PNC Bank 2001 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.70

essentially the same as that involved in extending loans and is

subject to normal credit policies. Collateral may be obtained

based on management’s assessment of the customer.

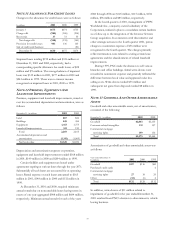

Additionally, the Corporation enters into other derivative

transactions for risk management purposes that are not

designated as accounting hedges. The positions of customer

and other derivatives are recorded at fair value and changes

in value are included in noninterest income.

Derivative Instruments And Hedging Activities – Pre-SFAS

No. 133

Prior to January 1, 2001, interest rate swaps, caps and floors

that modified the interest rate characteristics (such as from

fixed to variable, variable to fixed, or one variable index to

another) of designated interest-bearing assets or liabilities

were accounted for under the accrual method. The net

amount payable or receivable from the derivative contract

was accrued as an adjustment to interest income or interest

expense of the designated instrument. Premiums on

contracts were deferred and amortized over the life of the

agreement as an adjustment to interest income or interest

expense of the designated instruments. Unamortized

premiums were included in other assets.

Changes in the fair value of financial derivatives

accounted for under the accrual method were not reflected

in results of operations. Realized gains and losses, except

losses on terminated interest rate caps and floors, were

deferred as an adjustment to the carrying amount of the

designated instruments and amortized over the shorter of the

remaining original life of the agreements or the designated

instruments. Losses on terminated interest rate caps and

floors were recognized immediately in results of operations.

If the designated instruments were disposed of, the fair value

of the associated derivative contracts and any unamortized

deferred gains or losses were included in the determination

of gain or loss on the disposition of such instruments.

Contracts not qualifying for accrual accounting were marked

to market with gains or losses included in noninterest

income.

Credit default swaps were entered into to mitigate credit

risk and lower the required regulatory capital associated with

commercial lending activities. If the credit default swaps

qualified for hedge accounting treatment, the premium paid

to enter into the credit default swaps was recorded in other

assets and deferred and amortized to noninterest expense

over the life of the agreement. Changes in the fair value of

credit default swaps qualifying for hedge accounting

treatment were not reflected in the Corporation’s financial

position and had no impact on results of operations.

If the credit default swap did not qualify for hedge

accounting treatment or if the Corporation was the seller of

credit protection, the credit default swap was marked to

market with gains or losses included in noninterest income.

Due to the particular structure of the Corporation’s

credit default swaps discussed in the preceding paragraphs,

these instruments are not considered financial derivatives

under the provisions of SFAS No. 133. Commencing

January 1, 2001, the premiums paid to enter credit default

swaps not considered to be derivatives are recorded in other

assets and amortized to noninterest expense over the life of

the agreement.

ASSET MANAGEMENT AND FUND SERVICING FEES

Asset management and fund servicing fees are recognized

primarily as the services are performed. Asset management

fees are primarily based on a percentage of the fair value of

the assets under management and performance fees based on

a percentage of the returns on such assets. Fund servicing

fees are primarily based on a percentage of the fair value of

the assets, and the number of shareholder accounts,

administered by the Corporation.

INCOME TAXES

Income taxes are accounted for under the liability method.

Deferred tax assets and liabilities are determined based on

differences between financial reporting and tax bases of

assets and liabilities and are measured using the enacted tax

rates and laws that are expected to be in effect when the

differences are expected to reverse.

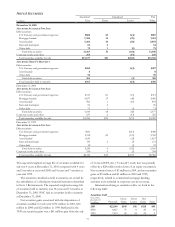

EARNINGS PER COMMON SHARE

Basic earnings per common share is calculated by dividing

net income adjusted for preferred stock dividends declared

by the weighted-average number of shares of common stock

outstanding.

Diluted earnings per common share is based on net

income adjusted for dividends declared on nonconvertible

preferred stock. The weighted-average number of shares of

common stock outstanding is increased by the assumed

conversion of outstanding convertible preferred stock and

debentures from the beginning of the year or date of

issuance, if later, and the number of shares of common stock

that would be issued assuming the exercise of stock options

and the issuance of incentive shares. Such adjustments to net

income and the weighted-average number of shares of

common stock outstanding are made only when such

adjustments are expected to dilute earnings per common

share.