PNC Bank 2001 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

STATISTICAL INFORMATION

THE PNC FINANCIAL SERVICES GROUP, INC.

94

PNC restated its consolidated financial statements for the

first, second and third quarters of 2001 and revised

previously announced results for the fourth quarter of

2001. These restatements were made to reflect the

correction of an error related to the accounting for the sale

of the residential mortgage banking business in the first

quarter and to consolidate certain subsidiaries of a third

party financial institution in the second, third and fourth

quarters. See Note 3 Restatements for additional

information.

The error correction reduced income from

discontinued operations and net income by $35 million for

the first quarter of 2001. Diluted earnings per share was

reduced by $.12.

The consolidation of the third party subsidiaries

reduced third quarter net income by $51 million and

diluted earnings per share by $.18 and fourth quarter

results by $104 million and $.37, respectively

In consolidation, all loan assets of the third party

subsidiaries are included in loans held for sale. At the date

of sale, the difference between the sale price and carrying

value was recorded as charge-offs for portfolio loans and

as valuation adjustments in noninterest income for loans

previously held for sale. Subsequent to the date of sale,

lower of cost or market adjustments have been recorded

through charges to noninterest income.

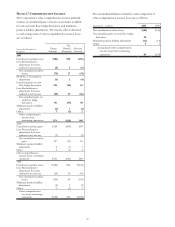

The following table summarizes the charges related to

the assets in these entities for 2001.

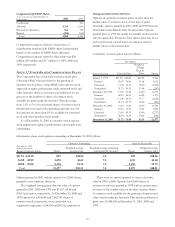

Charges Related To Third Party Subsidiaries

Year ended

December 31, 2001

In millions

Fourth

Quarter

Third

Quarter

Second

Quarter Total

At time of sale:

Charge-offs $9 $15 $24

Valuation adjustments 3 1 4

12 16 28

Valuation adjustments

subsequent to sale $158 82 240

Total $158 $94 $16 $268

Venture capital assets in one of the third party subsidiaries

were carried at estimated fair value and additional valuation

adjustments of $7 million were recorded in the fourth

quarter of 2001.

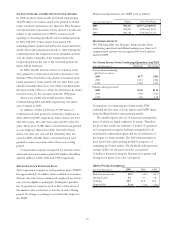

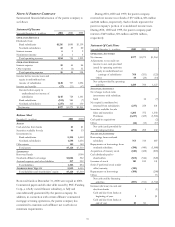

SELECTED QUARTERLY FINANCIAL DATA

2001 2000

Dollars in millions,

except per share data Fourth Third Second First Fourth Third Second First

SUMMARY OF OPERATIONS

Interest income $902 $984 $1,079 $1,172 $1,190 $1,201 $1,180 $1,161

Interest expense 324 419 514 618 657 670 635 606

Net interest income 578 565 565 554 533 531 545 555

Provision for credit losses 668 110 45 80 40 30 35 31

Noninterest income before net

securities (losses) gains 418 619 703 672 719 693 728 731

Net securities (losses) gains (3) 88 17 29 16 7 (3)

Noninterest expense 987 787 789 775 752 747 780 792

(Loss) income from continuing

operations before income taxes (662) 375 451 400 476 454 458 460

Income taxes (232) 128 156 135 162 155 159 158

(Loss) income from continuing

operations (430) 247 295 265 314 299 299 302

Income from discontinued operations 520 23 16 6

Net (loss) income before cumulative

effect of

accounting change (430) 247 295 270 334 322 315 308

Cumulative effect of accounting change (5)

Net (loss) income $(430) $247 $295 $265 $334 $322 $315 $308

PER COMMON SHARE DATA

Book value $20.54 $23.09 $22.60 $22.39 $21.88 $21.01 $20.22 $19.68

Basic earnings (a)

Continuing operations (1.52) .85 1.01 .90 1.07 1.02 1.01 1.02

Discontinued operations .02 .07 .08 .06 .02

Before cumulative effect of

accounting change (1.52) .85 1.01 .92 1.14 1.10 1.07 1.04

Cumulative effect of accounting

change (.02)

Net income (1.52) .85 1.01 .90 1.14 1.10 1.07 1.04

Diluted earnings (a) (b)

Continuing operations (1.52) .84 1.00 .89 1.06 1.01 1.01 1.01

Discontinued operations .02 .07 .08 .05 .02

Before cumulative effect of

accounting change (1.52) .84 1.00 .91 1.13 1.09 1.06 1.03

Cumulative effect of accounting

change (.02)

Net income (1.52) .84 1.00 .89 1.13 1.09 1.06 1.03

(a) The sum of the quarterly amounts in 2001 does not equal the year’s amount because the quarterly calculations are based on a changing number of average shares.

(b) Additional shares were excluded from fourth quarter 2001 EPS calculations since they were antidilutive.