PNC Bank 2001 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

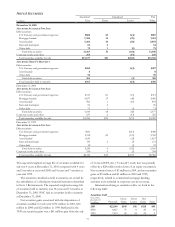

CONSOLIDATED STATEMENT OF CASH FLOWS

THE PNC FINANCIAL SERVICES GROUP, INC.

65

Year ended December 31

In millions 2001 2000 1999

OPERATING ACTIVITIES

Net income $377 $1,279 $1,264

Income from discontinued operations (5) (65) (62)

Cumulative effect of accounting change 5

Income from continuing operations 377 1,214 1,202

Adjustments to reconcile income from continuing operations

to net cash provided by operating activities

Provision for credit losses 903 136 163

Depreciation, amortization and accretion 260 340 305

Deferred income taxes (48) 376 97

Securities transactions (128) (29) (25)

Gain on sale of businesses (317)

Valuation adjustments 265 27 195

Change in

Loans held for sale (92) 1,652 175

Other (271) (668) (23)

Net cash provided by operating activities 1,266 3,048 1,772

INVESTING ACTIVITIES

Net change in loans 4,099 (2,215) 348

Repayment of securities 2,445 920 1,303

Sales

Securities 22,144 8,427 7,553

Loans 1,155 551 648

Foreclosed assets 15 24 36

Purchases

Securities (28,598) (8,437) (9,576)

Loans (758) (363)

Net cash received (paid) for divestitures/acquisitions 485 (30) 1,854

Other (131) (301) (139)

Net cash provided (used) by investing activities 856 (1,061) 1,664

FINANCING ACTIVITIES

Net change in

Noninterest-bearing deposits 1,634 329 (1,289)

Interest-bearing deposits (1,994) 1,533 1,328

Federal funds purchased (1,260) 164 891

Repurchase agreements 347 205 (45)

Sale/issuance

Bank notes and senior debt 2,157 2,849 2,416

Federal Home Loan Bank borrowings 3,123 1,781 1,696

Subordinated debt 100 650

Other borrowed funds 35,346 37,060 32,997

Common stock 184 189 141

Repayment/maturity

Bank notes and senior debt (1,915) (3,715) (5,827)

Federal Home Loan Bank borrowings (1,576) (3,539) (1,802)

Subordinated debt (200) (20) (104)

Other borrowed funds (35,752) (37,367) (32,614)

Acquisition of treasury stock (681) (428) (803)

Series F preferred stock tender offer/redemption (301)

Cash dividends paid (569) (546) (520)

Net cash used by financing activities (1,457) (1,405) (2,885)

INCREASE IN CASH AND DUE FROM BANKS 665 582 551

Cash and due from banks at beginning of year 3,662 3,080 2,529

Cash and due from banks at end of year $4,327 $3,662 $3,080

CASH PAID FOR

Interest $1,813 $2,598 $2,237

Income taxes 215 289 344

NON-CASH ITEMS

Transfer of mortgage loans to securities 4,341 710

Transfer to (from) loans from (to) loans held for sale (2,707) 143 (3,378)

Transfer from loans to other assets 11 23 37

See accompanying Notes to Consolidated Financial Statements.