PNC Bank 2001 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

OTHER DERIVATIVES

To accommodate customer needs, PNC enters into

customer-related financial derivative transactions primarily

consisting of interest rate swaps, caps, floors and foreign

exchange contracts. Risk exposure from customer positions

is managed through transactions with other dealers.

Additionally, the Corporation enters into other derivative

transactions for risk management purposes that are not

designated as accounting hedges, primarily consisting of

interest rate floors and caps and basis swaps. Other

noninterest income for 2001 included $31 million of net

gains related to the derivatives held for risk management

purposes not designated as accounting hedges. Prior to 2001,

changes in the fair value of these derivatives that were

previously accounted for under the accrual method were not

reflected in operating results.

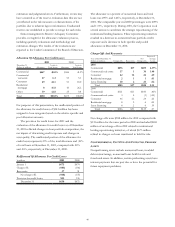

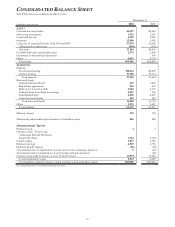

Other Derivatives

At December 31, 2001 2001

Positive Ne

g

ative Avera

g

e

Notiona

l

Fair Fair Net Asse

t

Fair

In millions Value Value Value (Liability) Value

Customer-related

Interest rate

Swaps $20,317 $336 $(335) $1 $(6)

Caps/floors

Sold 3,493 (34) (34) (25)

Purchased 2,791 27 27 21

Foreign exchange 4,429 43 (39) 4 11

Other 2,957 65 (55) 10 4

Total customer-related 33,987 471 (463) 8 5

Other risk management and proprietary

Interest rate

Basis swaps 2,408 8 8 10

Caps/floors

Sold 250 (2) (2) (1)

Purchased 4,650 2 2 1

Other 547 8 (3) 5 7

Total other risk management and

proprietary 7,855 18 (5) 13 17

Total other derivatives $41,842 $489 $(468) $21 $22

“OFF-BALANCE-SHEET” ACTIVITIES

PNC has reputation, legal, operational and fiduciary risks in

virtually every area of its business, many of which are not

reflected in assets and liabilities recorded on the balance

sheet, and some of which are conducted through limited

purpose entities known as “special purpose entities.” These

activities are part of the banking business and would be

found in most larger financial institutions with the size and

activities of PNC. Most of these involve financial products

distributed to customers, trust and custody services, and

processing and funds transfer services, and the amounts

involved can be quite large in relation to the Corporation’s

assets, equity and earnings. The primary accounting for these

activities on PNC’s records is to reflect the earned income,

operating expenses and any receivables or liabilities for

transaction settlements. For example: PNC Bank provides

credit and liquidity to customers through loan commitments

and letters of credit (see the Other Commitments table in the

Liquidity Risk section of Risk Management in this Financial

Review); BlackRock provides investment advisory and

administration services for others through registered

investment companies, separate accounts, and other legal

entities - additional information about BlackRock is available

in its filings with the SEC and may be obtained electronically

at the SEC’s home page at www.sec.gov; PFPC processes

mutual fund transactions, provides securities lending services

and maintains custody of certain fund assets; PNC Advisors

provides trust services and holds assets for personal and

institutional customers; Hilliard Lyons maintains brokerage

assets of customers; and Columbia Housing administers and

manages funds that invest in affordable housing projects that

generate tax credits to investors; among others. In addition

to these activities, PNC has other activities or financial

interests that involve credit risk and market risk (including

interest rate risk) that are not fully reflected on the balance

sheet. The most significant of these activities include the

following:

• PNC sponsors Market Street Funding Corporation

(“Market Street”), a multi-seller asset-backed

commercial paper conduit -- see discussion that follows