PNC Bank 2001 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

REVIEW OF BUSINESSES

PNC operates seven major businesses engaged in regional

community banking, corporate banking, real estate finance,

asset-based lending, wealth management, asset management

and global fund services.

Results of individual businesses are presented based on

PNC’s management accounting practices and the

Corporation’s management structure. There is no

comprehensive, authoritative body of guidance for

management accounting equivalent to generally accepted

accounting principles; therefore, the financial results of

individual businesses are not necessarily comparable with

similar information for any other financial services

institution. Financial results are presented, to the extent

practicable, as if each business operated on a stand-alone

basis.

The management accounting process uses various

balance sheet and income statement assignments and

transfers to measure performance of the businesses.

Methodologies change from time to time as management

accounting practices are enhanced and businesses change.

Securities available for sale or borrowings and related net

interest income are assigned based on the net asset or liability

position of each business. Capital is assigned based on

management’s assessment of inherent risks and equity levels

at independent companies providing similar products and

services. The allowance for credit losses is allocated based on

management’s assessment of risk inherent in the loan

portfolios. Support areas not directly aligned with the

businesses are allocated primarily based on the utilization of

services.

Total business financial results differ from consolidated

results from continuing operations primarily due to

differences between management accounting practices and

generally accepted accounting principles, equity management

activities, minority interest in income of consolidated entities,

residual asset and liability management activities, unallocated

reserves, eliminations and unassigned items, the impact of

which is reflected in the “Other” category. Details of inter-

segment revenues are included in Note 26 Segment

Reporting. The operating results and financial impact of the

disposition of the residential mortgage banking business,

previously PNC Mortgage, are included in discontinued

operations.

The impact of the institutional lending repositioning and

other strategic actions that occurred during 2001 is reflected

in the business results presented in the table below. The

charges are separately identified in the business income

statements. Performance ratios in the results of individual

businesses reflect the impact of the charges.

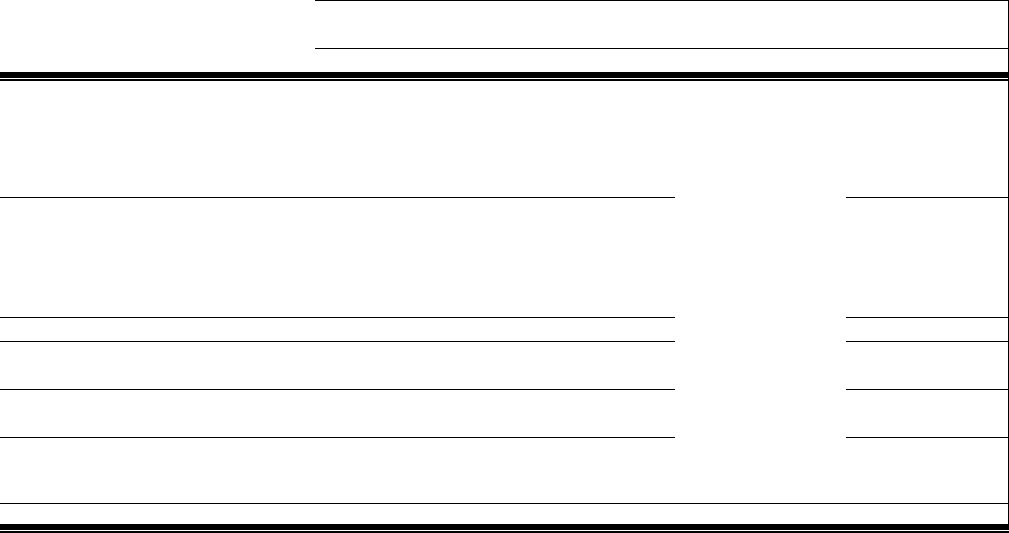

Results Of Businesses

Return on

Earnin

g

s (Net Loss) Revenue (a) Assi

g

ned Ca

p

ita

l

Avera

g

e Assets

Year ended December 31 - dollars in millions 2001 2000 2001 2000 2001 2000 2001 2000

Banking Businesses

Re

g

ional Community Bankin

g

$596 $590 $2,231 $2,033 22% 22% $40,285 $38,958

Cor

p

orate Bankin

g

(375) 241 764 84

4

(30) 18 16,685 17,746

PNC Real Estate Finance 38 8

4

213 229 10 21 5,290 5,889

PNC Business Credi

t

22 49 134 119 13 32 2,463 2,271

T

otal bankin

g

businesses 281 96

4

3,342 3,225 621 64,723 64,86

4

Asset Mana

g

ement and Processin

g

PNC Advisors 143 173 735 792 26 32 3,330 3,500

BlackRock 107 87 533 477 25 27 684 537

PFPC 36 47 738 67

4

17 22 1,771 1,578

T

otal asset mana

g

ement and

p

rocessin

g

286 307 2,006 1,943 24 28 5,785 5,615

T

otal business results 567 1,271 5,348 5,168 10 23 70,508 70,479

Other (190) (57) (527) (95) (153) (1,988)

Results from continuin

g

o

p

erations 377 1,21

4

4,821 5,073 621 70,355 68,491

Discontinued o

p

erations 565 51 487

Results before cumulative effect of

accounting change 382 1,279 4,821 5,073 622 70,406 68,978

Cumulative effect of accounting change (5)

Total consolidated - as reported $377 $1,279 $4,821 $5,073 622 $70,406 $68,978

(a) Business revenues are presented on a taxable-equivalent basis except for BlackRock and PFPC.