PNC Bank 2001 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2001 PNC Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

86

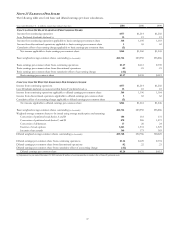

NOTE 23 INCOME TAXES

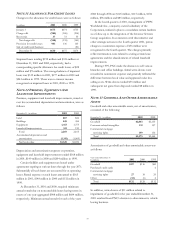

The components of income taxes were as follows:

Year ended December 31

In millions 2001 2000 1999

Current

Federa

l

$195 $226 $454

State 40 32 35

T

otal curren

t

235 258 489

Deferred

Federa

l

(

51

)

363 102

State 313

(

5

)

Total deferred (48) 376 97

Total $187 $634 $586

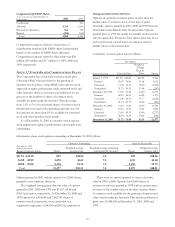

Significant components of deferred tax assets and liabilities

are as follows:

December 31 - in millions 2001 2000

Deferred tax assets

Allowance for credit losses $225 $250

Compensation and benefits 31 85

Net unrealized securities losses 75 19

Loan valuations related to

institutional lending repositioning 330

Other 163 104

T

otal deferred tax assets 824 458

D

eferred tax liabilities

Leasing 1,182 824

Depreciation 53 37

Other 89 102

T

otal deferred tax liabilities 1

,

324 963

Net deferred tax liability $500 $505

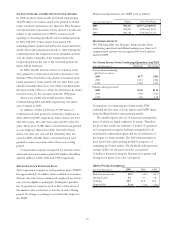

A reconciliation between the statutory and effective tax

rates follows:

Year ended December 31 2001 2000 1999

Statutory tax rate 35.0% 35.0% 35.0%

Increases (decreases) resulting from

State taxes 4.9 1.6 1.1

Tax-exempt interest (1.8) (.6) (.7)

Goodwill 3.0 .9 .9

Life insurance (3.5) (1.0) (1.0)

Tax credits (7.6) (1.8) (1.4)

Other 3.2 .2 (1.1)

Effective tax rate 33.2% 34.3% 32.8%

NOTE 24 LEGAL PROCEEDINGS

Several putative class action complaints have been filed

against the Corporation, certain present and former

officers or directors and its independent auditors for 2001

alleging violations of federal securities laws relating to

disclosures and seeking unquantified damages on behalf of

purchasers of the Corporation’s common stock during

specified periods. Management believes there are

substantial defenses to the lawsuits and intends to defend

them vigorously. The impact of the final disposition of

these lawsuits cannot be assessed at this time.

In January 2001, PNC sold its residential mortgage

banking business. Certain closing date purchase price

adjustments aggregating approximately $300 million pretax

are currently in dispute between the parties. The

Corporation has established a receivable of approximately

$140 million to reflect additional purchase price it believes

is due from the buyer. The buyer has taken the position

that the purchase price it has already paid should be

reduced by approximately $160 million. The Corporation

has established specific reserves related to a portion of its

recorded receivable. The purchase agreement requires that

an independent public accounting firm determine the final

adjustments. The buyer also has filed a lawsuit against the

Corporation seeking compensatory damages with respect

to certain of the disputed matters that the Corporation

believes are covered by the process provided in the

purchase agreement, unquantified punitive damages and

declaratory and other relief. Management intends to assert

the Corporation’s positions vigorously. Management

believes that, net of available reserves, an adverse outcome,

expected to be recorded in discontinued operations, could

be material to net income in the period in which recorded,

but that the final disposition of this matter will not be

material to the Corporation’s financial position.

The Corporation, in the normal course of business, is

subject to various other pending and threatened lawsuits in

which claims for monetary damages are asserted.

Management does not anticipate that the ultimate aggregate

liability, if any, arising out of such other lawsuits will have a

material adverse effect on the Corporation’s financial

position.

At the present time, management is not in a position to

determine whether any pending or threatened litigation will

have a material adverse effect on the Corporation’s results

of operations in any future reporting period.

The staffs of the Securities and Exchange Commission

and the Federal Reserve Board have informed PNC that

they are conducting inquiries with respect to the

transactions with subsidiaries of a third party financial

institution described in Note 3 Restatements. PNC is

cooperating with these inquiries.