PNC Bank 2001 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

28

OVERVIEW

THE PNC FINANCIAL SERVICES GROUP, INC.

The Corporation is one of the largest diversified financial

services companies in the United States, operating businesses

engaged in regional community banking, corporate banking,

real estate finance, asset-based lending, wealth management,

asset management and global fund services. The Corporation

provides certain products and services nationally and others

in PNC’s primary geographic markets in Pennsylvania, New

Jersey, Delaware, Ohio and Kentucky. The Corporation also

provides certain banking, asset management and global fund

services internationally.

The most significant events affecting PNC’s financial

results in 2001 were the actions PNC took to reposition its

banking businesses. The impact of these and other actions

resulted in charges totaling $1.181 billion or $768 million

after tax.

PNC continues to pursue strategies to build a more

diverse and valuable business mix designed to create

shareholder value over time. PNC’s focus is on increasing

the contribution from more highly-valued businesses such as

asset management and processing while reducing lending

leverage and improving the risk/return characteristics of

traditional banking businesses. BlackRock and PFPC

continued to grow revenues at attractive rates and

contributed an increasing proportion of the Corporation’s

earnings. While PNC Advisors was adversely impacted by

weak equity market conditions in 2001, customer growth

continued with further investment in the sales and brokerage

force.

PNC’s goal is to derive a greater proportion of its

revenue from less volatile, fee-based products and services.

Over the past three years, PNC has reduced loans by $20

billion and unfunded loan commitments by $25 billion and

the loans to deposits ratio has improved from 121% at

December 31, 1998 to 80% at December 31, 2001. The term

“loans” in this report excludes loans held for sale and

securities that represent interests in pools of loans.

STRATEGIC REPOSITIONING

PNC took several actions in 2001 to accelerate the strategic

repositioning of its lending businesses that began in 1998.

Loans were reduced $12.6 billion from year end 2000

primarily due to residential mortgage securitizations and

runoff, transfers to held for sale and the managed reduction

of institutional loans. A total of $12.0 billion of credit

exposure (comprised of loans outstanding, unfunded

commitments and letters of credit) including $6.2 billion of

outstandings were designated for exit or sale during the year,

of which $10.1 billion and $4.3 billion, respectively, related to

the institutional lending portfolio. The remaining credit

exposure and outstandings related to PNC’s vehicle leasing

business that it decided to discontinue.

Historically, vehicle leasing had provided appropriate

returns at reasonable risk with returns primarily dependent

upon residual value insurance protection. Recently,

circumstances in the vehicle leasing industry have changed as

depressed market conditions combined with manufacturers’

pricing incentives have significantly dampened revenues and

weakened the used car market. In addition, residual value

protection has become more difficult and significantly more

costly to obtain. Also, in the fourth quarter of 2001 one of

the companies that issued residual value insurance policies to

PNC was placed in liquidation. PNC’s vehicle leasing

business had $1.9 billion in assets at December 31, 2001 that

have been designated for exit and are expected to mature

over a period of approximately five years. Costs incurred in

2001 to exit this business and additions to reserves related to

insured residual value exposures totaled $135 million.

In connection with these repositioning actions and other

strategic initiatives, $1.2 billion of pretax charges were taken

in 2001 as detailed in the tables below. The charges related to

institutional lending repositioning reflect adjustments to

market value that include the impact of deterioration in asset

quality and market liquidity conditions, among other factors.

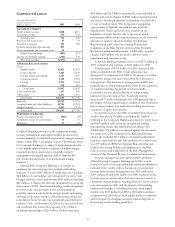

Details Of Strategic Repositioning Charges

Year ended December 31, 2001 - in millions Pretax charges

Institutional lending repositioning $973

Vehicle leasing 135

Asset impairment and severance costs 37

Facilities consolidation and other charges 36

Total charges $1,181

Strategic Repositioning Charges By Business

Year ended December 31, 2001 - in millions Pretax charges

Corporate Banking $907

Regional Community Banking 148

PNC Business Credit 48

PFPC 36

PNC Real Estate Finance 35

Other 7

Total $1,181