PNC Bank 2001 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

48

estimation and judgmental errors. Furthermore, events may

have occurred as of the reserve evaluation date that are not

yet reflected in the risk measures or characteristics of the

portfolio due to inherent lags in information. Unallocated

reserves are established to provide coverage for such risks.

Senior management’s Reserve Adequacy Committee

provides oversight for the allowance evaluation process,

including quarterly evaluations and methodology and

estimation changes. The results of the evaluations are

reported to the Credit Committee of the Board of Directors.

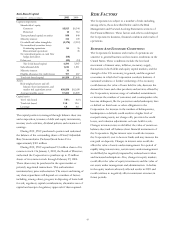

Allocation Of Allowance For Credit Losses

2001 2000

December 31

Dollars in millions Allowance

Loans to

Total Loans Allowance

Loans to

Total Loans

Commercial $467 40.0% $536 41.9

%

Commercial

real estate 67 6.3 53 5.1

Consumer 49 24.1 51 18.0

Residential

mortgage 816.8 10 26.2

Other 39 12.8 25 8.8

Total $630 100.0% $675 100.0

%

For purposes of this presentation, the unallocated portion of

the allowance for credit losses of $143 million has been

assigned to loan categories based on the relative specific and

pool allocation amounts.

The provision for credit losses for 2001 and the

evaluation of the allowance for credit losses as of December

31, 2001 reflected changes in loan portfolio composition, the

net impact of downsizing credit exposure and changes in

asset quality. The unallocated portion of the allowance for

credit losses represents 23% of the total allowance and .38%

of total loans at December 31, 2001, compared with 20%

and .26%, respectively, at December 31, 2000.

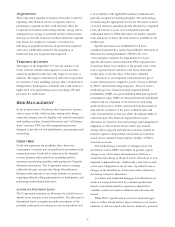

Rollforward Of Allowance For Credit Losses

In millions 2001 2000

January 1 $675 $674

Char

g

e-offs (985) (186)

Recoveries 37 51

Net char

g

e-offs (948) (135)

Provision for credit losses 903 136

December 31 $630 $675

The allowance as a percent of nonaccrual loans and total

loans was 299% and 1.66%, respectively, at December 31,

2001. The comparable year end 2000 percentages were 209%

and 1.33%, respectively. During 2001, the Corporation took

several actions to accelerate the strategic repositioning of the

institutional lending business. These repositioning initiatives

resulted in a decrease in commercial loan portfolio credit

exposure and a decrease in both specific and pooled

allowances at December 31, 2001.

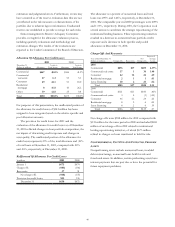

Charge-Offs And Recoveries

Percent of

Year ended December 31 Net Average

Dollars in millions Charge-offs Recoveries Charge-offs Loans

2001

Commercial $876 $17 $859 4.37%

Commercial real estate 37 1 36 1.40

Consumer 42 16 26 .29

Residential mortgage 21 1.01

Lease financing 28 2 26 .62

Total $985 $37 $948 2.12

2000

Commercial $121 $21 $100 .46%

Commercial real estate 3 4 (1) (.04)

Consumer 46 22 24 .26

Residential mortgage 8 2 6 .05

Lease financing 8 2 6 .19

Total $186 $51 $135 .27

Net charge-offs were $948 million for 2001 compared with

$135 million for the same period in 2000 and included $804

million of net charge-offs in 2001 related to institutional

lending repositioning initiatives, of which $673 million

related to charges on loans transferred to held for sale.

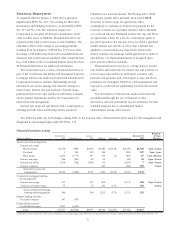

NONPERFORMING, PAST DUE AND POTENTIAL PROBLEM

ASSETS

Nonperforming assets include nonaccrual loans, troubled

debt restructurings, nonaccrual loans held for sale and

foreclosed assets. In addition, certain performing assets have

interest payments that are past due or have the potential for

future repayment problems.