PNC Bank 2001 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

77

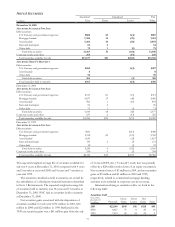

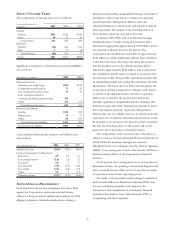

NOTE 11 ALLOWANCE FOR CREDIT LOSSES

Changes in the allowance for credit losses were as follows:

In millions 2001 2000 1999

January 1 $675 $674 $753

Charge-offs (985) (186) (216)

Recoveries 37 51 55

Net charge-offs (948) (135) (161)

Provision for credit losses 903 136 163

Sale of credit card business (81)

December 31 $630 $675 $674

Impaired loans totaling $192 million and $316 million at

December 31, 2001 and 2000, respectively, had a

corresponding specific allowance for credit losses of $28

million and $76 million. The average balance of impaired

loans was $319 million in 2001, $277 million in 2000 and

$243 million in 1999. There was no interest income

recognized on impaired loans in 2001, 2000 or 1999.

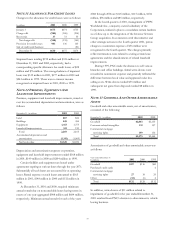

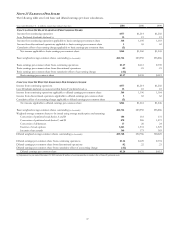

NOTE 12 PREMISES, EQUIPMENT AND

LEASEHOLD IMPROVEMENTS

Premises, equipment and leasehold improvements, stated at

cost less accumulated depreciation and amortization, were as

follows:

December 31 - in millions 2001 2000

Land $87 $86

Buildings 448 456

Equipment 1,413 1,373

Leasehold improvements 321 190

T

ota

l

2,269 2,105

Accumulated depreciation and

amortization (1,141) (1,069)

Net book value $1,128 $1,036

Depreciation and amortization expense on premises,

equipment and leasehold improvements totaled $168 million

in 2001, $149 million in 2000 and $204 million in 1999.

Certain facilities and equipment are leased under

agreements expiring at various dates through the year 2071.

Substantially all such leases are accounted for as operating

leases. Rental expense on such leases amounted to $165

million in 2001, $148 million in 2000 and $132 million in

1999.

At December 31, 2001 and 2000, required minimum

annual rentals due on noncancelable leases having terms in

excess of one year aggregated $908 million and $684 million,

respectively. Minimum annual rentals for each of the years

2002 through 2006 are $125 million, $115 million, $104

million, $96 million and $85 million, respectively.

In the fourth quarter of 2001, management of PFPC

Worldwide Inc., a majority-owned subsidiary of the

Corporation, initiated a plan to consolidate certain facilities

as a follow-up to the integration of the Investor Services

Group acquisition. In connection with this initiative and

other strategic actions in the fourth quarter 2001, pretax

charges to noninterest expense of $36 million were

recognized in the fourth quarter. The charges primarily

reflect termination costs related to exiting certain lease

agreements and the abandonment of related leasehold

improvements.

During 1999, PNC made the decision to sell various

branches and office buildings. Initial write-downs were

recorded in noninterest expense and generally reflected the

difference between book value and appraised value less

selling costs. Write-downs totaled $35 million and

subsequent net gains from disposals totaled $8 million in

1999.

NOTE 13 GOODWILL AND OTHER AMORTIZABLE

ASSETS

Goodwill and other amortizable assets, net of amortization,

consisted of the following:

December 31 - in millions 2001 2000

Goodwill $2,043 $2,155

Customer-related intangibles 131 157

Commercial mortgage

servicing rights 199 156

Total $2,373 $2,468

Amortization of goodwill and other amortizable assets was

as follows:

Year ended December 31

In millions 2001 2000 1999

Goodwill $117 $116 $80

Purchased credit cards 6

Commercial mortgage

servicing rights 27 18 20

Other (12) (6) 6

Total $132 $128 $112

In addition, write-downs of $11 million related to

impairment of goodwill for the year ended December 31,

2001 resulted from PNC’s decision to discontinue its vehicle

leasing business.