PNC Bank 2001 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.57

and the Other Commitments table under Liquidity Risk

in the Risk Management section of this Financial

Review.

• Loan commitments and letters of credit -- see the Other

Commitments table under Liquidity Risk and Credit

Risk in the Risk Management section of this Financial

Review, and Note 9 Loans and Commitments to Extend

Credit.

• Financial derivatives -- see Financial Derivatives in the

Risk Management section of this Financial Review and

Note 20 Financial Derivatives.

• Loan securitization and servicing activities – see

Securitizations in the Risk Management section of this

Financial Review and Note 14 Securitizations. See also

the discussion of the National Bank of Canada servicing

arrangement in Note 30 Subsequent Events.

Except to the extent inherent in customary activities such as

those described above, PNC does not use off-balance-sheet

entities to fund its business operations. The Corporation

does not capitalize any off-balance-sheet entity with PNC

stock and has no commitments to provide financial backing

to any such entity by issuing PNC stock.

The accounting for special purpose entities is currently

under review by the Financial Accounting Standards Board

and the conditions for consolidation or non-consolidation of

such entities could change.

See the Risk Factors section in this Financial Review for

a discussion of key risks associated with these and other off-

balance-sheet activities.

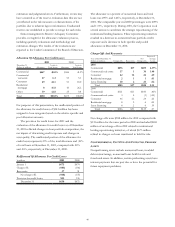

MARKET STREET FUNDING CORPORATION

The most significant portion of commercial loan facilities

provided by PNC Bank is to Market Street, an asset-backed

commercial paper conduit that is 100% independently owned

and managed. PNC Bank provides credit enhancement,

liquidity facilities and certain administrative services to

Market Street. Market Street had total assets of $5.2 billion

and $4.0 billion at December 31, 2001 and 2000, respectively.

The activities of Market Street are limited to the purchase of

undivided interests in pools of receivables from U.S.

corporations (“sellers”) that desire access to the commercial

paper market. Market Street funds the purchases by issuing

commercial paper (“CP”). The CP has been rated A1/P1 by

Standard & Poor’s and Moody’s. Credit enhancement

provided by PNC is in the form of a revolving credit facility

with a five year term expiring December 31, 2004. At

December 31, 2001 and 2000, $166.1 million and

$115.7 million, respectively, was outstanding. Also at

December 31, 2001 and 2000, Market Street had liquidity

facilities totaling $5.8 billion and $4.5 billion, respectively,

provided by PNC Bank. The maximum total amount of such

facilities and the amount of such total provided by PNC

Bank during the years ended December 31, 2001 and 2000,

was $7.0 billion and $5.8 billion, and $5.2 billion and $4.5

billion, respectively. PNC Bank received related loan

commitment fees of $7.8 million and $6.5 million for the

years ended December 31, 2001 and 2000, respectively.

PNC Bank serves as Market Street’s program

administrator for which it received related fees of $11.7

million and $10.7 million for the years ended December 31,

2001 and 2000, respectively.

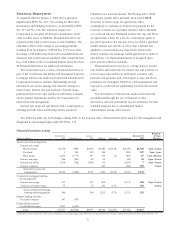

SECURITIZATIONS

From time to time the Corporation has sold loans in

secondary market securitization transactions. The

Corporation uses securitizations to manage various balance

sheet risks. Also, in such securitization transactions, the

Corporation may retain certain interest-only strips and

servicing rights that were created in the sale of the loans. The

Corporation’s liquidity is not dependent on securitizations.

During 2001 and 2000, the Corporation sold loans

totaling $1.5 billion and $865 million, respectively, in

secondary market securitization transactions, resulting in pre-

tax gains of $13 million in each year.

In addition to these transactions, in March 2001 PNC

securitized $3.8 billion of residential mortgage loans by

selling the loans into a trust with PNC retaining 99% or $3.7

billion of the certificates. PNC also securitized $175 million

of commercial mortgage loans by selling the loans into a

trust with PNC retaining 99% or $173 million of the

certificates. In each case, the 1% interest in the trust was

purchased by a publicly-traded entity managed by a

subsidiary of PNC. A substantial portion of the entity’s

purchase price was financed by PNC. The reclassification of

these loans to securities increased the liquidity of the assets

and was consistent with PNC’s on-going balance sheet

restructuring. At the time of the residential mortgage

securitization, gains of $25.9 million were deferred and are

being recognized when principal payments are received or

the securities are sold to third parties. At December 31, 2001,

these securities had been reduced to $1.3 billion through

sales and principal payments and the remaining deferred

gains were $7.8 million. No gain was recognized at the time

of the commercial mortgage loan securitization and none of

the securities retained at the time of the securitization

remained on the balance sheet at December 31, 2001.