain of $13 million.

Additionally, the Corporation sold $737 million of

commercial mortgage loans into a trust. The Corporation

retained servicing rights in the loans and 99% or $730 million

of the mortgage-backed securities. The 1% interest in the

trust was purchased by a publicly-traded entity managed by a

subsidiary of PNC. A substantial portion of the entity’s

purchase price was financed by PNC. The Corporation had

securities of $155 million related to the trust in its portfolio

at December 31, 2000. No gain related to the portion of

securities retained was recognized by the Corporation as of

December 31, 2000. The securities were subsequently sold to

third parties in the first quarter of 2001.

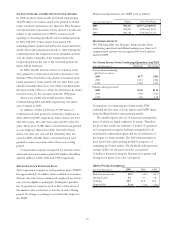

NOTE 15 DEPOSITS

The aggregate amount of time deposits with a denomination

greater than $100,000 was $4.0 billion and $5.8 billion at

December 31, 2001 and 2000, respectively. Remaining

contractual maturities of time deposits for the years 2002

through 2006 and thereafter are $8.7 billion, $1.3 billion, $1.2

billion, $681 million and $917 million, respectively.

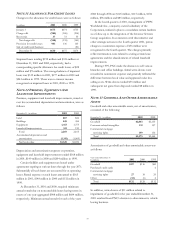

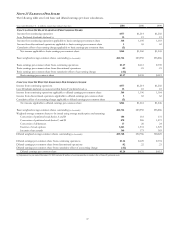

NOTE 16 BORROWED FUNDS

Bank notes have interest rates ranging from 1.95% to 6.50%

with approximately 40% maturing in 2002. Senior and

subordinated notes consisted of the following:

December 31, 2001

Dollars in millions Outstanding Stated Rate Maturity

Senior $2,762 2.45% – 7.00

%

2002-2006

Subordinated

Nonconvertible 2,298 6.13 – 8.25 2003-2009

Total $5,060

Borrowed funds have scheduled repayments for the years

2002 through 2006 and thereafter of $3.4 billion, $2.4 billion,

$2.1 billion, $1.6 billion and $2.6 billion, respectively.

Included in outstandings for the senior and subordinated

notes in the table above are basis adjustments of $8 million

and $89 million, respectively, related to SFAS No. 133.

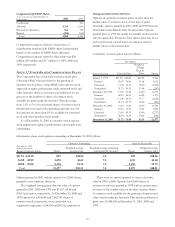

NOTE 17 CAPITAL SECURITIES OF SUBSIDIARY

TRUSTS

Mandatorily Redeemable Capital Securities of Subsidiary

Trusts (“Capital Securities”) include nonvoting preferred

beneficial interests in the assets of PNC Institutional Capital

Trust A, Trust B and Trust C. Trust A, formed in December

1996, holds $350 million of 7.95% junior subordinated

debentures, due December 15, 2026, and redeemable after

December 15, 2006, at a premium that declines from

103.975% to par on or after December 15, 2016. Trust B,

formed in May 1997, holds $300 million of 8.315% junior

subordinated debentures due May 15, 2027, and redeemable

after May 15, 2007, at a premium that declines from

104.1575% to par on or after May 15, 2017. Trust C, formed

in June 1998, holds $200 million of junior subordinated

debentures due June 1, 2028, bearing interest at a floating

rate per annum equal to 3-month LIBOR plus 57 basis

points. The rate in effect at December 31, 2001 was 2.65%.

Trust C Capital Securities are redeemable on or after June 1,

2008 at par.