PNC Bank 2001 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72

NOTE 2 DISCONTINUED OPERATIONS

In the first quarter of 2001, PNC closed the sale of its

residential mortgage banking business. Certain closing date

adjustments are currently in dispute between PNC and the

buyer, Washington Mutual Bank, FA. The ultimate financial

impact of the sale will not be determined until the disputed

matters are finally resolved. See Note 24 Legal Proceedings.

The income and net assets of the residential mortgage banking

business, which are presented on one line in the income

statement and balance sheet, respectively, are as follows:

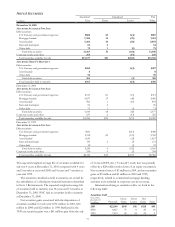

Income From Discontinued Operations

Year ended December 31 - in millions 2001 2000 1999

Income from operations, after tax $15 $65 $62

Net loss on sale of business, after tax (a) (10)

Total income from discontinued

operations $5 $65 $62

(a) Includes recognition of $35 million of previously unrealized securities losses in

accumulated other comprehensive income.

Investment In Discontinued Operations

December 31 - in millions 2000

Loans held for sale $3,003

Securities available for sale 3,016

Loans, net of unearned income 739

Goodwill and other amortizable assets 1,925

All other assets 1,168

Total assets 9,851

De

p

osits 1,150

Borrowed funds 7,601

Other liabilities 744

Total liabilities 9,495

Net assets $356

The notional and fair value of financial derivatives used for

residential mortgage banking risk management were $15.2

billion and $124 million, respectively, at December 31, 2000.

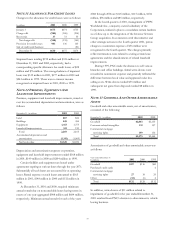

NOTE 3 RESTATEMENTS

In connection with the repositioning of its institutional

lending and venture capital businesses, PNC completed three

transactions during 2001, one each in June, September, and

November. In each of these transactions, assets were sold or

transferred to a subsidiary of a third party financial

institution and PNC received preferred interests in the

subsidiaries.

The transactions in the aggregate involved the sale of

loan assets of $592 million and venture capital assets of $170

million. Of the loan assets sold, $132 million were classified

as nonperforming assets at the date of sale. Loan assets sold

included loans previously held for sale and other loans that

were reclassified from loans to loans held for sale and

marked to the lower of cost or market prior to the sale. This

resulted in charge-offs at the date transferred of $24 million

on loans and valuation adjustments of $4 million for those

loans that previously had been classified as held for sale.

Including previous charge-offs and valuation adjustments,

loans transferred had been charged down by approximately

$108 million prior to sale. In addition to the loan and venture

capital assets, PNC also transferred cash amounting to $403

million. In return, PNC received one hundred percent of the

Class A convertible preferred shares in each subsidiary. The

Class A convertible preferred shares owned by PNC have no

voting rights. PNC, as holder of the Class A convertible

preferred shares, may convert such preferred shares to Class

A common shares and cause the liquidation of the

subsidiary. A noncumulative annual dividend may be paid on

the preferred stock.

The third party financial institution formed each of the

entities, contributed three percent equity in the form of cash

and received one hundred percent of the Class B preferred

shares and one hundred percent of the Class B common

shares of each entity. The proceeds received by the

applicable entity from the issuance of the Class A preferred

and all of the Class B shares were used by each entity to fund

certain operating expenses, future commitments under the

loan and venture capital agreements, investment in a

managed asset account and to purchase U. S. Treasury zero

coupon securities. The third party financial institution is the

managing member of each of the entities and holds one

hundred percent of the voting power. All management and

operating decisions regarding the assets are at the discretion

of the managing member. The managing member is paid an

annual fee for its services. PNC is the servicer of the loans

and venture capital assets and is paid a servicing fee.

At the time of the transactions, the loans and venture

capital investments were removed from PNC’s balance sheet

and the preferred interests in the entities were recorded as

securities available for sale in conformity with accounting

guidance received from PNC’s independent auditors. In

January 2002, the Federal Reserve Board staff advised PNC

that under generally accepted accounting principles the

subsidiaries of the third party financial institution should be

consolidated into the financial statements of PNC in

preparing bank holding company reports. After considering

all the circumstances, PNC restated its consolidated financial

statements for the second and third quarters of 2001 to

conform financial reporting with regulatory reporting

requirements.