PNC Bank 2001 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

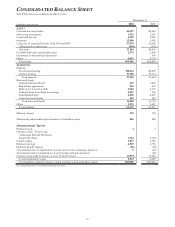

CONSOLIDATED BALANCE SHEET

THE PNC FINANCIAL SERVICES GROUP, INC.

63

December 31

In millions, except par value 2001 2000

ASSET

S

Cash and due from banks $4,327 $3,662

Short-term investments 1,335 1,151

Loans held for sale 4,189 1,655

Securities 13,908 5,902

Loans, net of unearned income of $1,164 and $999 37,974 50,601

Allowance for credit losses (630) (675)

Net loans 37,344 49,926

Goodwill and other amortizable assets 2,373 2,468

Investment in discontinued o

p

erations 356

Othe

r

6,092 4,724

T

otal assets $69,568 $69,844

LIABILITIES

De

p

osits

Noninterest-bearin

g

$10,124 $8,490

Interest-bearin

g

37,180 39,174

T

otal de

p

osits 47,304 47,664

Borrowed funds

Federal funds

p

urchased 167 1,445

Re

p

urchase a

g

reements 954 607

Bank notes and senior deb

t

6,362 6,110

Federal Home Loan Bank borrowin

g

s2,047 500

Subordinated deb

t

2,298 2,407

Other borrowed funds 262 649

T

otal borrowed funds 12,090 11,718

Othe

r

3,333 2,849

T

otal liabilities 62,727 62,231

Minority interes

t

170 109

Mandatorily redeemable ca

p

ital securities of subsidiary trusts 848 848

S

HAREHOLDERS’

E

QUITY

Preferred stock 17

Common stock - $5

p

ar value

Authorized 800 and 450 shares

Issued 353 shares 1,764 1,764

Ca

p

ital sur

p

lus 1,077 1,303

Retained earnin

g

s6,549 6,736

Deferred benefit ex

p

ense (16) (25)

Accumulated other com

p

rehensive income (loss) from continuin

g

o

p

erations 5(43)

Accumulated other com

p

rehensive loss from discontinued o

p

erations (45)

Common stock held in treasury at cost: 70 and 63 shares (3,557) (3,041)

T

otal shareholders’ e

q

uit

y

5,823 6,656

T

otal liabilities, minorit

y

interest, ca

p

ital securities and shareholders’ e

q

uit

y

$69,568 $69,844

See accompanying Notes to Consolidated Financial Statements.