PNC Bank 2001 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75

The carrying value of securities pledged to secure public and

trust deposits and repurchase agreements and for other

purposes was $6.2 billion and $3.8 billion at December 31,

2001 and December 31, 2000, respectively. The fair value of

securities accepted as collateral that the Corporation is

permitted by contract or custom to sell or repledge was $260

million at December 31, 2001, of which $160 million was

repledged to others.

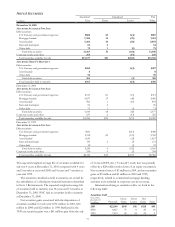

The following table presents the amortized cost, fair value and weighted-average yield of debt securities at December 31,

2001, by remaining contractual maturity.

Contractual Maturity Of Debt Securities

December 31, 2001 Within 1 to 5 to After 10

Dollars in millions 1 Year 5 Years 10 Years Years Total

SECURITIES AVAILABLE FOR SALE

U.S. Treasury and government agencies $95 $591 $116 $6 $808

Mortgage-backed 29 11 7,262 7,302

Asset-backed 2,309 1,010 1,847 5,166

State and municipal 21538 762

Other debt 33027 1575

Total securities available for sale $100 $2,974 $1,202 $9,137 $13,413

Fair value

$

100

$

2

,

958

$

1

,

183

$

9

,

059

$

13

,

300

Wei

g

hted-avera

g

e yield 1.93% 3.65% 5.35% 5.80

%

5.26%

S

ECURITIES HELD TO

M

A

TURIT

Y

U.S. Treasury and

g

overnment a

g

encies $260 $260

A

sset-backed $8 8

Other deb

t

$66 23 $6 95

T

otal securities held to maturit

y

$66 $31 $6 $260 $363

Fair value $66 $31 $6 $257 $360

Wei

g

hted-avera

g

e yield 2.04% 2.30% 5.88% 5.80

%

4.82%

Based on current interest rates and expected prepayment speeds, the total weighted-average expected maturity of mortgage-

backed securities was 4 years and asset-backed securities was 4 years and 2 months at December 31, 2001. Weighted-average

yields are based on historical cost with effective yields weighted for the contractual maturity of each security.

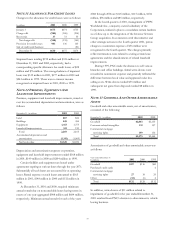

NOTE 9 LOANS AND COMMITMENTS TO EXTEND CREDIT

Loans outstanding were as follows:

December 31 - in millions 2001 2000 1999 1998 1997

Commercial $15,205 $21,207 $21,468 $25,177 $19,988

Commercial real estate 2,372 2,583 2,730 3,449 3,974

Consumer 9,164 9,133 9,348 10,980 11,205

Residential mortgage 6,395 13,264 12,506 12,253 12,776

Lease financing 5,557 4,845 3,663 2,978 2,224

Credit card 2,958 3,830

Other 445 568 682 392 650

T

otal loans 39,138 51,600 50,397 58,187 54,647

Unearned income (1,164) (999) (724) (554) (412)

Total loans, net of unearned income $37,974 $50,601 $49,673 $57,633 $54,235

Loans outstanding and related unfunded commitments are concentrated in PNC’s primary geographic markets. At December

31, 2001, no specific industry concentration exceeded 8.3% of total commercial loans outstanding and unfunded commitments.