PNC Bank 2001 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

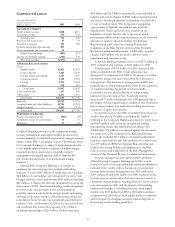

34

PNC REAL ESTATE FINANCE

Year ended December 31

Taxable-equivalent basis

Dollars in millions 2001 2000

INCOME STATEMENT

Net interest income $118 $121

Noninterest income

Commercial mortgage banking 58 68

Other 37 40

Total noninterest income 95 108

Total revenue 213 229

Provision for credit losses 16 (7)

Noninterest expense 157 145

Institutional lending repositioning 34

Severance costs 1

Pretax earnings 591

Income tax (benefit) ex

p

ense (33) 7

Earnin

g

s$38 $84

AVERAGE BALANCE

S

HEET

Loans

Commercial real estate $2,337 $2,427

Commercial – real estate related 1,751 2,118

Total loans 4,088 4,545

Commercial mortgages held for sale 279 396

Other assets 923 948

Total assets $5,290 $5,889

De

p

osits $518 $697

Assi

g

ned funds and other liabilities 4,375 4,784

Assi

g

ned ca

p

ita

l

397 408

T

otal funds $5,290 $5,889

P

ERFORMANCE

R

ATIO

S

Return on assi

g

ned ca

p

ita

l

10% 21%

Noninterest income to total revenue 43 47

Efficienc

y

60 51

PNC Real Estate Finance provides credit, capital markets,

treasury management, commercial mortgage loan servicing

and other financial products and services to developers,

owners and investors in commercial real estate. PNC’s

commercial real estate financial services platform provides

processing services through Midland Loan Services, Inc., a

leading third-party provider of loan servicing and technology

to the commercial real estate finance industry, and national

syndication of affordable housing equity through Columbia

Housing Partners, LP (“Columbia”).

On October 17, 2001, PNC completed the acquisition of

certain lending and servicing-related business from TRI

Acceptance Corporation. The acquisition expands PNC Real

Estate Finance’s reach in multi-family finance, combining

permanent loan capacity with PNC’s traditional interim

lending activities and Columbia’s tax credit syndication

capabilities.

Over the past three years, PNC Real Estate Finance has

been strategically shifting to a more balanced and valuable

revenue stream by focusing on real estate processing

businesses and increasing the value of its lending business by

seeking to sell more fee-based products.

During 2001, PNC Real Estate Finance took actions to

accelerate the downsizing of its institutional lending business.

A total of $400 million of credit exposure including $250

million of outstandings were designated for exit or held for

sale. Charges related to these actions were $34 million. At

December 31, 2001, $324 million of credit exposure

including $244 million of outstandings were classified as held

for sale, net of charges of $34 million that represented the

excess of principal balances outstanding over the lower of

cost or market values. See Strategic Repositioning and

Critical Accounting Policies and Judgments in the Risk

Factors section of this Financial Review for additional

information. A $1 million pretax charge for severance costs

was incurred in 2001.

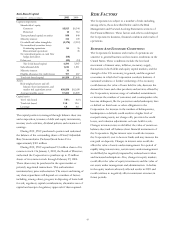

PNC Real Estate Finance earned $38 million in 2001

compared with $84 million in 2000.

Total revenue was $213 million for 2001 compared with

$229 million for 2000. The decrease was primarily due to

higher amortization of servicing intangibles caused by lower

interest rates and lower commercial mortgage-backed

securitization gains. The commercial mortgage servicing

portfolio increased 26% to $68 billion at December 31, 2001

as shown below:

Commercial Mortgage Servicing Portfolio

In billions 2001 2000

January 1 $54 $45

Acquisitions/additions 25 17

Repayments/transfers (11) (8)

December 31 $68 $54

Total credit costs in the 2001 consolidated provision for

credit losses were $44 million, including $16 million reflected

in the PNC Real Estate Finance provision for credit losses

and $28 million reflected in the institutional lending

repositioning charge that represented net charge-offs.

Additionally, $14 million was charged against the allowance

for credit losses. The institutional lending repositioning

charge also included $6 million of valuation adjustments

related to loans held for sale. The provision for 2000

reflected a net recovery of $7 million. See Critical

Accounting Policies and Judgments in the Risk Factors

section and Credit Risk in the Risk Management section of

this Financial Review for additional information.

Noninterest expense was $157 million for 2001

compared with $145 million in the prior year. The increase

was primarily due to non-cash (passive) losses on affordable

housing investments that were more than offset by related

income tax credits.