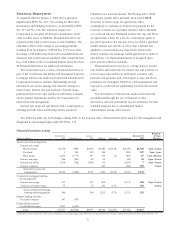

PNC Bank 2001 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.47

ACQUISITIONS

The Corporation expands its business from time to time by

acquiring other financial services companies. Factors

pertaining to acquisitions that could adversely affect the

Corporation’s business and earnings include, among others:

anticipated cost savings or potential revenue enhancements

that may not be fully realized or realized within the expected

time frame; key employee, customer or revenue loss

following an acquisition that may be greater than expected;

and costs or difficulties related to the integration of

businesses that may be greater than expected.

TERRORIST ACTIVITIES

The impact of the September 11th terrorist attacks or any

future terrorist activities and responses to such activities

cannot be predicted at this time with respect to severity or

duration. The impact could adversely affect the Corporation

in a number of ways including, among others, an increase in

delinquencies, bankruptcies or defaults that could result in a

higher level of nonperforming assets, net charge-offs and

provision for credit losses.

RISK MANAGEMENT

In the normal course of business, the Corporation assumes

various types of risk, which include, among other things,

credit risk, interest rate risk, liquidity risk, and risk associated

with trading activities, financial derivatives and “off-balance

sheet” activities. PNC has risk management processes

designed to provide for risk identification, measurement and

monitoring.

CREDIT RISK

Credit risk represents the possibility that a borrower,

counterparty or insurer may not perform in accordance with

contractual terms. Credit risk is inherent in the financial

services business and results from extending credit to

customers, purchasing securities and entering into financial

derivative transactions. The Corporation seeks to manage

credit risk through, among other things, diversification,

limiting credit exposure to any single industry or customer,

requiring collateral, selling participations to third parties, and

purchasing credit-related derivatives.

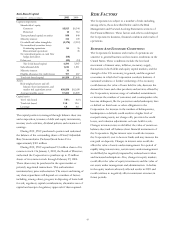

ALLOWANCE FOR CREDIT LOSSES

The Corporation maintains an allowance for credit losses to

absorb losses inherent in the loan portfolio. The allowance is

determined based on regular quarterly assessments of the

probable estimated losses inherent in the loan portfolio and

is in compliance with applicable regulatory standards and

generally accepted accounting principles. The methodology

for measuring the appropriate level of the allowance consists

of several elements, including specific allocations to impaired

loans, allocations to pools of non-impaired loans and

unallocated reserves. While allocations are made to specific

loans and pools of loans, the total reserve is available for all

credit losses.

Specific allowances are established for all loans

considered impaired by a method prescribed by Statement of

Financial Accounting Standards (“SFAS”) No. 114,

“Accounting by Creditors for Impairment of a Loan.”

Specific allowances are determined by PNC’s Special Asset

Committee based on an analysis of the present value of the

loan’s expected future cash flows, the loan’s observable

market price or the fair value of the loan’s collateral.

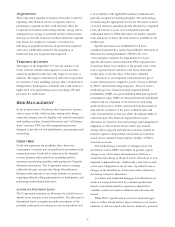

Allocations to non-impaired commercial loans (pool

reserve allocations) are assigned to pools of loans as defined

by PNC’s internal risk rating categories. The pool reserve

methodology’s key elements include expected default

probabilities (EDP), loss given default (LGD) and expected

commitment usage. EDPs are derived from historical default

analyses and are a function of the borrower’s risk rating

grade and loan tenor. LGDs are derived from historical loss

data and are a function of the loan’s collateral value and

other structural factors that may affect the ultimate ability to

collect the loan. The final non-impaired loan reserve

allocations are based on this methodology and management’s

judgment of other relevant factors which may include,

among others, regional and national economic conditions,

business segment and portfolio concentrations, historical

actual versus estimated losses and the volatility of PNC’s

historic loss trends.

This methodology is sensitive to changes in key risk

parameters such as EDPs and LGDs. In general, a given

change in any of the major risk parameters will have a

commensurate change in the pool reserve allocations to non-

impaired commercial loans. Additionally, other factors such

as the rate of migration in the severity of problem loans or

changes in the distribution of loan tenor will contribute to

the final pool reserve allocations.

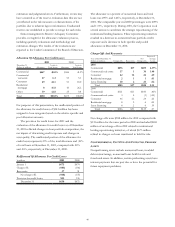

Consumer and residential mortgage loan allocations are

made at a total portfolio level by consumer product line

based on actual historical loss experience adjusted for

volatility, current economic conditions and other relevant

factors.

While PNC’s specific and pool reserve methodologies

strive to reflect all risk factors, there continues to be certain

elements of risk associated with, but not limited to, potential