PNC Bank 2001 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

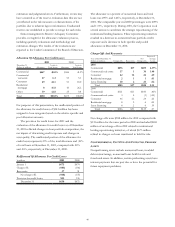

December 31, 2001 compared with 4 years and 5 months at

December 31, 2000.

Securities designated as held to maturity are carried at

amortized cost and are assets of subsidiaries of a third party

financial institution, which are consolidated in PNC’s financial

statements. The expected weighted-average life of securities

held to maturity was 18 years and 11 months at December

31, 2001. PNC had no securities held to maturity at December

31, 2000.

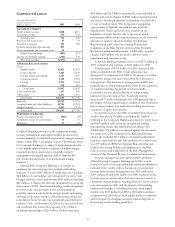

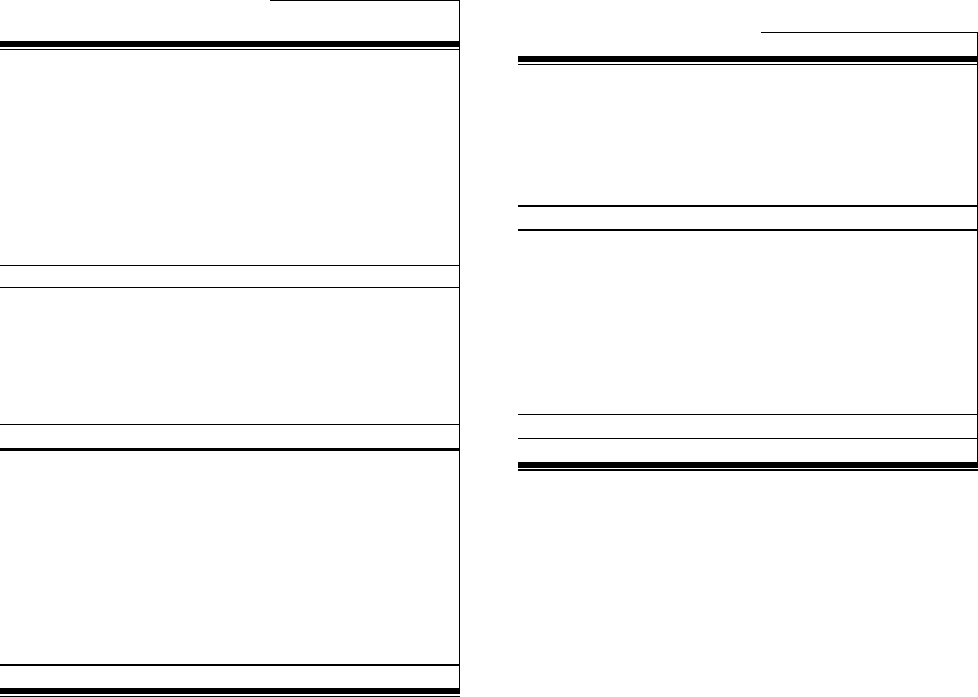

Details Of Securities

Amortized Fair

In millions Cos

t

Value

December 31, 2001

SECURITIES AVAILABLE FOR SALE

Debt securities

U.S. Treasury and government

agencies $808 $807

Mortgage-backed 7,302 7,261

Asset-backed 5,166 5,093

State and municipal 62 64

Other debt 75 75

Corporate stocks and other 264 245

Total securities available for sale $13,677 $13,545

SECURITIES HELD TO MATURITY

Debt securities

U.S. Treasury and government

agencies $260 $257

Asset-backed 88

Other debt 95 95

Total securities held to maturity $363 $360

December 31, 2000

SECURITIES AVAILABLE FOR SALE

Debt securities

U.S. Treasury and government

agencies $313 $313

Mortgage-backed 4,037 4,002

Asset-backed 902 893

State and municipal 94 96

Other debt 73 73

Corporate stocks and other 537 525

Total securities available for sale $5,956 $5,902

See Securitizations in the Risk Management section of this

Financial Review and Note 14 Securitizations for additional

information regarding the change in securities available for

sale.

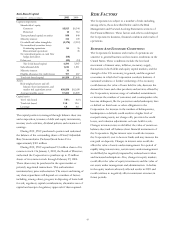

FUNDING SOURCES

Total funding sources were $59.4 billion at December 31,

2001 and 2000. Demand and money market deposits

increased due to ongoing strategic marketing efforts to retain

customers, as higher-cost, less valuable retail certificates of

deposit were de-emphasized. The change in the composition

of borrowed funds reflected a shift within categories to

manage overall funding costs. See Liquidity Risk under Risk

Management in the Financial Review section for additional

information.

Details Of Funding Sources

December 31 - in millions 2001 2000

Deposits

Demand and money marke

t

$32,589 $28,771

Savin

g

s1,942 1,915

Retail certificates of de

p

osi

t

10,727 14,175

Other time 472 567

De

p

osits in forei

g

n offices 1,574 2,236

T

otal de

p

osits 47,304 47,664

Borrowed funds

Federal funds purchased 167 1,445

Repurchase agreements 954 607

Bank notes and senior debt 6,362 6,110

Federal Home Loan Bank

borrowings 2,047 500

Subordinated debt 2,298 2,407

Other borrowed funds 262 649

Total borrowed funds 12,090 11,718

Total $59,394 $59,382

CAPITAL

The access to and cost of funding new business initiatives

including acquisitions, the ability to engage in expanded

business activities, the ability to pay dividends, the level of

deposit insurance costs, and the level and nature of

regulatory oversight depend, in large part, on a financial

institution’s capital strength. At December 31, 2001, the

Corporation and each bank subsidiary were considered

“well-capitalized” based on regulatory capital ratio

requirements. See Note 19 Regulatory Matters and

Supervision and Regulation in the Risk Factors section of

this Financial Review for additional information.