PNC Bank 2001 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

85

INCENTIVE SHARE AND RESTRICTED STOCK AWARDS

In 1998, incentive share awards potentially representing

362,250 shares of common stock were granted to certain

senior executives pursuant to the Incentive Plan. Issuance

of restricted shares pursuant to these incentive awards was

subject to the market price of PNC’s common stock

equaling or exceeding specified levels for defined periods.

In 2001, 104,250 of these shares were issued. The

remaining shares expired and will not be issued under this

award. The restricted period ends July 1, 2003. During the

restricted period, the recipient receives dividends and can

vote the shares. Generally, if the recipient leaves the

Corporation before the end of the restricted period, the

shares will be forfeited.

In 2000, 606,000 incentive shares of common stock

were granted to certain senior executives pursuant to the

Incentive Plan. One-half of any shares of restricted stock

issued pursuant to these awards will vest after three years

and the remainder after four years. Shares awarded under

this grant will be offset on a share-for-share basis by shares

received, if any, by the executive from the 1998 grant.

There were 39,000 and 66,000 incentive shares

forfeited during 2001 and 2000, respectively. No shares

were forfeited in 1999.

In addition, 33,600, 53,100 and 37,500 shares of

restricted stock were granted to certain key employees in

2001, 2000 and 1999, respectively. These shares vest 25%

after three years, 25% after four years and 50% after five

years. There were 13,000 shares of restricted stock granted

to non-employee directors in 2001. One half of these

shares vest after one year and the remainder after two

years. In 2000, 245,000 shares of restricted stock were

granted to senior executives with a three-year vesting

period.

Compensation expense recognized for incentive share

and restricted stock awards totaled $10 million, $8 million

and $12 million in 2001, 2000 and 1999, respectively.

EMPLOYEE STOCK PURCHASE PLAN

The Corporation’s employee stock purchase plan (“ESPP”)

has approximately 2.6 million shares available for issuance.

Persons who have been continuously employed for at least

one year are eligible to participate. Participants purchase

the Corporation’s common stock at 85% of the lesser of

fair market value on the first or last day of each offering

period. No charge to earnings is recorded with respect to

the ESPP.

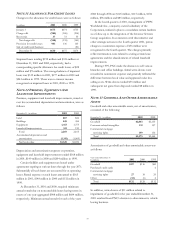

Shares issued pursuant to the ESPP were as follows:

Year ended December 31 Shares Price Per Share

2001 395,217 $55.57 and $49.26

2000 504,988 42.82 and 45.53

1999 406,740 43.99 and 47.39

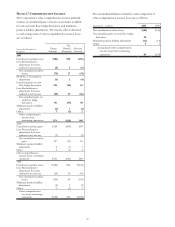

PRO FORMA EFFECTS

The following table sets forth pro forma income from

continuing operations and diluted earnings per share as if

compensation expense was recognized for stock options

and the ESPP.

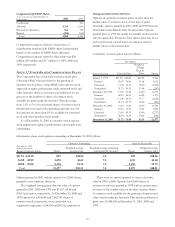

Pro Forma Income From Continuing Operations And EPS

Year ended December 31 Re

p

orted Pro forma

Income from continuing

operations (in millions)

2001 $377 $344

2000 1,214 1,196

1999 1,202 1,194

D

iluted earnings per share

2001 $1.26 $1.14

2000 4.09 4.02

1999 3.94 3.92

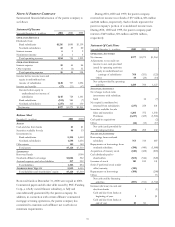

For purposes of computing pro forma results, PNC

estimated the fair value of stock options and ESPP shares

using the Black-Scholes option pricing model.

The model requires the use of numerous assumptions,

many of which are highly subjective in nature. Therefore,

the pro forma results are estimates of results of operations

as if compensation expense had been recognized for all

stock-based compensation plans and are not indicative of

the impact on future periods. The following assumptions

were used in the option pricing model for purposes of

estimating pro forma results. The dividend yield represents

average yields over the previous three-year period.

Volatility is measured using the fluctuation in quarter-end

closing stock prices over a five-year period.

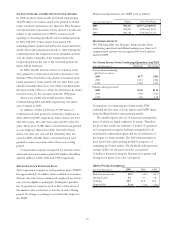

Option Pricing Assumptions

Year ended December 31 2001 2000 1999

Risk-free interest rate 4.9% 6.6% 5.2%

Dividend yield 3.2 3.1 3.6

Volatility 25.7 21.8 22.1

Expected life 5 yrs. 5 yrs. 6 yrs.