PNC Bank 2001 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

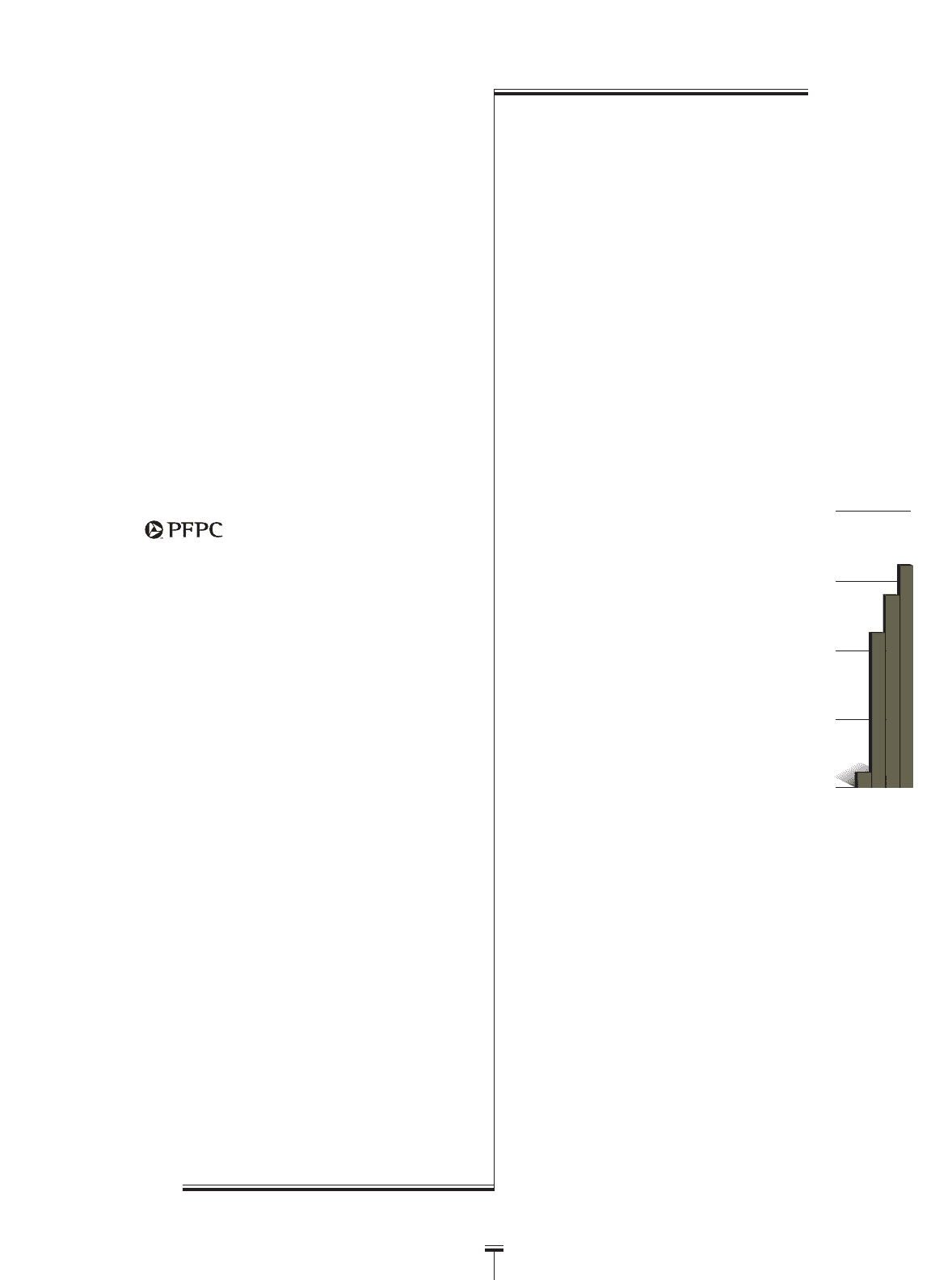

01

49

00

43

99

34*

0

15

30

45

60

98

3

PFPC

SHAREHOLDER

ACCOUNTS

SERVICED

(in millions)

fixed income manager, an increasingly

diverse mix of high-quality businesses

and a recognized commitment to

delivering superior investment

performance and exceptional service

to its clients, BlackRock enters

2002 well-positioned to build on

its record of achievement for clients

and shareholders alike.

Technology-driven, customized

solutions, a wide range of products and

services and strategic global expansion

continue to fuel the success of PFPC.

In 2001, PFPC strengthened its status

among the world’s largest providers of

services to the investment fund and retire-

ment services industry and now services

more than $1.5 trillion in total assets.

PFPC is the nation’s largest full-

service mutual fund transfer agent and the

second-largest provider of mutual fund

accounting and administration services.

PFPC is also a leading provider of retire-

ment, subaccounting, custody, alternative

investment and Blue Sky services.

To help solidify its leadership

position and enhance its ability to

drive continued growth, PFPC made

significant progress on several strategic

initiatives in 2001.

PFPC expanded its product base by

introducing a unique, full-service transfer

agency and shareholder accounting solu-

tion for brokerage-marketed products

and also enhanced services for the college

savings plan market.

Moreover, PFPC continued

to diversify its revenue stream by

expanding its international presence

and further penetrating the alternative

investments market.

With offices in Europe and the

Cayman Islands, PFPC doubled its inter-

national client base and now services

more than $20 billion in offshore assets.

Entering 2002, PFPC is focused

on leveraging the innovative applica-

tion of leading-edge technology to

continue creating customized client

solutions and developing a broader

global business base.

For example, greater use of

Internet-based services — like Web-

enabled 401(k) processing — will help

address the e-commerce needs of

clients. Two other recent initiatives

include AdvisorCentral.com — an

Internet portal for financial advisors

created and jointly owned by PFPC,

Fidelity Investments, Franklin

Templeton Investor Services, Inc.,

and Putnam Investments — and

AssetDirectionsSM, a Web-based

managed account platform.

This focused approach to antici-

pating customer needs, extending the

breadth of product lines and improv-

ing efficiency supports PFPC’s strategy

for continued growth.

21

*Reflects ISG

Acquisition